Cars as gifts and donations must pay extra income tax

|

| The representatives of Customs Control and Supervision Department and the Import and Export Duty at the press conference. |

Each organization and individual is allowed to import one car per year

According to Director of Customs Control and Supervision Department (under the General Department of Vietnam Customs) Au Anh Tuan has released the customs control for imported cars as gifts and donations at the press conference held by the General Department of Vietnam Customs (GDVC) on May 25.

Director Au Anh Tuan said that the GDVC detected cases that abused incentive policies to import cars as assets of Vietnamese oversea citizens, temporarily imported cars of people who are entitled to tax incentives or imported cars as gifts and donations.

The GDVC has investigated and handled some cases of tax evasion and fraud or transferred to competent agencies for handling, and reported to the Prime Minister to issue management policies to prevent violations.

For cars imported as gifts, the Ministry of Finance issued Circular 143/2015/TT-BTC which stipulates that vehicles imported as gifts must be licensed before carrying out import procedures and each organization or individual is only allowed to import one vehicle per year.

| The revenue from import duty of less than 9-seat cars (including import tax, excise tax, value-added tax) between 2016 and May 22, 2022 reached VND12,644 billion. |

Circular 143/2015/TT-BTC creates a legal framework, strengthens the control and limits the rampant import through the quantitative limitation of import, without affecting the production, assembly and import activities of domestic auto operators and facilitates enforcement entitles by specifying the subjects, dossier and procedures for issuing the import permit.

“The circular limits the number of imported cars as gifts. Each organization and individual is allowed to import only one car per year. Therefore, it contributes to restricting imports, and protecting domestic production and assembly. Statistics of the past 5 years (from 2016 to 2021) show that the number of cars imported as gifts only accounts for less than 1% of the total import of less than 9-seat cars," said Director Au Anh Tuan.

The quality inspection for car imports must meet quality standards as prescribed by the Ministry of Transport. The year of manufacture of the used car must not exceed five years from the year of manufacture to the import date. The donated car must be inspected by the Ministry of Transport before customs clearance.

Director Au Anh Tuan cites the tax policy for the donated cars as saying that the customs declarant must pay import tax, excise tax and value-added tax and extra income tax at the domestic tax office before customs clearance. The donated cars must pay extra income tax at the domestic tax office.

For donated cars, Customs will implement the procedures in accordance with current regulations and fully collect their taxes. The customs authority will send relevant documents to the domestic tax office to collect extra income tax.

Urgently review performance to provide appropriate policies

Following the direction of Deputy Prime Minister Le Minh Khai, to strictly control the donated cars, the Ministry of Finance has coordinated with relevant agencies to review the performance and proposed management measures.

The Ministry also assigned the GDVC to urgently complete the review of the legal framework and evaluate the results of the implementation of Circular 143/2015/TT-BTC to promptly propose specific and effective measures to control imported and temporarily imported automobiles for non-commercial purposes.

The General Department of Customs shall propose the Ministry of Finance for consulting relevant ministries and agencies on the draft dispatch and report to the Prime Minister on the draft Circular amending and supplementing in the direction of abolishing the authority of import licensing.

Regarding the information mentioned by the press about the import of cars as gifts and donations, Mr. Au Anh Tuan said the General Department of Customs will seriously handle violations in licensing and the customs process for these imported cars.

For information about an address where many businesses receive cars as gifts, or cars after customs clearance they have brought the cars for sale, according to Mr. Au Anh Tuan, the customs authority shall perform the licensing based on valid dossiers as prescribed in Circular 143/2015 of the Ministry of Finance, submitted by receivers (including business registration certificates).

The fact that an address has many businesses is in accordance with the law on business management. “If the address is a bogus address which is used to make false declarations, Customs will work with relevant authorities to review and handle them," said Mr. Tuan.

| The Ministry of Finance has directed the Customs authority to provide solutions to ensure the control and prevention of trade fraud and anti-revenue loss such as: The Customs will not issue an import permit if the application for the permit is not consistent with regulations. The application for the import permit must be checked by customs, and include documents to prove the relationship (declaration, payment contract and sale contract). If the relationship between the giver and the donor shows suspicious signs, customs units must report to the General Department of Vietnam Customs for verification. The Customs must verify businesses that regularly import cars as gifts and donations in recent years. Border gate customs branches must strengthen control of the customs valuation for imported cars. The ministry has requested Customs set up inspection teams at four customs departments of provinces and cities where a large number of imported cars as gifts and donations. |

