Preventing loss of revenue via goods classification: Making healthy competitive environment for enterprises

|

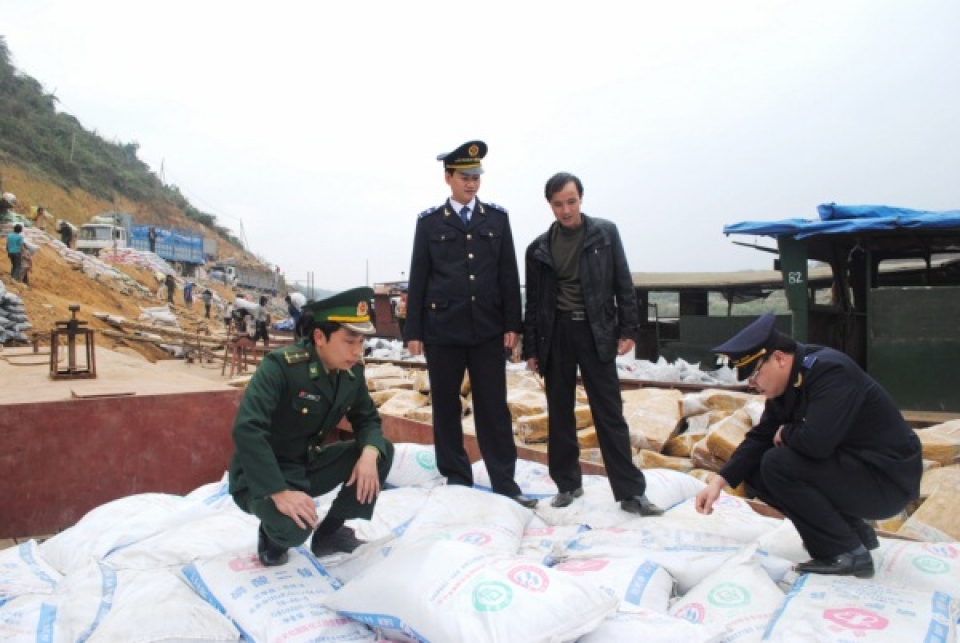

| Customs officials of Bat Xat Customs Branch - Lao Cai Customs Department coordinated with Border Defense force to inspect imported goods. Photo: T.Thắng |

Enterprises are more convenient in the goods classification

Preventing and combating tax losses via declaring commodity classification has become an important factor for ensuring the prevention of revenue loss for the state budget and facilitating the healthy competition environment in the domestic market. Therefore, improving the management of goods codes declaration along with completing the policy on commodities is an important task that customs sector has been implementing in recent times.

It can be seen that in 2017, the classification of goods and application of tariffs has been focused and had a unified direction throughout the Customs sector. In particular, the risk management list in classification has been developed by the General Department of Vietnam Customs, covering approximately 500 commodity items at the level of 8-digits, and 7 commodity groups at the level of 6-digits, including import and export goods. This is an important document, management tools in goods classification of Customs authorities in both processes of clearance and post clearance.

Not only that, currently, this classification procedure has unified the good classification opinions of different categories between units before issuing the result announcement about goods classification. At the same time, establishing the software MHs on storing the classification result in the Customs sector. This would help enterprises to easily look up the results of goods classification and help enterprises’ convenience in applying goods classification of their business, because all the classification results are published on the Customs website by the General Department of Vietnam Customs.

Along with that, the regulations on pre-determination of commodity codes and origin of goods are implemented by the General Department of Vietnam Customs in order to help businesses proactively calculate business efficiency, reduce compliance costs as well as help Customs authorities increase management efficiency. Most of the documents sent to Import-Export Duty Department have been solved within 30 days; the complex cases are also resolved within a maximum of 60 days.

According to the feedback by the business community, the implementation of pre-determination of commodity codes brings benefits for both Customs and enterprises. Customs authorities improve the productivity and efficiency of management by speeding up the cargo clearance, rational allocation of resources in the process of pre-clearance, clearance and post clearance. Meanwhile, enterprises will base on legally binding forensic information for market research, business planning and profit calculation. Thus, it will increase confidence and it could be predictable for enterprises when participating in international trade transactions.

One of the successes in the goods classification in 2017 is the completion of policy on goods. The General Department of Vietnam Customs, as the main unit in charge of the development, the List of Vietnam Exports and Imports 2017 has been issued by the Ministry of Finance with many lines of goods that have been added, detailed or replaced in order to update the changes in technology, facilitation of international trade, the implementation of treaties, international conventions on environmental protection and management of hazardous chemicals... these are important tasks in goods classification to ensure uniformity and integration, and transparency in the import-export goods classification.

Continue to improve the efficiency of goods classification

However, in fact, by using the mechanism of self-declaration and self-taxation, many enterprises have declared low values of goods compared to reality or wrong description of goods in order to avoid paying tax. Simultaneously, with the trend of commodity development, especially the introduction of many complicated items, the management of commodity code declaration is more difficult.

