Ha Nam Ninh Customs analyzes and evaluates product category and item to provide appropriate solutions for revenue collection

|

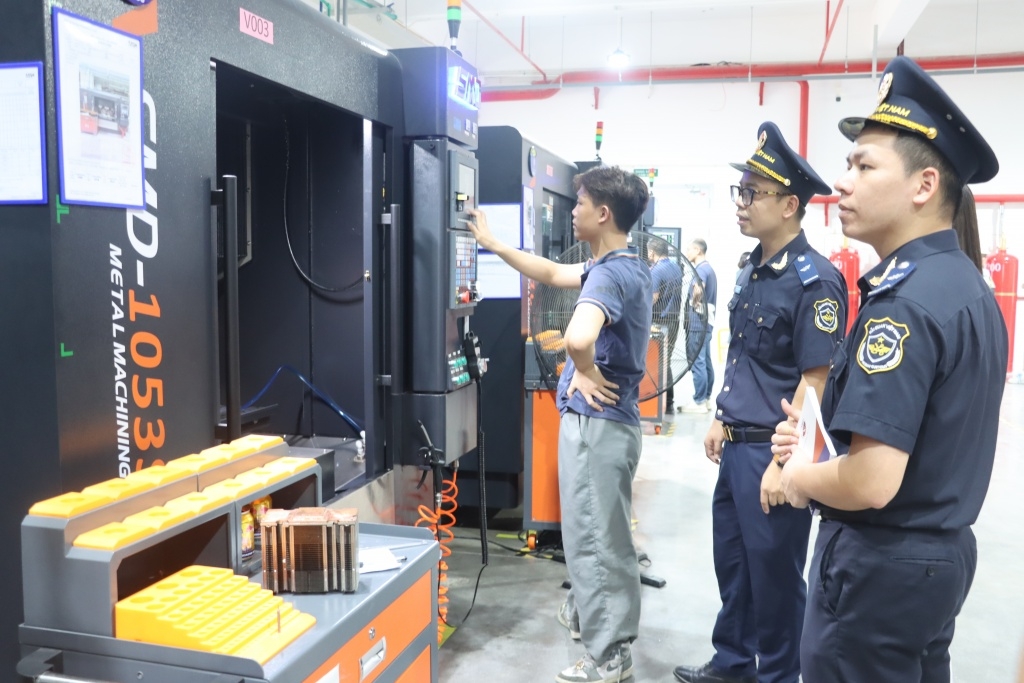

| Ha Nam Customs officers inspect operation at processing enterprises. Photo: H.N |

Achieving to reach over 50% of revenue target

As of July 31, Ha Nam Ninh Customs Department’s revenue increases by 32% to VND 3,340 billion year-on-year, meeting 56% of the revenue target.

According to Nguyen Thu Nhieu, Director of Ha Nam Ninh Customs Department, the tax refund for enterprises eligible to apply the tax incentive program for imported components for domestic automobile production and assembly and the Government's preferential VAT reduction policy has had a direct impact on the department’s revenue. June 30, 2024 only the amount of tax refunded on imported components of Hyundai Thanh Cong Vietnam Automobile Manufacturing Joint Stock Company reached over VND1,000 billion.

| As of July 31, Ha Nam Ninh Customs Department implemented customs value rulings for 1,027 declarations, including 1,015 accepted declarations and 12 rejected declarations with additional tax payment of VND143.8 million. As of July 15, the total outstanding tax debt managed by Ha Nam Ninh Customs Department was over VND70.6 billion. As of July 15, Ha Nam Ninh Customs Department issued 16 decisions on post clearance audit at Customs declarant’s premise, and collected tax arrears worth over VND1.2 billion; and issued 15 decisions on administrative violations with the budget payment of over VND218 million. As of July 31, the department processed customs procedures for 1,763 registered enterprises, increasing by 17.5% year-on-year with 343,391 declarations and the total turnover of over US$19.8 billion. |

Ha Nam Customs, Nam Dinh Customs and Ninh Binh Customs processed procedures for 791 businesses, 312 enterprises and 181 enterprises, respectively. Items that are registered customs procedures by enterprises, mainly are processed minerals, electronic components, garments, footwear, machinery and equipment imported under regime of investment and business; raw materials for the garment industry; plastic beads; raw wood; auto components; chemicals; raw materials for modern medicine production; raw materials to produce all kinds of milk...

To achieve the above results, right from the beginning of the year, Ha Nam Ninh Customs Department has developed a plan on revenue collection and assigned revenue target to each unit. The department has implemented comprehensive solutions and removed difficulties for enterprises as well as instructed regulations on new items for them.

Notably, in 2024, the department will focus on dialogue with export processing enterprises, which are large enterprises with the scale affecting import-export activities, as well as revenues in the area to promptly grasp their business situation and remove problems if any.

