Top 10 outstanding events of Vietnam Customs in 2019

Event 1: Successfully organizing the 13th ASEM Customs Directors-General and Commissioners Meeting

|

| View of the conference. Photo: H. Mu |

Within the framework of ASEM Customs cooperation in 2019, the General Department of Customs has successfully hosted the 13th ASEM Director General of Customs Conference, taking place from 9-10 October 2019 in Ha Long City, QuảngNinh. The conference, with the participation of 53 delegations of the Director General/High Commission of Customs Offices of ASEM member countries, General Secretary of the World Customs Organization (WCO), the European Union and representatives of some embassies of ASEM member countries in Vietnam, is the largest international event on the organizational scale of Vietnam Customs ever.

Through the conference, Vietnam Customs affirmed its active role and participation in international integration cooperation, especially in connecting the two continents of Asia and Europe to coordinate and handle common challenges for Asia and Europe with the goal of building a modern and professional customs office. In particular, emphasizing the continued efforts to build and implement trade facilitation and supply chain security measures between the two continents; information exchange between customs authorities to fight against the trade of counterfeit goods and enforce border control in protecting intellectual property rights, preventing the illegal transportation of substances affect the community and the environment.

The meeting reached high consensus amongthe leaders of member countries' Customs, showing the commitment of the Director of the Customs Department of ASEM on the goals and priorities of ASEM customs cooperation in the future. It also emphasizes the strengthening of efforts to connect Asia - Europe Customs through the Ha Long Declaration and ASEM Customs Action Plan for the period 2020-2021.

In line with promoting and raising multilateral foreign relations in the spirit of Directive No. 25-CT/TW of the Secretariat, chairing the Conference of General Director of the 13th ASEM General Department of Vietnam Customs once again affirmed the initiative in contributing to the orientation for cooperation activities of Eurasian Customs; contribute to creating regional connectivity and cooperation in the field of customs in the context of the fourth industrial revolution. More importantly, the Conference has contributed significantly to affirming the role and positive contribution of Vietnam Customs in ASEM customs cooperation and at the same time promoting the image of the country, people and Vietnamese culture in general and achievements of Vietnam Customs in particular with friends of customs colleagues aroundthe world.

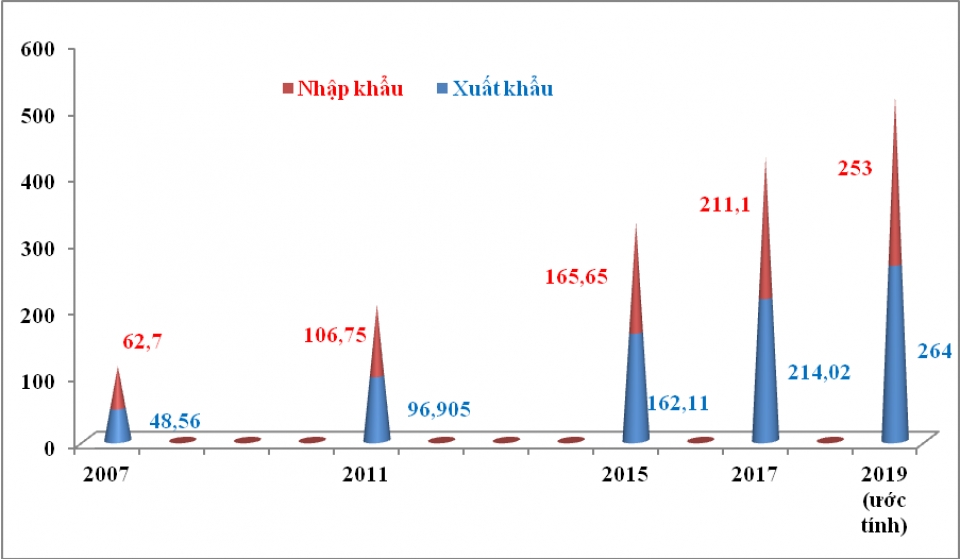

Event 2: Customs has completed clearance for 12.42 million declarations (as of December 9, 2019) with import-export turnover reaching US$500 billion in mid-December 2019.

|

| Import and Export chart of US$500 billion. Chart: T. Binh |

The General Department of Customs recorded a total value of US$500 billion inimport and export turnoverin mid-December 2019. Earlier, the General Department of Customs recorded total import and export value of our country's goods reaching US$400 billion in December 2017, and US$200 billion in December 2011.