Hence, making a healthy competitive environment for domestic enterprises, continuing to improve the efficiency of goods classification, applying tariff rates, ensuring the uniformity of goods classification across the country, detecting and handling timely the cases of inconsistent tax declaration, tax code application and tariff rates,… are the goals that Customs sector will deploy for good classification and determination of tariffs in 2018.

To achieve this goal, according to the director of Export-Import Duty Department Luu Manh Tuong, the Department will conduct a review on basic data of centralized management to detect and prevent timely the case of performing incorrect regulations and apply wrong tax rates according to the current tax rates. In 2018, the unit will conduct physical inspection on goods classification at some provincial Customs units. In that, focusing on promoting inspection and reviewing import-export items that need to meet requirements in order to enjoy preferential tariff rates.

Along with that is handling timely the problem relating to the classification and tariff rates of local Customs and enterprises in accordance with regulations. At the same time, we will actively improve professional knowledge for Customs officials in order to improve the efficiency of work, ensuring the classification of goods in accordance with regulations.

Particularly, the list of risky export and import goods in classification and applying tariff rates will be reviewed, updated and adjusted regularly in order to set a basis for comparison about codes, and tariff rates of customs declarant. Thus, it could prevent and handle timely the cases of incorrect declaration or cheating in code declaration, and tariff rate for import-export goods.

The Import-Export Duty Department will promote research, updating and finalization of HS documents, such as HS explanatory notes, classification comments note, professional manuals on goods classification,… in order to make a basis for reference to apply consistency in goods classification. Furthermore, continue to coordinate with units in reviewing and developing special preferential tariffs, the list of specialized management for ensuring commitments and compatibility with general policies.

It can be seen that the Customs authorities focus on measures to improve the efficiency of goods classification as well as to prevent fraud in code declaration, against loss to the state revenue and make a healthy competitive environment for domestic enterprises.

| In 2018, deploying the list of risk goods for classification and applying tax rates in order to take place on the list of risk goods for classification and applying tax rates (List) promulgated together with Decision No. 1381/QD-TCHQ dated 24/4/2017 of the Director General of Vietnam Customs. The Export-Import Duty Department has requested the provincial Customs Departments to evaluate the efficiency, difficulties and problems of the application of the list and propose amendments and supplements to the information norms in List that was issued in the appendix to Decision No. 1381 / QD-TCHQ dated 24/4/2017. Also, sending requests to localities for adding all 08 digit for the lines in the list attached to Decision No. 1381 / QD-TCHQ dated 24/4/2017. And request the units to propose the cancellation, supplement goods items (code number 08) that have signs of risk classification and application of tariffs. |

Related News

Checking and reviewing the classification of exported copper

09:37 | 10/10/2024 Regulations

Prime minister directs to boost consumption, support production and business, and develop the domestic market

13:41 | 30/08/2024 Headlines

Urgent solutions needed to revive the domestic market

10:13 | 19/08/2024 Headlines

Gold market management needs to be changed to resolve the paradox

09:54 | 24/02/2024 Headlines

Latest News

Many "big enterprises" pay taxes after enforcement

09:00 | 05/11/2024 Anti-Smuggling

Milk as a cover for illicit drug transportation on airlines

09:52 | 04/11/2024 Anti-Smuggling

Cracking down on counterfeit and smuggled goods during the year-end peak

09:52 | 04/11/2024 Anti-Smuggling

Strictly control imports and trade of toxic chemicals

17:34 | 03/11/2024 Anti-Smuggling

More News

Sharing responsibility for ensuring security and safety of the supply chain

07:13 | 03/11/2024 Import-Export

Three-year drug bust nets over 23 tons

10:36 | 02/11/2024 Anti-Smuggling

Thousands of diamonds seized in airport smuggling bust

16:37 | 01/11/2024 Anti-Smuggling

Exposing a transnational drug ring hidden in pet food

14:42 | 28/10/2024 Anti-Smuggling

Customs control and prevent many drug trafficking cases in the South

14:18 | 25/10/2024 Anti-Smuggling

An Giang Customs announces businesses with tax arrears

14:51 | 24/10/2024 Anti-Smuggling

Unit 4: Stopping dozens of cases of transportation in counterfeits through border gates

13:45 | 23/10/2024 Anti-Smuggling

Establish nearly 170 bogus enterprises to purchase illegal invoice

14:07 | 22/10/2024 Anti-Smuggling

Foreigner caught smuggling 7 gold pieces at Noi Bai Airport

20:01 | 21/10/2024 Anti-Smuggling

Your care

Many "big enterprises" pay taxes after enforcement

09:00 | 05/11/2024 Anti-Smuggling

Milk as a cover for illicit drug transportation on airlines

09:52 | 04/11/2024 Anti-Smuggling

Cracking down on counterfeit and smuggled goods during the year-end peak

09:52 | 04/11/2024 Anti-Smuggling

Strictly control imports and trade of toxic chemicals

17:34 | 03/11/2024 Anti-Smuggling

Sharing responsibility for ensuring security and safety of the supply chain

07:13 | 03/11/2024 Import-Export