Sharp increase of imported automobiles at Cao Bang Customs

|

| Sketched by Thái Bình |

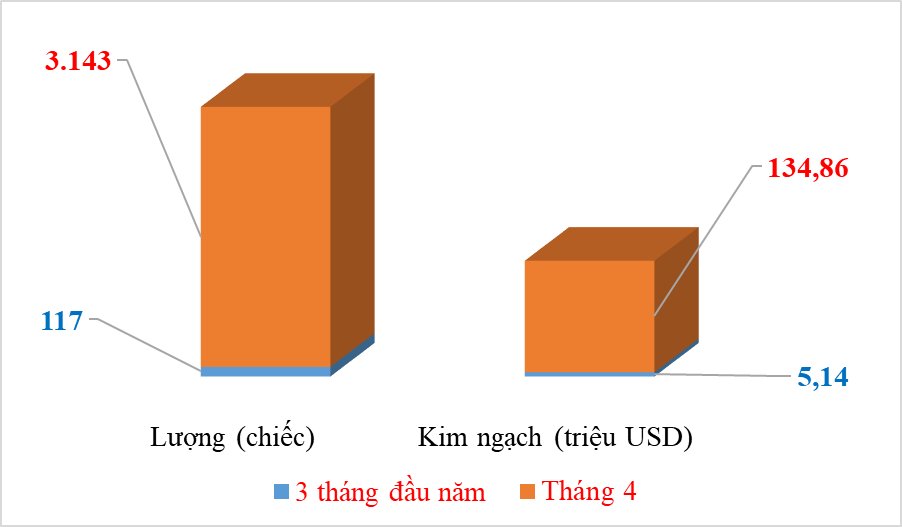

Accordingly, in April, the number of CBU cars imported at Cao Bang Customs reached 3,143 units with a total turnover of US$134.86 million, an increase of 2,498% compared to March 2022.

Notably, April accounted for 96.4% of total automobile imports in the first four months of the year (4,260 vehicles in the first four months of the year), while the turnover accounted for 96.3%.

In April, the group of automobiles alone accounted for 93.53% of the total import turnover of goods carrying out procedures at Cao Bang Customs Department.

The high increase of imported cars with high tax rates and high value leads to a sharp increase in revenue collection of Cao Bang Customs in April.

Specifically, in April, the revenue collection of Cao Bang Customs reached VND722.26 billion, an increase of 2,224% compared to March.

By the end of April, the revenue collection at Cao Bang Customs reached VND893.85 billion.

Automobile import activity increased sharply at Cao Bang Customs at the end of 2021 (implementing procedures at Ta Lung Customs Branch), then it decreased and spiked again in the past four months. However, this is a non-traditional and regular imported item at Cao Bang Customs.

On the northern border, usually, CBU cars which are trucks or specialized vehicles, are imported mainly through the border gate in Lang Son province.

According to regulations, passenger cars under 16 seats are only imported through six seaport border gates, including Quang Ninh (Cai Lan port); Hai Phong; Thanh Hoa (Nghi Son port); Danang; HCM City; and Ba Ria-Vung Tau.

Related News

Minister of Finance Nguyen Van Thang: Facilitating trade, ensuring national security, and preventing budget losses

19:09 | 21/12/2024 Customs

Hai Phong Customs processes over 250,000 declarations in November

15:18 | 19/12/2024 Customs

Binh Duong Customs surpasses budget revenue target by over VND16.8 Trillion

09:39 | 18/12/2024 Customs

Ho Chi Minh City achieves record state revenue of over VND500 trillion in 2024

10:33 | 10/12/2024 Finance

Latest News

Official implementation of the program encouraging enterprises to voluntarily comply with Customs Laws

18:31 | 21/12/2024 Customs

Proactive plan to meet customs management requirements at Long Thanh International Airport

18:30 | 21/12/2024 Customs

An Giang Customs issues many notes to help businesses improve compliance

09:29 | 20/12/2024 Customs

Achievements in revenue collection are a premise for breakthroughs in 2025

09:57 | 18/12/2024 Customs

More News

Director General Nguyen Van Tho: Customs sector strives to excellently complete 2025 tasks

16:55 | 17/12/2024 Customs

Customs sector deploys work in 2025

16:43 | 17/12/2024 Customs

Mong Cai Border Gate Customs Branch makes great effort in performing work

11:23 | 16/12/2024 Customs

Declarations and turnover of imported and exported goods processed by Lao Bao Customs surge

09:17 | 15/12/2024 Customs

General Department of Vietnam Customs prepares for organizational restructuring

19:28 | 14/12/2024 Customs

Revenue faces short-term difficulties but will be more sustainable when implementing FTA

19:27 | 14/12/2024 Customs

Customs sector collects over VND384 trillion in revenue

17:13 | 12/12/2024 Customs

Japanese businesses express satisfaction with HCMC Customs’ Support

09:40 | 12/12/2024 Customs

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Your care

Minister of Finance Nguyen Van Thang: Facilitating trade, ensuring national security, and preventing budget losses

19:09 | 21/12/2024 Customs

Official implementation of the program encouraging enterprises to voluntarily comply with Customs Laws

18:31 | 21/12/2024 Customs

Proactive plan to meet customs management requirements at Long Thanh International Airport

18:30 | 21/12/2024 Customs

An Giang Customs issues many notes to help businesses improve compliance

09:29 | 20/12/2024 Customs

Hai Phong Customs processes over 250,000 declarations in November

15:18 | 19/12/2024 Customs