According to the World Trade Organization's statistics published on April 2, 2019, in 2018, Vietnam's merchandise exports were ranked 26th in the world (up oneplacecompared to 2017) and 4th in ASEAN (after Singapore, Thailand and Malaysia).Vietnam's imports of goods ranked 23rd in the world (up two places compared to 2017) and ranked 3rd in ASEAN (after Singapore and Thailand). In ASEAN, when calculating the total value of exports and imports of goods, Vietnam ranked third (after Singapore and Thailand).

In 2006, Vietnam joined the group of 50 economies with the largest import and export value of the world.Since 2016, Vietnam has always been in the group of 30 countries with the largest import and export value of goods on a global scale.

Event 3: Efforts to implement the State budget collection task in 2019.

|

| Import and export goods at Tan Vu - Hai Phong port. Photo T. Binh |

As of November 25, 2019, the total tax collection of the whole Customs sector reached VND312,548 billion, equaling 104% of the estimate according to the ordinance norm (VND300,500 billion) and reaching 99% of the target assigned by the Ministry of Finance (VND315,500 billion). The General Department of Customs strives to reach VND335,000 billion in 2019, accounting for 111.48% of the estimate, equal to 106.2% of the target, up 6.56% over the same period last year.

From the beginning of the year, the General Director of Customs has drastically directed the whole industry to strive to complete the task of State budget collection in 2019; closely monitor the local Customs Departments to ensure correct and adequate collection and full implementation of collection solutions under Directive No. 723/CT-TCHQ on synchronous and drastic implementation of favorable solutions. Trade and combat revenue losses in implementing the state budget collection task in 2019; promote post-clearance inspection; strictly implement the specialized inspection plan, internal inspection plan; paying special attention to the prevention of fraud through the value, tax rate, origin and the collection and handling of outstanding tax debts.

In addition, the Customs sector has stepped up administrative reform to create favorable conditions for import and export activities; signed an agreement with 42 commercial banks, including 30 commercial banks that have implemented electronic tax payment and customs clearance 24/7.By the end of 2019, the PRC has implemented the Business Collection program. As such, businesses can apply three methods of payment of import and export taxes –pay directly at the bank, pay electronic taxes 24/7, participate in the collection business program. Thereby, the rate of import-export enterprises paying electronic taxes via banks will reach nearly 100%.

Event 4: Strengthening inspection, combating fraud, counterfeit, labeling of goods, and combating illegal transshipment, ensuring benefits for businesses, complying with laws and reputation of goods in the international arena, and at the same time disseminating information to raise awareness of law observance of businesses.

|

| Chinese phone components made in Vietnam seized by Hai Phong Customs in July 2019. Photo: T. Binh. |

In the face of complicated developments in the globaleconomic situation, many countries are making major changes in trade policy in the direction of protectionismand increasing the use of trade remedies such as anti-dumping tax, anti-subsidy tax and safeguard tax, with very high tax rates to restrict imports and protect domestic production. Meanwhile, Vietnam has participated in signing and negotiating 17 Free Trade Agreements (FTA) and goods of Vietnamese origin will be exempt from import tax when exporting to partner countries. Especially, the US-China trade war has had a great impact on Vietnam's economy. It is forecast that goods from countries that are subject to high tax rates by the United States will likely find ways to illegally transfer to Vietnam, fake the Vietnamese origin and then export to the US, Europe or Japan to evade the high tax rates applied by these countries. This behavior leads to the risk of Vietnam's exports being investigated by countries, imposing anti-dumping, safeguard and subsidy taxes, causing damage to Vietnamese manufacturers, discrediting the international market or restricting exports to these markets.

Therefore, the General Department of Customs has actively, aggressively and drastically implemented measures to prevent fraud, counterfeiting of origin and illegal transmission to ensure interests for production and trading businesses.

On July 4, 2019, the Prime Minister issued Decision No. 824/QD-TTg approving the project "Strengthening state management of evading trade defense measures and origin fraud". In furtherance of the Prime Minister's opinion in Decision No. 824/QD-TTg of July 4, 2019, approving the project "Strengthening state management of the avoidance of trade remedy measures and fraud."

