E- tax payment 24/7: Stepping stone for e-government implementation

| Experts: Non-cash payments need support | |

| Late payment shall not be charged for the period pending the analysis results | |

| Enterprises must not submit deposit slip when the e-payment system has error |

|

| Tax payment shall be secured |

For maximum facilitation goal

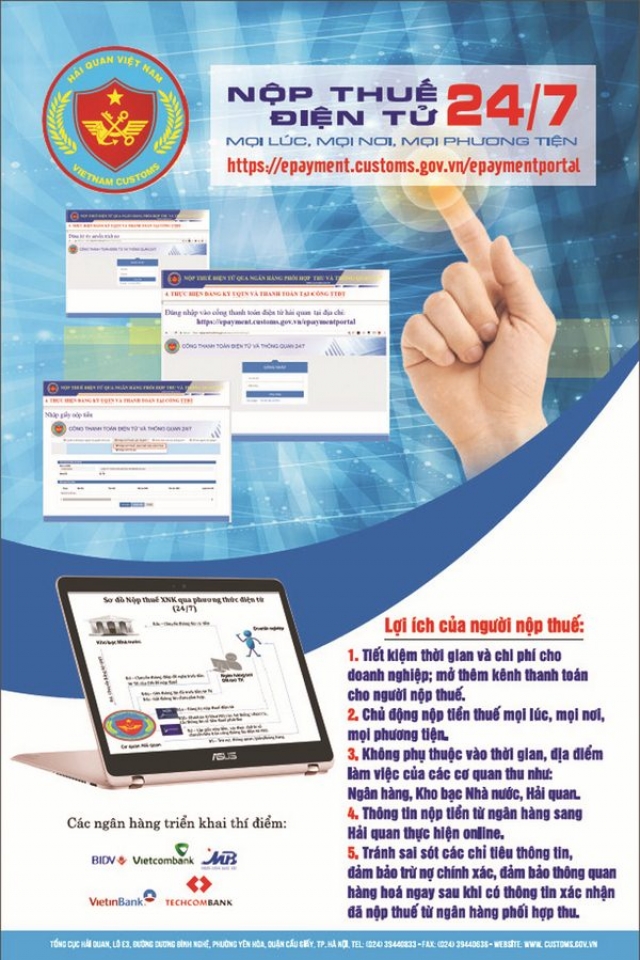

Since 2014, the General Department of Customs has deployed the form of electronic tax payment to support import and export businesses to pay tax quickly and conveniently. So far, electronic tax payments have accounted for over 90% of the total state budget revenue of the Customs. However, in order to meet the need for administrative reform, the Customs sector is required to upgrade the electronic payment gateway for the goal of: facilitating taxpayers to pay taxes anytime, everywhere and by all means and minimizing the cash payment; ensuring tax payment information being liquidated promptly and accurately; reducing time of tax payment and concurrently clearing the goods immediately after tax payment, thereby shortening the customs clearance time for import and export goods to the average level of ASEAN 4 countries under the Government's direction.

From October, 2017, the General Department of Customs has implemented the project "E-tax payment via authorized banks and customs clearance 24/7" to support businesses to pay directly at the Customs e-payment gate. Accordingly, taxpayers are permitted to make direct tax declaration forms at the Customs e-payment gateway at anytime, anywhere and by any means connected to the Internet. The banks shall verify the successful payment immediately after receiving the request for remittance of tax payment and immediate clearance of goods.

Compared with the current collection procedures, especially the electronic payment method via banks, tax payment process and Customs clearance 24/7 is simple, exact, preeminent and convenient. Instead of taking payment documents to commercial banks, and then banks having to look up their own information on enterprises on the Customs system, enterprises will now directly declare and make payment documents on the Customs e-portal system. Accordingly, the Customs no longer has to wait for information from the banking system, the Customs will directly receive the information from enterprises and transfer the remittance to banks.

The projects will help taxpayers not having to depend on working times, working place of collecting agencies such as banks, state treasuries and Customs. In particular, this new form of tax payment will ensure the security of taxpayers' tax information, overcome shortcomings of information field of payment when exchanging one or more documents via the inter-bank, and overcome transaction time limit of commercial banks.

