A question of origin violation: how did six timber enterprises violate?

| Increasing the number of violated goods through screening | |

| Customs seize 6 cargo trucks transporting violated goods |

|

| Director of the Anti-Smuggling and Investigation Department Nguyen Phi Hung gave a speech at the press conference. Photo: T. Binh |

At apress conference on ‘Combating fraud of goods origin of the Customs sector’, which took place on July 19, a representative of the Anti-Smuggling and Investigation Department spoke about recent developments.

Focus - VT Company Limited

According to the representative of the Anti-Smuggling and Investigation Department, based on revieweddata and information about the violations of plywood companies, the Anti-Smuggling and Investigation Department and other related units planned to verify information related to production activities and the export of plywood and veneer of six companies with large production and export volume which have hadabnormal growth in turnover.

Related to the above cases, the Department of Anti-Smuggling and Investigation is clarifying further the nature and extent of the violations according to the law on C/O, including dishonesty, counterfeiting records, papers and appropriating value-added tax.

The results of the investigation and verification showed that VT Co., Ltd.,located in Hanoi,is a commercial enterprise.

From 2018 to the end of March 2019, the company exported 27,051.73 square metres of plywood and plywood panel products worth 405.7 billion VND. It received a VAT refund of more than 32.5 billion VND.

Recently, many businesses have sold goods to VT Co., Ltd.Ofwhich, VM Company Limited (Hung Yen), from its establishment in January 2018 to March 31, 2019, produced and sold VT Co., Ltd. 5,499.22 square metres, worth over 64 billionVND for export. Especially, the batch which was produced from peeled board and imported from China, produced 8.425 sheets of finished products, worth nearly 3.4 billion VND.

In addition, the company exported 79.9 m3 of plywood, worth 935 million VND.

AA Joint Stock Company (Nam Dinh), from its establishment in June 2018 to March 2019, produced and sold VT Company Limited 5,709 square metresfor export, worth more than 60.4 billion VND.

GR Joint Stock Company (Lang Son) was established in June 2018. In March 2019, it produced and sold VT 24,078 square metresof plywood blocks for export, worth 112.7 billion VND.

Moreover, the Customs office identified that FN Co., Ltd. (PhuTho) had imported semi-finished plywood from China, including 2,087 square metres of veneer wood from white maple and poplar and 28,935 square metres of plywood.

The company exported finished plywood to seven partners with a total export volume of 15,542 square metres and got value-added tax refund of more than 12 billion VND.

Go Company Limited (Hanoi) opened 80 export declarations for 12,600 square meres, worth over 120 billion VND, in 2018.

However, the company did not apply for Certificate of Origin (C/O) from Vietnam for these export shipments.

According to the company, the buyer did not require C/O. This content was verified by the Anti-Smuggling and Investigation Department and is waiting for a reply from the customs of the company’s timber import partners.

Are there any accomplices?

After verifying the six companies and working with households and local authorities, the Anti-Smuggling and Investigation Department discovered someissues related to violations in the establishment of C/O applications.

For enterprises, Customs authorities determined that the application for C/O of VT Company Limited, VM Company Limited, GR Joint Stock Company and AA Joint Stock Company had violated the law.

Specifically, the enterprises admitted to not buyingsapgum and acacia materials from the households stated in the contract.

The companies used a raw material purchase contract with bogus signature andfake land use right certificates in some C/O applications, the purpose of validating input documents to carry out procedures to apply for certificates of origin in Vietnam for goods that the company produced to sell to another company for export or to directly export itself.

They also used value-added tax invoices to buy acacia and wheat flour for many declarations to make C/O application dossiers. Ofwhich, the total amount of acacia and wheat flour in the declarations exceeded the amount on the input bills.

Notably, some businesses imported peeled veneer and semi-finished products from China to produce peeled wood for export but did not declarethem in their C/O application.

For VT Co., Ltd., some of its applications for C/O for export shipments (provided by manufacturing companies) used illegal or counterfeitdocuments.

Regarding the responsibility of local authorities in forest product management, the Anti-Smuggling and Investigation Department found signs of loose management in the certification of forest products.

Specifically, the People's Committees of some communes did not open records for monitoring forest product exploitation and did not check the actual situation before confirming the records.Onmany records, plot numbers were not available in reality or did not match the plot numbers that households are planting and exploiting.

In particular, there are cases in whichthe leader of the commune People's Committee signed and stamped some applications for exploitation permits, lists of exploited forest products, lists of forest products in advance and gave them to households to fill out the above documents.

During the investigation process, the Customs authorities also identified irregularities in issuing C/O of the Vietnam Chamber of Commerce and Industry (VCCI).

Specifically, a number of forest product lists and exploited forest product liststhat were without date, signatures of forest owners, signatures of commune authorities, signatures of the people in the contract to buy materials were still granted C/O.

Many declarations of export goods that met the "CTC" criteriahad contradictions and overlaps in invoices and data but were still granted C/O.

Bills of acacia, wheatflour, and wood planks were used by companies many times in C/O declarations exceeded the amount of acacia, wheat flour, and planks in the input billsto produce plywood for export, but were not checked for violations

According to the evaluation of the Anti-Smuggling and Investigation Department, the provision of origin according to the criteria for converting 6-digit goods codes for some cases is relatively loose.