The General Department of Customs advised the Ministry of Finance to issue Decision No. 1662/QD-BTC dated August 23, 2019 on the plan for the implementation of the above Decision (including contents on tracking import and export statistics from China and the United States).

On August 6, 2019, the Ministry of Finance issued Official Letter No. 885/ BTC-TCHQ (Confidential) to report to the Prime Minister, which assessed the situationof fraud, counterfeiting of origin, illegal transmission; problems and inadequacies in policies related to the field of origin and labeling of import and export goods, reporting on contents that the Ministry of Finance directs for implementation and proposing solutions to each of the relevant ministries and branches.

On August 13, 2019, the General Department of Customs issued Official Letter No. 5189/TCHQ-GSQL to direct Customs Departments of provinces and cities and units of the General Department to inspect, determine the origin and combat againstfraud, counterfeiting origin, infringement of IP rights and illegal transmission, which clearly define the responsibilities and coordination of professional units under the General Department of Customs in collecting, analyzing information and identifying goods and businesses with high risks of fraud, counterfeiting of origin or illegally conveying goods to apply appropriate control measures;responsibilities of provincial/municipal Customs Departments in inspecting and determining the origin of goods when carrying out customs procedures for export and import goods.

In addition, the General Department of Customs has set up working groups to check the prevention and handling of fraud, counterfeiting of origin, labeling of goods, infringement of intellectual property rights, illegal transmission of some local Customs Departments (Hanoi Customs Department, Bac Ninh Customs Department, Quang Nam Customs Department, Lang Son Customs Department; Ho Chi Minh City Customs Department, Customs Department of Dong Nai province, the Customs Department of Binh Duong province).

On November 14-15, 2019, the General Department of Customs coordinated a project on trade facilitation by USAID to organize an international experience workshop on prevention of origin fraud, illegal transmission and evading commercial defense measures. The seminar was attended by the business community and local customs authorities. According to the participants, the workshop provided very useful and high-quality information, especially techniques of traceability verification for import and export shipments.

Event 5: Efforts in the fight and prevention of drug smuggling

The problem of drug trafficking has been widespread throughout routes and the scale of the problem is increasingly serious, with border gates, seaways and international airports all detecting crimes. This causesCustoms forces to increasingly face difficulties and challenges when performing their tasks. From the beginning of the year, following the Directive and Plan of the General Department, the Department of Financial Affairs has coordinated the synergy between forces inside and outside the Customs sector such as Police and Border Patrol to complete the task of combating drug smuggling.

As a result, the Department has chaired and coordinated manysuccessful projects, including the proposal to establish the three largest special cases. The results of the arrest were 30 suspects, 446 seized bricks of heroin, 363kg of all kinds of drugs, 507kg of Ketamine and many other evidences. In addition, it also coordinated with local customs forces to detect and handlenearly 30 cases, seize 80kg of all kinds of drugs and 100kg of cocaine from South Africa to Vietnam.

|

| The case of 446 heroin packages seized by Customs and functional forces in November 2019. Photo: Le Thu. |

In particular, the most prominent case is MT619, which was a line operated by Taiwanese people, illegally transporting drugs to Taiwan. This is a case led by the Anti-Smuggling Investigation Department (Team 6) in coordination with the Drug Investigation Police Department (C04) and the Taiwanese authorities through international cooperation, conducted from basic investigation, scouting to organize the dissolution plan. As a result, on November 3, 2019, the functional force has successfully destroyedthis cross-border drug trafficking line, seizing 446 bricks of heroin.

In addition, in collaboration with C04, the Ministry of Public Security successfully broke the drug transport line from Vietnam to a third country under the LP218 project of the Ministry of Public Security, seized 300kg of drugs, 4 suspects and timely information sharing with the Philippine authorities to seize276kg of synthetic drugs. Collaborating with Ho Chi Minh City Customs Department and functional forces successfully broke the M918 project to seize 507kg of Ketamine and arrest 5 suspects.

In order to achieve such positive results, it is thanks to the close guidance, support and encouragement of the leaders of the Ministry of Finance and the leaders of the General Department of Customs; smooth coordination between forces; together with the effort to avoid difficulties and dangers of the customs control force.

