Focus on handling tax debt

|

VND246 billion collected from handling tax debts

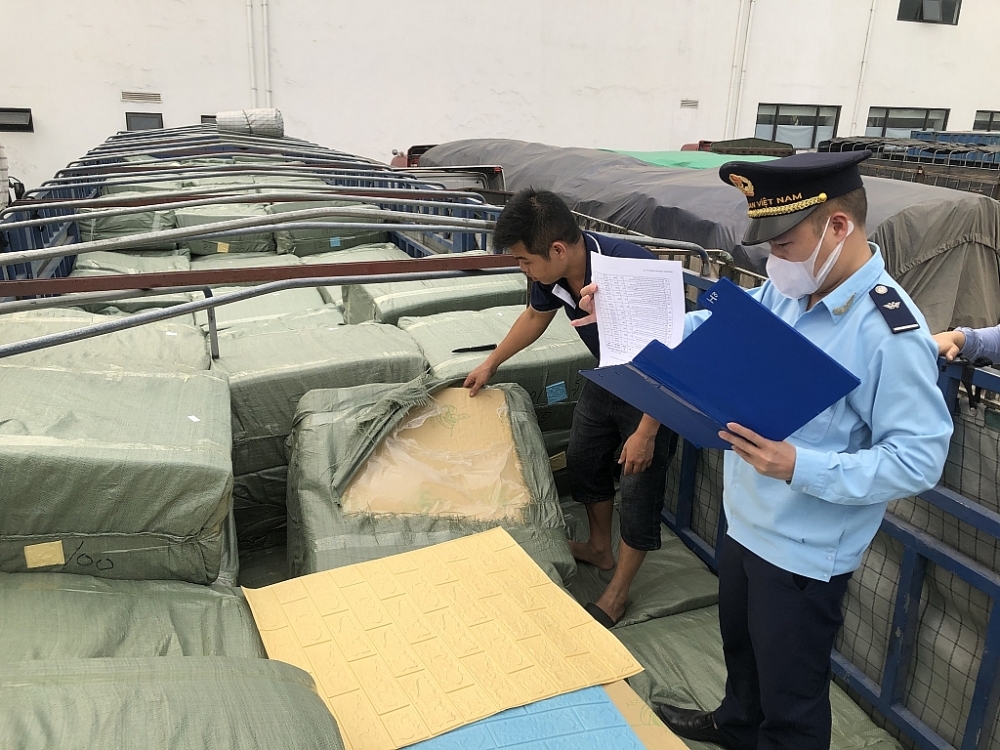

The GDVC requests its subordinate units to take measures to handle and collect outstanding tax debts, including reviewing and classifying debt groups and completing files eligible for debt cancellation.

Statistics from Import and Export Duty show that as of April 30, the amount of overdue debt is VND5,584.54 billion, down by VND66.82 billion compared to December 31, 2020.

The amount of bad debts, pending debts, recoverable debts and debt from administrative violation fines is VND3,882.44, up 12.9 billion, 82.36 billion, down VND1.97 billion, VND1,457.12 billion, down VND66.71 billion, and VND162.62 billion, down VND11.05 billion, respectively.

To reduce tax debts to the lowest level, the GDVC has requested customs departments carry out plans for tax debt collection. It also asks all departments to strengthen the tax debt collection and inspection of tax debt management in their localities.

They were told to focus on reviewing and grasping the tax debt status at departments, classifying debt groups of recoverable tax debts and bad debts to issue decisions for assigning debt collection targets to municipal and provincial customs departments.

Departments also are required by the GDVC to assess each tax debt group of each firm, the actual status of the enterprise, handle former debts and prevent new debts; assign targets of collection and handling of recoverable debts for each local customs department.

Coordination in coercive measures

To fulfill revenue collection, the GDVC asks the Import and Export Duty Department to regularly monitor and urgent units to provide solutions for debt collection, to monthly and quarterly check the tax debt collection and to request local customs departments to complete documents of cases eligible for tax debt cancellation as prescribed in Resolution No. 94/2019/QH14 and the Law on Tax Administration 38/2019/QH14 to write off tax debts, reducing the total tax debt amount.

Conditional tax exemptions and reductions such as processed goods, imported goods for the production of processed goods, and goods imported for production of export goods must be strictly controlled to prevent arising tax debts due to the fleeing of business owners.

The GDVC requests local customs departments perform coercive measures such as revoking the Enterprise Registration Certificates and Business Registration Certificates for firms that have overdue tax debts as prescribed in Point g, Clause 1, Article 125, Clause 1, Article 135 of the Law on Tax Administration No. 38/2019/QH14.

The head of the taxman is responsible for proposing the competent State management agency revoke these certificates as prescribed of the Law on Enterprises No. 59/2020/QH14. If a business registration office receives a written request for revocation of the enterprise registration certificate from a competent State agency, the office will revoke the certificate.

Customs has applied coercive measures under the Law on Tax Administration for tax debtors like stopping customs clearance however they still delay in tax debt payment. Customs continues to coordinate with authorities to decide temporary suspension of exit for tax debtors, business owners and legal representatives of firms as specified in Clause 1, Article 21 of Decree 126/2020/ND-CP.

Related News

Ho Chi Minh City Customs: Exceeded the state budget revenue target by nearly 100 billion VND

15:27 | 31/12/2024 Customs

Hai Phong Customs collects over VND87 billion from post-clearance audit

15:30 | 31/12/2024 Customs

Hai Phong Customs sets new record in revenue of VND70,000 billion

07:45 | 31/12/2024 Customs

Latest News

Customs reduces VAT under Resolution No. 174/2024/QH15

14:53 | 06/01/2025 Customs

HCMC Customs: Outstanding performance across all operations

06:36 | 05/01/2025 Customs

Tackling revenue challenges: Dong Nai Customs Department’s strategic plan for 2025

14:28 | 03/01/2025 Customs

Director General Nguyen Van Tho: streamlining apparatus to meet the requirements of customs modernization

15:53 | 02/01/2025 Customs

More News

Cao Bang Customs Department collects over VND 940 Billion, achieving a 22% increase

23:00 | 31/12/2024 Customs

Ba Ria - Vung Tau Customs: A strategic partner in business success

22:00 | 31/12/2024 Customs

Challenges facing customs revenue collection in 2025

20:00 | 31/12/2024 Customs

Quang Ninh Customs: making efforts to help businesses improve compliance

16:47 | 31/12/2024 Customs

Customs modernization: From VNACCS to Digital Customs: Part 3: Part 3: Comprehensive digital transformation in customs field

15:30 | 31/12/2024 Customs

Modernizing Customs: From VNACCS to Digital Customs Part 2: The urgent need for a new IT system

07:55 | 31/12/2024 Customs

Hai Phong Customs focuses on customs supervision and management

13:55 | 30/12/2024 Customs

Businesses highly appreciate support of Quang Ngai Customs

17:59 | 29/12/2024 Customs

Dong Nai Customs proposes to pilot restructuring according to the new model

13:47 | 28/12/2024 Customs

Your care

Customs reduces VAT under Resolution No. 174/2024/QH15

14:53 | 06/01/2025 Customs

HCMC Customs: Outstanding performance across all operations

06:36 | 05/01/2025 Customs

Tackling revenue challenges: Dong Nai Customs Department’s strategic plan for 2025

14:28 | 03/01/2025 Customs

Director General Nguyen Van Tho: streamlining apparatus to meet the requirements of customs modernization

15:53 | 02/01/2025 Customs

Cao Bang Customs Department collects over VND 940 Billion, achieving a 22% increase

23:00 | 31/12/2024 Customs