How do experts evaluate the new specialized inspection model?

|

| Customs officers of Na Meo International Customs Branch (Thanh Hoa Customs Department) inspect import and export goods. Photo: N.L |

Benefits from cutting and simplifying procedures

The USAID-funded trade facilitation project has independently and objectively assessed the impact of the Scheme on reforming the model of quality inspection and food safety inspection for import goods. As a result, in terms of legal and administrative procedures, the Scheme helps to simplify the process and minimize procedures for quality inspection and food safety inspection.

Specifically, steps in the inspection process arereducedcompared to the current model because the business does not have to get test results from the inspection agency under the management ministries to submit to Customs; the application for an inspection exemption certificate is not required because customs already has data on the inspection history, and the customs system automatically updates information on goods and businesses subject to inspection exemptions or reductions.

The scheme also helps to simply procedures as the application for inspection is submitted to the National Single Window, so the business does not need to submit dossiers to the customs, reducing documents between inspections, and between customs dossiers and dossiers of quality inspection and food safety inspection.

The scheme helps reduce the burden of quality inspection and food safety inspection.According to the new model, the percentage of consignments that need to be inspected will decrease because the normal inspection and reduced inspection will be conducted more effectively and substantially; customs clearance time will be shortened due to the reduction in the proportion of consignments subject to inspection and the simplification of inspection procedures. Accordingly, the business will save costs and time.

In particular, the risk management principle is applied more comprehensively. This is shown in the identification and inspection method based on each item (instead of basedon goods owner as in the current model). The amendment will increase the number of subjects eligible for normal inspection (profile check); reduced inspection (only random inspection up to 5% of the total volume of goods subject to reduced inspection).

The inspection by goods is consistent with the provisions, because the Law on Product and goods quality regulates the quality management based on technical regulations and standards announced by manufacturers.

The new model enhances the voluntary compliance of businesses through random inspection. The Projectstatesthat the random selection of 5% for food safety and quality control, plus the enforcement of regulations and non-compliance sanctions, will encourage voluntary compliance amongbusinesses. The management agency will perform its management role, meeting the requirements of both facilitating import and export activities and enhancing the effectiveness of risk control.

Meanwhile, transparency and information sharing among management ministries are also enhanced. The role of the private sector in testing and assessing conformity is increasedbecause the business is allowed to select the conformity assessment organization for goods verification at the border gate.

According to an independent assessment from the USAID-funded Trade Facilitation Project, the number of customs declarations subject to quality inspection and food safety inspection per year under the new model reduces to 54.4% compared to the current model (excluding the reduction in the number of consignments subject to inspection as per the proposal of the scheme on the increase in the subjects exempt from quality inspection and food safety inspection).

The businesses will save 2,484,038 days per year for quality inspection and food safety inspection when applying the new model. The firms will save more than VND881 billion per year from the reduction in the days for the quality inspection and food safety inspection.

The overall impact on the economy, according to the USAID-funded Trade Facilitation Project, will reduce the number of shipments subject to inspection leading to a reduction in trade costs because the demand for inventory is cut and capital for business production is more effective.

Accordingly, it will encourage growth especially for manufacturers and distributors, boost exports and increase final output, providing more efficient opportunities for the economy.

Improve reputation and responsibility of all parties

For stakeholders, the Project statesthat the scheme has directly impacted many aspects. For the Government, the unification of the focal point with the implementation of customs procedures is an international trend, contributing to better integration, enhancing the Government’s reputation, improving the administrative reform index, increasing Vietnam's position on the world rankings of competitiveness and business environment.

The Government saves budget through reducing administrative procedures, cutting resources, reducing costs for cumbersome human resources for quality inspection and food safety inspection, and reducing customs clearance time for goods.

The management ministries still perform quality inspection and food safety inspection as at present, and only transfer the inspection at border gates to the Customs. Accordingly, it is required to strengthen information connections and exchange with the customs, supporting training for customs officials, and reorganizing resources to perform quality inspection and control for import goods during production and circulation in the domestic market. The management ministries must strengthen post-inspection.

For Customs, the Scheme helps strengthen the role of Customs in quality inspection and food safety inspection, in particular, the inspection focal point. This requires Customs to arrange additional personnel and standardize equipment.