Event 6: Implementing the electronic tax payment collection program

This is the Electronic Tax Payment program, which facilitates enterprises to regularly do import and export procedures with a large number of tax declaration forms. After arising a tax debt declaration, the Customs system immediately transfers information about the payable tax amount of each declaration form to the bank where the enterprise has authorized to debit the tax payment account with the payable tax amount for a certain period of time. Businesses are completely free and do not spend time and money to pay taxes. The payment of taxes, clearing debts and customs clearance of goods are fully automatic without the intervention of enterprises and customs officers.

Event 7: The General Department of Customs is awarded the prize of a state-owned digital transformation agency for excellence.

|

| Officials of the Center for Management and Operation of Customs IT Systems (Department of IT and Customs Statistics) inspect the operation of server systems at the Center. Photo: T. Binh |

The second awards ceremony of Vietnam Digital Transformation - Vietnam Digital Awards in 2019 was organized on the afternoon of September 6, 2019 in Vietnam. The awards were for organizations and individuals that have made achievements, contributed to the development of digital technology, made important contributions to the digital transformation and national digital economic development.

The General Department of Customs is one of 13 state agencies at all levels which are highly appreciated by the Vietnam Digital Conversion Award 2019 in the process of receiving the excellent digital transformation state prize in 2019. A number of typical digital technology application solutions of the unit have been implemented and recognized such as: developing and perfecting information technology applications to serve people and businesses; application of information technology to serve expertise and build the National Database on Finance; developing and perfecting the application of information technology within the Finance sector.

Event 8: Expanding and evaluating the capacity of professional civil servants from six fields to eight professional fields for more than 2,000 civil servants of 28 provincial and municipal Customs Departments and two Departments.

In 2019, following the activities of assessing the capacity of civil servants working in six key professional fields to be implemented in 2018, the General Department of Customs will expand the assessment of the capacity of public servants in eight. The main business areas: professional areas of Inspection and Testing in the whole industry; 6 major professional fields (Management Supervision, Import and Export Tax, Anti-smuggling, Post-clearance Inspection, Risk Management, Handling of Violations) at 28 Customs Departments of provinces and cities have not organized price assessment of civil servant capacity in 2018. The purpose of capacity assessment in 2019 is to create a movement of learning, training, capacity building of civil servants, gradually piloting applications in arrangement, mobilize rotation of civil servants in accordance with capacity.

|

| Customs officials and employees of the provinces of Bac Ninh, Ha Nam Ninh and Thanh Hoa participated in the competency assessment exam at the No. 2 Examination Team (Bac Ninh Customs Department) from November 26-28, 2019. Photo: Q.H |

According to the plan, the General Department of Customs will organize the assessment of competencies according to the examination cluster, specifically including seven groups held in Lang Son, Bac Ninh, Quang Binh, BinhDinh, Ba Ria Vung Tau, Can Tho and the headquarters ofthe General Department of Customs. The 2019 capacity assessment competition will take place from November 19, 2019 in Bac Ninh.

Event 9: Signing the Agreement between the Government of the Socialist Republic of Vietnam and the Government of the United States of America on mutual assistance in the field of customs.

|

| Overview of the signing ceremony of the Agreement between the two Governments of the Socialist Republic of Vietnam and the United States of America on mutual assistance in the field of customs. |

The agreement between the Government of the Socialist Republic of Vietnam and the Government of the United States of America on mutual support in the field of customs has undergone a process of negotiation lasting from the 2000s.There are times when negotiations are interrupted due to differences in authority and approach, but with the determination and efforts of both sides in removing obstacles, narrowing the gap in perspective and approach. In the last few years, the negotiations for the agreement have been completed and the agreement has been authorized by Deputy Minister of Finance Vu Thi Mai under the authorization of the Government of Vietnam and the Representative of the United States Caryn McClelland. U.S. Government signed on December 6, 2019.

The signing of this Agreement is very important in creating a legal foundation for the official relationship and cooperation mechanism, technical assistance, and information exchange between the two customs authorities in order to prevent, detect and handle violations of customs law in the course of performing the tasks of the two customs offices. Especially, in the context of increasing economic and trade relations between Vietnam and the United States, today, the support and cooperation activities between the two sides under the Agreement will bring substantive contributions in preventing fraudulent activities and illegal transfer of goods across the territory of one party in order to evade trade remedies.