Actively reviewing and understanding causes

Director Nguyen Thu Nhieu said that to achieve the highest revenue in the last months of the year, Ha Nam Ninh Customs Department has closely monitored the fluctuations in taxable import-export turnover of goods, and each commodity group to evaluate the collection results. Therefore, the department has identified causes to promptly report and provide solutions in line with the reality of the management area.

Ha Nam Ninh Customs Department has directed units to closely follow the revenue collection progress, regularly analyze, evaluate, and forecast factors affecting the revenue and progress of each area; proposed solutions to control the revenue and achieve the highest revenue.

Ha Nam Ninh Customs Department has implemented solutions to collect tax debts; reviewed and controlled tax debts and classified tax debt groups, recoverable tax debt, non-recoverable tax debts to effectively perform tax debts, prevent new tax debts and tax debt as of December 31, 2024 higher than December 31, 2023.

In addition, the department has required units to facilitate enterprises participating in import and export activities. It has also resolved problems related to customs procedures, tax policies, tax management, tax refund and exemption regimes, and facilitated enterprises in tax payment, attracting new businesses to invest and carry out procedures in the area.

Notably, Ha Nam Ninh Customs Department has coordinated with the People's Committee, departments and branches of the three provinces of Nam Dinh, Ninh Binh and Ha Nam to assign officers to directly work with enterprises that have large revenue and turnover in these provinces to promptly remove difficulties and obstacles for businesses.

Ha Nam Ninh Customs Department continues to comply with regulations on tax debt and other revenue management processes; reviewed and evaluated the risk level and checked tax exemption, tax reduction, tax refund, non-tax collection, non-taxable for export processing and manufacturing enterprises, and firms subject to tax exemption, tax reduction, tax refund, non-tax collection, and non-taxable.

The department continues to take measures to inspect customs value for product categories and items that have high tax rates, high import frequency, and large turnover; strengthens internal inspection to promptly detect errors customs value inspection. The department inspects codes, tax rate, quantity, C/O for cases subject to tax exemption, reduction, tax refund, etc. The department strictly controls and promptly prevent the transportation and import of goods with counterfeit labels, infringing trademarks, intellectual property rights violations; goods inconsistent with category, quantity, and value; goods banned from import; and goods under Customs supervision, Director Nguyen Thu Nhieu said.

Related News

Customs sector strengthens anti-smuggling for e-commerce products

19:09 | 21/12/2024 Anti-Smuggling

Preliminary assessment of Vietnam international merchandise trade performance in the second half of November, 2024

15:18 | 19/12/2024 Customs Statistics

Achievements in revenue collection are a premise for breakthroughs in 2025

09:57 | 18/12/2024 Customs

Ministry of Finance stands by enterprises and citizens

15:30 | 13/12/2024 Finance

Latest News

Minister of Finance Nguyen Van Thang: Facilitating trade, ensuring national security, and preventing budget losses

19:09 | 21/12/2024 Customs

Official implementation of the program encouraging enterprises to voluntarily comply with Customs Laws

18:31 | 21/12/2024 Customs

Proactive plan to meet customs management requirements at Long Thanh International Airport

18:30 | 21/12/2024 Customs

An Giang Customs issues many notes to help businesses improve compliance

09:29 | 20/12/2024 Customs

More News

Hai Phong Customs processes over 250,000 declarations in November

15:18 | 19/12/2024 Customs

Binh Duong Customs surpasses budget revenue target by over VND16.8 Trillion

09:39 | 18/12/2024 Customs

Director General Nguyen Van Tho: Customs sector strives to excellently complete 2025 tasks

16:55 | 17/12/2024 Customs

Customs sector deploys work in 2025

16:43 | 17/12/2024 Customs

Mong Cai Border Gate Customs Branch makes great effort in performing work

11:23 | 16/12/2024 Customs

Declarations and turnover of imported and exported goods processed by Lao Bao Customs surge

09:17 | 15/12/2024 Customs

General Department of Vietnam Customs prepares for organizational restructuring

19:28 | 14/12/2024 Customs

Revenue faces short-term difficulties but will be more sustainable when implementing FTA

19:27 | 14/12/2024 Customs

Japanese businesses express satisfaction with HCMC Customs’ Support

09:40 | 12/12/2024 Customs

Your care

Minister of Finance Nguyen Van Thang: Facilitating trade, ensuring national security, and preventing budget losses

19:09 | 21/12/2024 Customs

Official implementation of the program encouraging enterprises to voluntarily comply with Customs Laws

18:31 | 21/12/2024 Customs

Proactive plan to meet customs management requirements at Long Thanh International Airport

18:30 | 21/12/2024 Customs

An Giang Customs issues many notes to help businesses improve compliance

09:29 | 20/12/2024 Customs

Hai Phong Customs processes over 250,000 declarations in November

15:18 | 19/12/2024 Customs