For the conformity assessment organization, the project evaluates that the role of the conformity assessment organization remainsbasically unchanged compared with the present. However, the new model requires the synchronous application of information technologyamong agencies and organizations related to quality inspection and food safety inspection such as returning results on the National Single Window. Additionally, the reduction in the proportion of consignments subject to inspection can reduce the revenue of the conformity assessment organization.

Especially, for the business, the new model savestime for carrying out procedures for quality inspection and food safety inspection, because it mainly deals with one focal point; integrates inspection procedures into customs procedures; applies digitization to the inspection process; facilitates the settlement of arising problems by agreeing on the last responsible agency before customs clearance; saves cost when the shipment is exempt from inspection; creates a more competitive and equalbusiness environment because import goods will be controlled more closely, transparently and objectively.

Meanwhile, for consumers, in the long term, the price of goods can be reduced due to the decrease in costs of the business for quality inspection, food safety inspection, and the shortening of customs clearance time, facilitating fast commodity distribution and increasing business opportunities.

Related News

Goods trading, being seen from Lang Son border gate

13:45 | 28/11/2024 Customs

7 key export groups bring in US$234.5 billion

13:54 | 28/11/2024 Import-Export

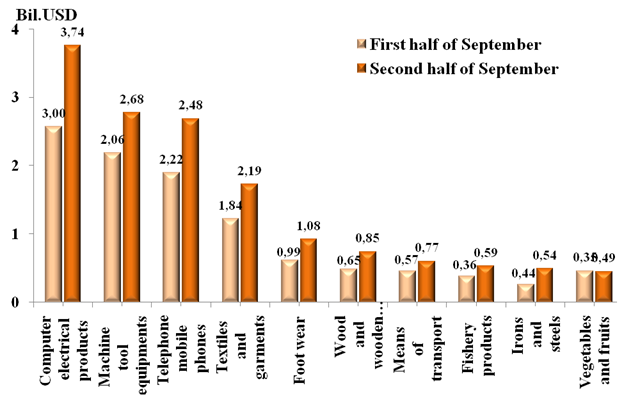

Preliminary assessment of Vietnam international merchandise trade performance in the second half of September, 2024

09:21 | 20/11/2024 Customs Statistics

Do exported foods need iodine supplementation?

11:06 | 29/11/2024 Regulations

Latest News

Ho Chi Minh City Customs: Satisfactorily resolving problems for Japanese businesses

11:07 | 23/12/2024 Customs

Minister of Finance Nguyen Van Thang: Facilitating trade, ensuring national security, and preventing budget losses

19:09 | 21/12/2024 Customs

Official implementation of the program encouraging enterprises to voluntarily comply with Customs Laws

18:31 | 21/12/2024 Customs

Proactive plan to meet customs management requirements at Long Thanh International Airport

18:30 | 21/12/2024 Customs

More News

An Giang Customs issues many notes to help businesses improve compliance

09:29 | 20/12/2024 Customs

Hai Phong Customs processes over 250,000 declarations in November

15:18 | 19/12/2024 Customs

Achievements in revenue collection are a premise for breakthroughs in 2025

09:57 | 18/12/2024 Customs

Binh Duong Customs surpasses budget revenue target by over VND16.8 Trillion

09:39 | 18/12/2024 Customs

Director General Nguyen Van Tho: Customs sector strives to excellently complete 2025 tasks

16:55 | 17/12/2024 Customs

Customs sector deploys work in 2025

16:43 | 17/12/2024 Customs

Mong Cai Border Gate Customs Branch makes great effort in performing work

11:23 | 16/12/2024 Customs

Declarations and turnover of imported and exported goods processed by Lao Bao Customs surge

09:17 | 15/12/2024 Customs

General Department of Vietnam Customs prepares for organizational restructuring

19:28 | 14/12/2024 Customs

Your care

Ho Chi Minh City Customs: Satisfactorily resolving problems for Japanese businesses

11:07 | 23/12/2024 Customs

Minister of Finance Nguyen Van Thang: Facilitating trade, ensuring national security, and preventing budget losses

19:09 | 21/12/2024 Customs

Official implementation of the program encouraging enterprises to voluntarily comply with Customs Laws

18:31 | 21/12/2024 Customs

Proactive plan to meet customs management requirements at Long Thanh International Airport

18:30 | 21/12/2024 Customs

An Giang Customs issues many notes to help businesses improve compliance

09:29 | 20/12/2024 Customs