GDVC’s Deputy Director General Luu Manh Tuong: Customs sector makes great efforts to ensure State revenue

| Customs sector collects revenue exceeding VND200,000 billion | |

| Discover more than 1,000 cases of violation in customs field in one month | |

| Bac Ninh Customs sees revenue collection decrease 4.9% |

|

| Deputy Director General of GDVC Luu Manh Tuong |

During the past 75 years, the performance of Vietnam Customs has always been associated with the political and economic tasks of the country. Vietnam’s changes in the foreign economic management in the spirit of innovation, opening up and international integration have posed challenges for Vietnam Customs to reform and innovate to meet the requirements of the new era. Customs regulations must be transparent, simple and meet international standards.

The annual growth of import and export turnover means an increase in the workload of the Customs sector. It also requires the Customs sector to reform methods of tax collection and administration to ensure accurate and sufficient revenue forthe State budget.

The statistics of the State budget revenues of the whole sector inthe past 10 years show that Customs revenue always accounts for 15% to 17% of the total State budget (after deducting VAT refunds). From 2011 to 2020, the Customs sector has collected and contributed VND 2,682,843 billion to the State budget; from 2014 to 2019 the customs’ revenue exceeded the estimated revenues. If the Customs’ revenue reached more than VND 217 trillion in 2011, reached VND 347 trillion in 2019, it reached VND199 trillion in the first eight months of 2020.

This is a great effort of the whole customs sector to ensure State budget revenue, contributing to socio-economic development. However, to achieve this result, the Customs sector has made great efforts in modernising the revenue management, classifying and assessing customs value.

Previously, enterprises had to declare the quantity, category and nature of goods in customs declaration, and the receipt of customs declaration, inspection of goods, tax assessment and tax collection were conducted by customs. Goods were only cleared after the taxes were assessed and tax notices were issued. Currently, tax collection has fundamentally changed. The Customs sector has applied the mechanism allowing taxpayers to self-declare, calculate and pay taxes, and customs performs tax administration through inspection and supervision of compliance with the tax law of taxpayers (since the implementation of the Customs Law and the Tax Administration Law).

In 2017, the GDVC launched the scheme of e-tax payment and customs clearance 24/7 has achieved positive results. In 2019, based on the e-tax payment 24/7 platform, the GDVC has deployed the pre-authorised tax payment programme and currently, 44 commercial banks have workedwith the GDVC in revenue collection. Of which, 30 banks have participated in e-tax payment and customs clearance 24/7. The e-tax payment 24/7 has created a breakthrough in tax collection and payment and other revenues, facilitating and supporting taxpayers to pay taxes anytime, anywhere and on any device, minimizing payment in cash; avoiding errors in tax collection and payment and other revenues when accounting for businesses and revenue management agencies. More than 97% of customs' revenue is now collected electronically.

To ensure revenue target, the GDVC’s leaders direct and administer the estimation, perform revenue collection and propose solutions to raise revenue, develop programs and systems meeting administration requirements, facilitating taxpayers, preventing trade fraud, tax evasion and tax loss, helping the customs sector to accomplish its revenue targets for many years.

Regarding tax debt management, the Customs sector has classified each tax debt type and applied information technology in tax debt management, put the tax debt management into order, contributing to reducing the proportion of tax debt compared to the total annual revenue (if the ratio of tax debt to total revenues was 2.25% in 2011, it was 1.6% in 2019).

With the great efforts in revenue collection and remittance, it can be seen that that the Customs sector has implemented many synchronous solutions to fulfill and exceed the State revenue target. At the same time, it has prevented and handled tax evasion and tax loss effectively. Customs’ revenue has made an important contribution to balance the State revenues and expenditures, ensuring a healthy national financial system.

Related News

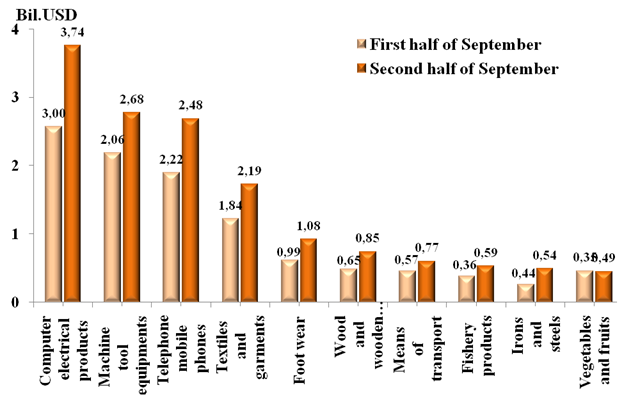

Preliminary assessment of Vietnam international merchandise trade performance in the second half of September, 2024

09:21 | 20/11/2024 Customs Statistics

Ho Chi Minh City: Imported gasoline, iron and steel greatly affect state budget revenue

09:22 | 20/11/2024 Customs

Enforcement authorities busts 67, 000 cases and seizes about 10 tons of drugs

09:23 | 20/11/2024 Anti-Smuggling

Quang Nam Customs facilitates trade and increases revenue

09:41 | 19/11/2024 Customs

Latest News

Promoting Vietnam-Laos Customs cooperation

09:44 | 21/11/2024 Customs

Quang Tri Customs: Revenue from imported coal plunges

10:05 | 18/11/2024 Customs

Closely control imported products traded via e-commerce

09:19 | 17/11/2024 Customs

Mong Cai Customs sets new record in revenue collection

19:39 | 16/11/2024 Customs

More News

Lao Cai Customs attracts over 100 new businesses for customs procedures

09:34 | 16/11/2024 Customs

Vietnam Customs attends WCO’s flagship conference

09:33 | 16/11/2024 Customs

Da Nang Customs joins efforts to establish free trade zone proposal

10:56 | 15/11/2024 Customs

Quang Ninh Customs sees revenue boost of nearly VND 900 Billion from new enterprises

10:55 | 15/11/2024 Customs

Roadmap set for pilot program of smart border gate initiative

10:49 | 15/11/2024 Customs

Hanoi Customs partners with businesses to boost import-export activities

10:49 | 15/11/2024 Customs

Get opinions on perfecting regulations on procedures, inspection, supervision and customs control

10:05 | 14/11/2024 Customs

General Department of Customs strengthen discipline in public services

10:00 | 14/11/2024 Customs

GDVC gets feedback from Vietnam Logistics Business Association

10:10 | 12/11/2024 Customs

Your care

Promoting Vietnam-Laos Customs cooperation

09:44 | 21/11/2024 Customs

Ho Chi Minh City: Imported gasoline, iron and steel greatly affect state budget revenue

09:22 | 20/11/2024 Customs

Quang Nam Customs facilitates trade and increases revenue

09:41 | 19/11/2024 Customs

Quang Tri Customs: Revenue from imported coal plunges

10:05 | 18/11/2024 Customs

Closely control imported products traded via e-commerce

09:19 | 17/11/2024 Customs