For example, converting the code from 4412.39 (imported materials) to code 4412.33/4412.34 is very simple. From the code 4412.39 (imported), it can be added at least 1 layer of plywood code 4412.94 (imported) or a product having surface layer of peeled board code 4408.90/10 (imported) or wood planks with Vietnamese origin (not pine or coniferous), the output will be declared in code 4412.33/4412.34.

Thus, goods have been identified as Vietnamese origin because they met the criteria for converting commodity codes at 6-digit level.

Related News

Kien Giang Customs’ revenue reaches over 190% of target

10:36 | 02/11/2024 Customs

Revise regulations on implementing administrative procedures under the National Single Window

09:28 | 31/10/2024 Customs

Digital transformation in Customs sector is a revolution

10:45 | 28/10/2024 Customs

Customs handles a daily trade volume of over US$2 billion

10:46 | 28/10/2024 Customs

Latest News

Three-year drug bust nets over 23 tons

10:36 | 02/11/2024 Anti-Smuggling

Thousands of diamonds seized in airport smuggling bust

16:37 | 01/11/2024 Anti-Smuggling

Exposing a transnational drug ring hidden in pet food

14:42 | 28/10/2024 Anti-Smuggling

Customs control and prevent many drug trafficking cases in the South

14:18 | 25/10/2024 Anti-Smuggling

More News

An Giang Customs announces businesses with tax arrears

14:51 | 24/10/2024 Anti-Smuggling

Unit 4: Stopping dozens of cases of transportation in counterfeits through border gates

13:45 | 23/10/2024 Anti-Smuggling

Establish nearly 170 bogus enterprises to purchase illegal invoice

14:07 | 22/10/2024 Anti-Smuggling

Foreigner caught smuggling 7 gold pieces at Noi Bai Airport

20:01 | 21/10/2024 Anti-Smuggling

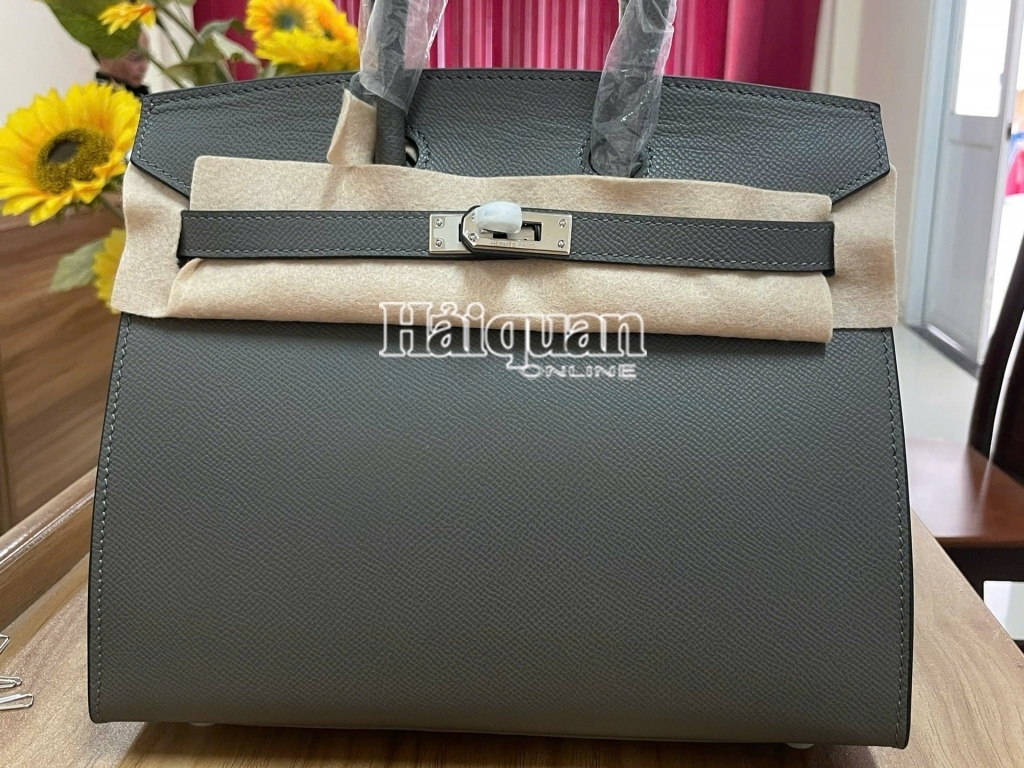

Dozens of fake HERMÈS bags intercepted in a border crackdown

15:28 | 20/10/2024 Anti-Smuggling

Ho Chi Minh City Customs and Border Guard join hands to prevent dozens of smuggling cases

10:27 | 18/10/2024 Anti-Smuggling

Vietnam, Laos cooperate effectively in combating drug crimes

07:41 | 16/10/2024 Anti-Smuggling

HCM City Customs detect over 20 cases of smuggling and tax evasion

07:39 | 16/10/2024 Anti-Smuggling

Ho Chi Minh City: Tightening management of trading of toxic chemicals

10:08 | 13/10/2024 Anti-Smuggling

Your care

Three-year drug bust nets over 23 tons

10:36 | 02/11/2024 Anti-Smuggling

Thousands of diamonds seized in airport smuggling bust

16:37 | 01/11/2024 Anti-Smuggling

Exposing a transnational drug ring hidden in pet food

14:42 | 28/10/2024 Anti-Smuggling

Customs control and prevent many drug trafficking cases in the South

14:18 | 25/10/2024 Anti-Smuggling

An Giang Customs announces businesses with tax arrears

14:51 | 24/10/2024 Anti-Smuggling