The fight against origin fraud and raised issues - Part 1: When the war of the "giants" broke out

|

| All components of a bicycle were imported from China, the business only brought back to Vietnam to re-assemble the fleet of Made in Vietnam, the case was conducted by the Post-Clearance Inspection Department and the Binh Duong Customs Department. Photo: Post-clearance Inspection Department |

Trade fraud, including goods origin fraud is always a challenge for every country in the globalization trend. For Vietnam, origin fraud was really hot for more than a year before the trade war between major countries took place.

Avoid the punishment and gain benefit illegally

More than a year ago, the working schedule of the General Department of Customs was always full of meetings related to the origin of goods. With the role of "gatekeeper" of the economy, Customs has always been active and proactive in assessing the effects of integration trends to take timely preventive and preventive measures.

In the documents the reporter has access to, the Customs agency made the assessment: in the trend of deep integration into the world economy, Vietnam has signed many free trade agreements (FTAs) with countries around the world and created great competitive advantages for Vietnam in attracting FDI, growing the scale of import and export turnover. Besides the positive side, it also poses many challenges to the regulatory agencies, especially to promptly detect and prevent frauds that take advantage of the open policy of the Vietnamese state.

|

| Finished cell phone batteries imported from China but made in Vietnam, discovered by HaiPhong Customs, seized in July 2019. Photo: T. Binh |

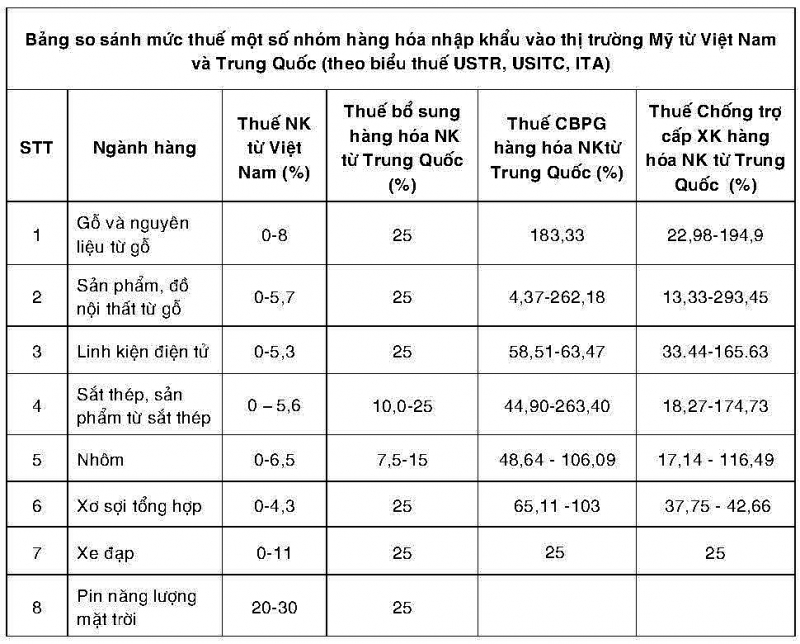

In fraud, the problem of taking advantage of the origin of Vietnamese goods aims to benefit from taxes and evade "sanctions" from technical barriers as countries increase protectionism of production in the country.

This behavior leads to the risk of Vietnam's exports being investigated by countries, imposing very high anti-dumping, safeguard and subsidy taxes, causing damage to Vietnamese manufacturers, losing credibility in the international market or restricting exports to these markets if detected by the importing country and apply trade remedies.

Under these circumstances, following the directions of the Government, the Ministry of Finance, and the General Department of Customs, there has been a fierce and timely effort to uncover many fraud and cases of fraudulent origin (this will be discussed in detail in the following articles).

Therefore, over the past year, the issue of origin fraud in Vietnam has been gradually controlled.

The higher the incentive, the tighter the origin

As mentioned above, the challenge posed when implementing FTAs is to combat origin fraud. Therefore, in the new generation FTAs that Vietnam joins as CPTPP, EVFTA, the issue of goods origin is strictly regulated. This issue is even more evident when EVFTA was approved by the Vietnamese National Assembly on June 8 at the 9th session, National Assembly XIV and is expected to take effect from August 1, 2020.

|

Please cite the issue related to the origin of the textile industry. This is a key export group for many years in Vietnam and is also one of the commodities that are expected to benefit greatly from FTAs that Vietnam has been participating. So, what are the provisions of EVFTA on the rules of origin for this item?

According to the Ministry of Industry and Trade, EVFTA requires the "two-stage" of origin rule (from fabric onwards) for textiles. That is, in order to enjoy the preferential tariff under the EVFTA, Vietnam's textiles and garments must be made from fabrics of Vietnamese origin. In addition, for textile products under Chapters 61 and 62 of the Tariff Schedule, the EU also allows Vietnam to use fabrics imported from Korea to produce final products exported to the EU and still enjoy preferential tax rate of the EVFTA.

Meanwhile, the provisions of the CPTPP are stricter because the agreement requires textiles and clothing of "yarn forward" origin, that is, yarns and fabrics to be manufactured and/or imported from CPTPP countries in order to enjoy the agreement's preferential tariff upon export to CPTPP countries.

