Revenue from post-clearance audit increases by 136%

| Post-clearance audit as key solution to combat revenue loss of HCM City Customs Department | |

| Customs earns VND300 billion in revenue from post-clearance audit |

|

| The revenue from post-clearance audit increases by 136%. |

According to the General Department of Vietnam Customs, in the first half of August, the Customs sector performed 229 post-clearance audits, including 108 audits at the customs declarant’s premises and 121 audits at the Customs’ offices.

The Customs imposed VND 264.6 billion in taxes and administrative fines and remitted VND 211.77 billion to the State budget.

As of August 15, the Customs sector implemented 1,114 post-clearance audits, including 466 audits at the Customs declarant’s premises and 648 audits at the Customs’ offices.

The Customs imposed VND 580.67 billion in taxes and administrative fines and remitted VND 511.01 billion to the State budget.

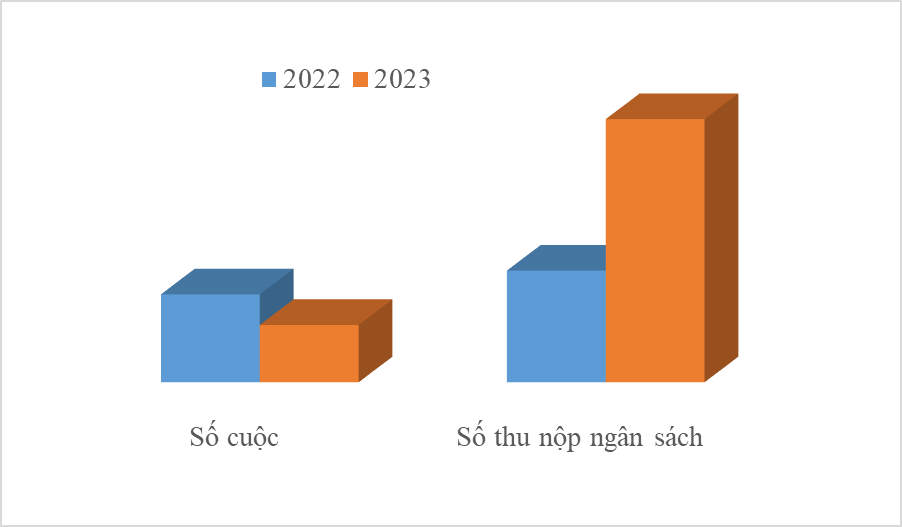

Notably, the number of post-clearance audits only reached 65% compared with the previous year, but the revenue from the post-clearance audit grew 136% or VND294 billion.

The Post-Clearance Audit Department alone conducted 158 audits and remitted VND291.13 billion year-on-year. The number of audits only reached 99%, but the revenue rose 190% or VND191 billion.

Related News

Customs sector strengthens anti-smuggling for e-commerce products

19:09 | 21/12/2024 Anti-Smuggling

Preliminary assessment of Vietnam international merchandise trade performance in the second half of November, 2024

15:18 | 19/12/2024 Customs Statistics

Achievements in revenue collection are a premise for breakthroughs in 2025

09:57 | 18/12/2024 Customs

Ministry of Finance stands by enterprises and citizens

15:30 | 13/12/2024 Finance

Latest News

Minister of Finance Nguyen Van Thang: Facilitating trade, ensuring national security, and preventing budget losses

19:09 | 21/12/2024 Customs

Official implementation of the program encouraging enterprises to voluntarily comply with Customs Laws

18:31 | 21/12/2024 Customs

Proactive plan to meet customs management requirements at Long Thanh International Airport

18:30 | 21/12/2024 Customs

An Giang Customs issues many notes to help businesses improve compliance

09:29 | 20/12/2024 Customs

More News

Hai Phong Customs processes over 250,000 declarations in November

15:18 | 19/12/2024 Customs

Binh Duong Customs surpasses budget revenue target by over VND16.8 Trillion

09:39 | 18/12/2024 Customs

Director General Nguyen Van Tho: Customs sector strives to excellently complete 2025 tasks

16:55 | 17/12/2024 Customs

Customs sector deploys work in 2025

16:43 | 17/12/2024 Customs

Mong Cai Border Gate Customs Branch makes great effort in performing work

11:23 | 16/12/2024 Customs

Declarations and turnover of imported and exported goods processed by Lao Bao Customs surge

09:17 | 15/12/2024 Customs

General Department of Vietnam Customs prepares for organizational restructuring

19:28 | 14/12/2024 Customs

Revenue faces short-term difficulties but will be more sustainable when implementing FTA

19:27 | 14/12/2024 Customs

Japanese businesses express satisfaction with HCMC Customs’ Support

09:40 | 12/12/2024 Customs

Your care

Minister of Finance Nguyen Van Thang: Facilitating trade, ensuring national security, and preventing budget losses

19:09 | 21/12/2024 Customs

Official implementation of the program encouraging enterprises to voluntarily comply with Customs Laws

18:31 | 21/12/2024 Customs

Proactive plan to meet customs management requirements at Long Thanh International Airport

18:30 | 21/12/2024 Customs

An Giang Customs issues many notes to help businesses improve compliance

09:29 | 20/12/2024 Customs

Hai Phong Customs processes over 250,000 declarations in November

15:18 | 19/12/2024 Customs