HCM City Customs Department responds online regarding problems about goods origin for businesses

| Listing projects with slow disbursement in HCM City | |

| HCM City: Revenue collection falls more than VND 12,500 billion | |

| HCM City ready to welcome investment opportunities in new situation |

|

| HCM city Customs Department has implemented online dialogues with businesses. Photo: T.H |

Documents to enjoy preferential treatment from EVFTA

The EVFTA is one of contents businesses have paid attention and asked questions about. Answering the problem of Moet Hennessy Vietnam Distribution Shareholding Company about proof of goods originto enjoy special preferential import tax according to the EVFTA, Dang Thai Thien- Deputy Head of Customs Control and Supervision Division of HCM City Customs Department instructs as follows:

For goods transshipped or transited via a non-EVFTA member state, Clause 2, Article 16 of Circular 11/2020/TT-BTC stipulates if originating goods are exported from an EVFTA member stateand then re-imported from a non-EVFTA member state, re-imported goods shall be considered as non-originating goods, except they are eligible for requirements by the Customs agency.

Re-imported goods are those that have been exported, whilere-exported goods do not undergo necessary stages for goods preservation in good conditions in the warehouses in non-EVFTA member states or during the export.

According to the HCM City Customs Department, Clause 4, Article 17 Circular 11/2020/TT-BTC also provides in case of suspect, the importing country requires customs declarant to submit proof of compliance, including transport documents such as bill of lading; actual or specific documents of the labelling or numbering of the package; documents related to goods and certificate of non-manipulation issued by the competent authorities of the transiting country or the country dividing the shipment or any document providing the goods are under the control of customs authority of the transiting country or the country dividing the shipment.

Answering questions about the time limit for thesubmission of the proof of origin due to waiting for instructions, HCM City Customs Department said as per the instructions of the General Department of Vietnam Customs in Official Dispatch No. 5575/TCHQ-GSQL dated August 21, while waiting for the promulgation of the decree on preferential export tariffs and special preferential import tariffs to implement the EVFTA, for import customs declarations registered from August 1, businesses shall declare the proof of origin in the declarations and submit proof of goods origin in accordance with Article 5, Article 7 of Circular 38/2018 / TT-BTC dated April 20, 2018 (amended and supplemented in Circular No. 62/2019 / TT-BTC dated September 5, 2020).

Amid the Covid-19 pandemic, the time limit for thesubmission of proof of origin for import goods willcomply with the provisions in Circular No. 47/2020/TT-BTC dated May 27, 2020.

HCM City Customs Department has also reported to the General Department of Vietnam Customs on some proposals of businesses on the EVFTA such as self-issued certificates of origin; only using documents listed in Point a, b and c of Clause 4, Article 17 to prove compliance; invoice issued by the third party; and requirements on documents for shipments imported from August 1, 2020 to beforethe issue date of the decree on the EVFTA tariffs.

Remove problems on forms of C/O

Instructing Korea Mikasa Vietnam Co., Ltd on declaring C/O form KV, arepresentative of HCM City Customs Department said that the C/O form KV issued by South Korea is specified in Appendix VI issued together Circular No. 44/2015/TT-BCT dated November 18, 2015 of the Ministry of Industry and Traderegulating the implementation of the Rules of Origin in the Vietnam - Korea Free Trade Agreement.

Accordingly, the gross weight of goods or other quantity and the value of the shipment must be declared in box No.9 of this form (the FOB value is only declared for goods applied the regional value content).

If the business declares the net weight in box No.9, Customs shall check the C/O with other documents in the customs dossier to consider the validity of the C/O.

Schneider Electric Vietnam Co., Ltd.proposed guidance on C/O form A, HCM City Customs Department said that Article 26 of Decree 31/2018/ND-CP dated 8 March 2018 detailing the Law on Foreign Trade Management, specifies cases that must submit the proof of goods origin to customs.

If the importer requires the exporter to provide C/O under their request, which is not required in the customs dossier, acceptance or not is decided by the enterprise.

HCM City Customs Department also notes businesses should contact customs where they opened the customs declaration for guidance on implementation.

Related News

Businesses need support from vietnamese representative offices abroad

14:48 | 20/11/2024 Headlines

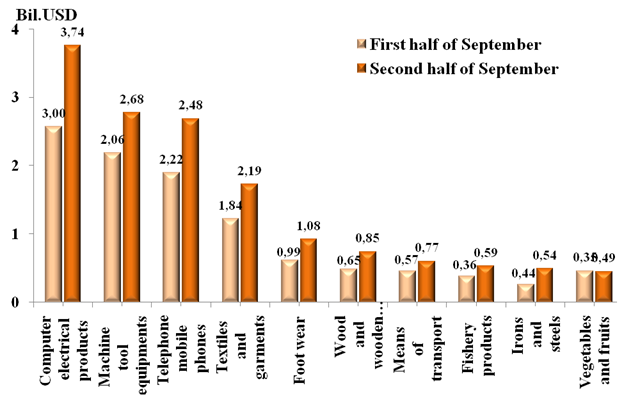

Preliminary assessment of Vietnam international merchandise trade performance in the second half of September, 2024

09:21 | 20/11/2024 Customs Statistics

What do businesses need for digital transformation?

09:20 | 17/11/2024 Headlines

Closely control imported products traded via e-commerce

09:19 | 17/11/2024 Customs

Latest News

Appointment of new Directors for the Customs Reform and Modernization Board and Anti-Smuggling and Investigation Department

13:41 | 22/11/2024 Customs

Binh Duong Seaport Customs Branch supports and facilitates enterprises

09:34 | 22/11/2024 Customs

Promoting Vietnam-Laos Customs cooperation

09:44 | 21/11/2024 Customs

Ho Chi Minh City: Imported gasoline, iron and steel greatly affect state budget revenue

09:22 | 20/11/2024 Customs

More News

Quang Nam Customs facilitates trade and increases revenue

09:41 | 19/11/2024 Customs

Quang Tri Customs: Revenue from imported coal plunges

10:05 | 18/11/2024 Customs

Mong Cai Customs sets new record in revenue collection

19:39 | 16/11/2024 Customs

Lao Cai Customs attracts over 100 new businesses for customs procedures

09:34 | 16/11/2024 Customs

Vietnam Customs attends WCO’s flagship conference

09:33 | 16/11/2024 Customs

Da Nang Customs joins efforts to establish free trade zone proposal

10:56 | 15/11/2024 Customs

Quang Ninh Customs sees revenue boost of nearly VND 900 Billion from new enterprises

10:55 | 15/11/2024 Customs

Roadmap set for pilot program of smart border gate initiative

10:49 | 15/11/2024 Customs

Hanoi Customs partners with businesses to boost import-export activities

10:49 | 15/11/2024 Customs

Your care

Appointment of new Directors for the Customs Reform and Modernization Board and Anti-Smuggling and Investigation Department

13:41 | 22/11/2024 Customs

Binh Duong Seaport Customs Branch supports and facilitates enterprises

09:34 | 22/11/2024 Customs

Promoting Vietnam-Laos Customs cooperation

09:44 | 21/11/2024 Customs

Ho Chi Minh City: Imported gasoline, iron and steel greatly affect state budget revenue

09:22 | 20/11/2024 Customs

Quang Nam Customs facilitates trade and increases revenue

09:41 | 19/11/2024 Customs