The signing of this Agreement will also be an important milestone towards the 25th anniversary of establishing diplomatic relations between Vietnam and the United States in 2020, contributing to deepening the comprehensive partnership between the two countries.

Event 10: General Department of Customs receives and initiates USAID-funded Trade Facilitation Project

|

| Launch Conference of USAID-funded Trade Facilitation Program. |

On July 10, 2019, the USAID-funded Trade Facilitation Project was officially launched in Hanoi. Attending the Launch Ceremony were Politburo Member, Deputy Prime Minister VuongDinh Hue, Ambassador Extraordinary and Plenipotentiary of the United States of America to Vietnam, Director of United States Agency for International Development (USAID Vietnam), Leaders of the Ministry of Finance, Leaders of the General Department of Customs and relevant ministries and branches, representatives of a number of embassies and some international organizations in Hanoi, business associations and businesses in Vietnam Male.

"USAID-funded Trade Facilitation Technical Assistance Project" has been approved by the Government and assigned the Ministry of Finance as the host agency and the General Department of Customs is the project owner. Total project aid: US$21,785,000, is the largest ODA project ever received by the General Department of Customs. The project will be implemented in fiveyears with the overall goal of reforming, standardizing, harmonizing and simplifying administrative procedures in the field of import and export, in accordance with international standards to implement the agreement. At the same time, trade facilitation of the World Trade Organization (WTO TFA) and the Government's policy of reforming specialized inspection of import and export goods.

USAID-supported technical assistance project is determined by the Government to be very practical, timely and necessary to support the implementation of the Organization's Trade Facilitation Agreement of the World Trade Organization. With high-value support, the project is expected to provide extremely valuable support to the implementation of the commitments of the WTO TFA in particular and trade facilitation efforts in Vietnam in general.

Related News

Temu not yet complete registration procedures for operation in Vietnam to implement customs process

11:03 | 29/11/2024 Customs

Tay Ninh Tax Department fines two FDI companies for false tax declaration

13:49 | 28/11/2024 Anti-Smuggling

HCM Customs rejects declared customs value for over 8,000 imported shipments

13:44 | 28/11/2024 Anti-Smuggling

GDVC appoints Nguyen Hong Linh as Director of Nghe An Customs Department

13:46 | 28/11/2024 Customs

Latest News

Hai Phong Customs achieves revenue target soon

09:16 | 01/12/2024 Customs

Import and export turnover across Quang Tri Customs increases by 31.39%

11:07 | 30/11/2024 Customs

Customs sector launches campaign against counterfeit goods and online fraud

11:03 | 29/11/2024 Customs

Significant changes ahead in the management of processing, export production, and export processing enterprises

13:47 | 28/11/2024 Customs

More News

Goods trading, being seen from Lang Son border gate

13:45 | 28/11/2024 Customs

Binh Duong General Port Customs: Driving efficiency and trade facilitation

09:23 | 25/11/2024 Customs

Initiative to disseminate legal policies using QR codes

09:01 | 24/11/2024 Customs

Southern Customs contributed many practical contents on customs supervision and control procedures

10:50 | 23/11/2024 Customs

Over 300 Southern enterprises attend workshop to provide feedback to the General Department of Vietnam Customs

10:50 | 23/11/2024 Customs

New Steering Committee to spearhead Customs Reform and Modernization

10:49 | 23/11/2024 Customs

Appointment of new Directors for the Customs Reform and Modernization Board and Anti-Smuggling and Investigation Department

13:41 | 22/11/2024 Customs

Binh Duong Seaport Customs Branch supports and facilitates enterprises

09:34 | 22/11/2024 Customs

Promoting Vietnam-Laos Customs cooperation

09:44 | 21/11/2024 Customs

Your care

Hai Phong Customs achieves revenue target soon

09:16 | 01/12/2024 Customs

Import and export turnover across Quang Tri Customs increases by 31.39%

11:07 | 30/11/2024 Customs

Customs sector launches campaign against counterfeit goods and online fraud

11:03 | 29/11/2024 Customs

Temu not yet complete registration procedures for operation in Vietnam to implement customs process

11:03 | 29/11/2024 Customs

Significant changes ahead in the management of processing, export production, and export processing enterprises

13:47 | 28/11/2024 Customs