Related News

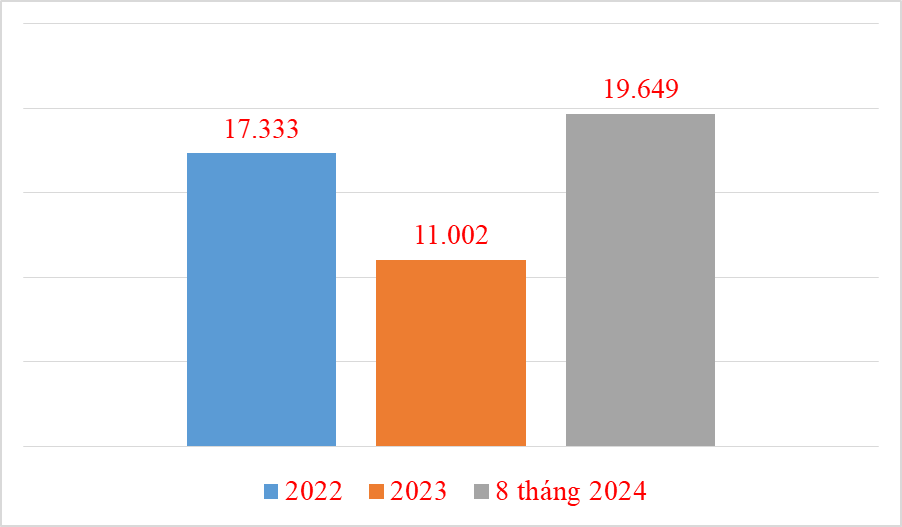

20,000 Chinese cars imported in 8 months

09:13 | 30/09/2024 Import-Export

From case of illegally importing three cars in Hai Phong: What are conditions for doing business of car import?

10:13 | 19/08/2024 Customs

Hai Phong Customs detects 3 smuggled cars hidden inside empty container

14:20 | 15/08/2024 Anti-Smuggling

Proposal to reduce registration fees to restore growth of domestic automobile industry

09:33 | 07/07/2024 Regulations

Latest News

Director of Dong Nai Customs engages monthly with enterprises

08:59 | 05/11/2024 Customs

Ha Nam Ninh Customs gathers feedback from the business community

09:55 | 04/11/2024 Customs

Facilitating trade and bolstering customs enforcement at Vinh Xuong border crossing

07:14 | 03/11/2024 Customs

3 items have a big impact on the budget revenue of Ho Chi Minh City Customs

19:38 | 02/11/2024 Customs

More News

Quang Ninh Customs collects 85.75% of the budget revenue through the seaport area

19:37 | 02/11/2024 Customs

Regulating goods across Huu Nghi International Border Gate during peak times

19:37 | 02/11/2024 Customs

Kien Giang Customs’ revenue reaches over 190% of target

10:36 | 02/11/2024 Customs

Quang Ninh Customs seeks solutions to promote import and export

10:34 | 02/11/2024 Customs

Businesses get a fair hearing under Customs' new 'three no' rule

09:31 | 31/10/2024 Customs

Khanh Hoa Customs reaches revenue target 1 quarter early

09:29 | 31/10/2024 Customs

WCO Permanent Technical Committee Meeting in Belgium: The managerial mark of the Vietnamese customs representative

09:29 | 31/10/2024 Customs

Revise regulations on implementing administrative procedures under the National Single Window

09:28 | 31/10/2024 Customs

Launch of the “Proud of 80 years of construction and development of Vietnam Customs” contest

09:08 | 30/10/2024 Customs

Your care

Director of Dong Nai Customs engages monthly with enterprises

08:59 | 05/11/2024 Customs

Ha Nam Ninh Customs gathers feedback from the business community

09:55 | 04/11/2024 Customs

Facilitating trade and bolstering customs enforcement at Vinh Xuong border crossing

07:14 | 03/11/2024 Customs

3 items have a big impact on the budget revenue of Ho Chi Minh City Customs

19:38 | 02/11/2024 Customs

Quang Ninh Customs collects 85.75% of the budget revenue through the seaport area

19:37 | 02/11/2024 Customs