In fact, at present, the main source of raw materials for the textile and apparel sector is from imported sources. For example, in the first five months of 2020, Vietnam's garment and textile export turnover reached US$10.56 billion. But during that time, Vietnam also spent billions of dollars importing goods related to raw materials of the textile industry. Specifically, four main commodity groups are: fabrics with a turnover of US$4.5 billion; textile, leather, footwear materials with US$2.1 billion; cotton US$1.08 billion; fiber, textile fiber US$832 million. Meanwhile, the two main import markets, China and Taiwan are not members of the CPTPP.

Through the typical example mentioned above, the deeper trend of integration, the greater the preference among members participating in FTAs, the more important the issue of origin of goods is. Therefore, the issue of anti-fraud origin always requires the fierce and regular participation of the Customs sector, the authorities and the business community.

Uncover violations of a series of businesses

For the General Department of Customs, thoroughly grasping the direction of the Government, leaders of the Ministry of Finance, the Customs authorities have actively and synchronously implemented a series of solutions. Thereby, it has been promptly prevented from taking advantage of the FTAs Vietnam has signed with other countries, especially the US, to commit violations of Vietnamese origin, affecting Vietnam's commitments to other countries.

Especially, we have controlled the export turnover to the US with sudden export turnover such as bicycles, solar batteries, seafood, wood and wood products and many other items to avoid adversely affecting exporting business of Vietnam.

Notably, at the press conference of the Customs sector on the inspection and investigation of fraud prevention of Vietnamese goods, the leader of the Post-clearance Inspection Department said: examined, investigated and verified 76 cases and found 24 cases of violations of goods origin. Customs authorities confiscated 3,590 complete bikes, more than 4,000 bicycle parts and more than 12,000 sets of kitchen cabinet assembly as exhibits of violations.

In addition, the Customs Department has collected and paid VND33 billion to the state budget (including the amount of money gained illegally due to committing acts of violation; administrative violations and confiscated material evidence).

Specifically, through the post-clearance inspection of the group of bicycles and electric bicycles found four enterprises violating Vietnamese origin; for solar battery group, there are five violating enterprises with wood products, wooden furniture found 12 violating enterprises.

Along with that, the Department of Anti-smuggling Investigation discovered two seafood enterprises that have made false declarations of origin of goods. In particular, the Anti-Smuggling Investigation Department discovered that an enterprise was not authorized by the Ministry of Industry and Trade, the Vietnam Chamber of Commerce and Industry (VCCI) to issue a certificate of origin but still issued C/O without permission for many businesses. The General Department of Customs is directing the Anti-Smuggling Investigation Department to coordinate closely with the Investigation Police Agency - C03 (Ministry of Public Security) to investigate and clarify violations to strictly handle them according to regulations.

(Waiting for Part 2:The origin fraudtricks)

Related News

Latest News

Fireworks, firecrackers "hot" again

09:32 | 22/11/2024 Anti-Smuggling

HCM City Customs detects violations worth nearly VND 4.4 trillion

14:35 | 21/11/2024 Anti-Smuggling

Strengthening efforts to combat smuggling and illegal pig transport

14:34 | 21/11/2024 Anti-Smuggling

Combat cigarette smuggling in the context of increasing excise tax

09:45 | 21/11/2024 Anti-Smuggling

More News

VND 479 Billion contributed to state budget from violations handling

14:48 | 20/11/2024 Anti-Smuggling

Crackdown on counterfeit goods in e-commerce uncovers widespread violations

09:27 | 20/11/2024 Anti-Smuggling

Enforcement authorities busts 67, 000 cases and seizes about 10 tons of drugs

09:23 | 20/11/2024 Anti-Smuggling

Solutions to prevent or fraud of origin and geographical indication violations

09:40 | 19/11/2024 Anti-Smuggling

Counterfeit goods in small e-commerce parcels challenge enforcement agencies

10:05 | 18/11/2024 Anti-Smuggling

Ho Chi Minh City Customs: Preventing many cases of importing goods that violate intellectual property rights

09:32 | 16/11/2024 Anti-Smuggling

Four business directors face exit bans over persistent tax debts

13:53 | 15/11/2024 Anti-Smuggling

Prosecuting a trafficking case of drug hidden in air compressors from France to Vietnam

10:51 | 15/11/2024 Anti-Smuggling

Search for owners of 59 containers of backlogged machinery and equipment at port

08:33 | 13/11/2024 Anti-Smuggling

Your care

Fireworks, firecrackers "hot" again

09:32 | 22/11/2024 Anti-Smuggling

HCM City Customs detects violations worth nearly VND 4.4 trillion

14:35 | 21/11/2024 Anti-Smuggling

Strengthening efforts to combat smuggling and illegal pig transport

14:34 | 21/11/2024 Anti-Smuggling

Combat cigarette smuggling in the context of increasing excise tax

09:45 | 21/11/2024 Anti-Smuggling

VND 479 Billion contributed to state budget from violations handling

14:48 | 20/11/2024 Anti-Smuggling