In order for further facilitation through the pilot implementation, from the desire of taxpayers, the e-tax payment system 24/7 has been upgraded, allowing entrusted import and export enterprises and Customs brokers to declare or pay taxes on behalf of other companies, and the system has been installed with some additional utilities. At the same time, the banking system performing electronic tax collection 24/7 has also been further expanded by the General Department of Customs to provide more channels for taxpayers.

If in the past a Green Channel consignment paid tax late on a Friday afternoon, it was difficult to clear the goods immediately, but now thanks to the e-tax payment 24/7, an enterprise can pay tax at 10 o'clock on Friday evening, and it can receive the goods on Saturday morning if the enterprise has a debit account that has enough money to pay taxes, and has a digital signature. This is the most obvious benefit that enterprises receive from the tax payment 24/7.

In addition, some other benefits that only companies participating in e-tax payment 24/7 realize, are: helping enterprises to save time and costs of goods clearance; helping enterprises monitor and control the tax payment process and record the paid taxes; helping enterprises to take the initiative in all their operations.

The results are behind the expectation

At the preliminary conference on the deployment of e-tax payment 24/7 organized by the General Department of Customs earlier last week, Mr. Luu Manh Tuong, Director of Import and Export Duties Department under the General Department of Customs, said that after 8 months of deployment of e- tax payment 24/7, the tax revenue via electronic payment 24/7 reached VND 5,443 billion and 33,308 transactions were implemented. Of which, the revenues of Vietcombank, BIDV and Vietinbank accounted for 83.2% of the total revenue.

It is noteworthy that the number of enterprises that have paid taxes by electronic method 24/7 is still lower than those registered on the system. Only 763 enterprises out of a total of 1,253 registered enterprises (accounting for 60.9 %, of which many enterprises registering the e-tax payment at many banks and carrying out the procedures for e-tax payment at many Customs Departments). The number of enterprises registering on the e-tax payment 24/7 accounted for a much lower rate than those participating in the traditional electronic tax payment (at counter and internet banking).

With above result, Deputy Director General of Customs Nguyễn Dương Thái assessed thật the result is still modest compared to the total tax revenue of the whole Customs sector. He emphasized that in the near future, the demand for tax payment everywhere, anytime and by any means is necessary and an inevitable development trend.

Therefore, in order to review shortcomings and obstacles arising, and accordingly introducing solutions to further develop the e-tax payment, many comments from commercial banks engaging in the electronic tax collection 24/7 as well as proposals from municipal and provincial Customs units in the implementation of this new tax payment method were listened to and discussed by the leaders of Import and Export Duties Department and Customs IT and Statistics Department. Accordingly, the shortcomings and reasons were analysed and explained clearly and specifically.

Accordingly, the main reason is because many enterprises are still afraid of e-tax payment 24/7, especially FDI enterprises, because when paying tax, the 24/7 system only requires businesses to confirm transactions through a digital signature, and many businesses are worried about the control of debit deductions from their accounts. The businesses expect that the 24/7 system shall verify the transactions through two different digital signatures to ensure the control of debit deductions from their accounts.

Due to the specialized characteristics of express delivery enterprises, they mainly pay taxes by deposit as stipulated in Circular No. 191/2015 / TT-BTC dated 24th November 2015, they do not want to change the payment method and expect to maintain the traditional payment method.

Some enterprises also hesitate to register for electronic tax payment 24/7 because they are not used to doing transactions at the counter or transferring money via internet banking. However, it is only when they need the Customs clearance outside working hours,on holidays, they can see the convenience of electronic tax payment 24/7. Therefore, the propaganda for taxpayers of Customs, banks and press media is very necessary.

| E-tax payment 24/7 system continues to be upgraded and expanded VCN- According to the statistics from the General Department of Vietnam Customs (GDVC), as of the end ... |

The some municipal and provincial Customs units also proposed that currently, Customs officers do not have the tools to collect and access information related to enterprises when paying tax in electronic method 24/7. Therefore, these units requested the General Department of Customs to provide this function to facilitate the units to monitor and evaluate the implementation of e-tax payment 24/7, thereby introducing solutions to disseminate and support enterprises better, improving efficiency and bringing more practical benefits to enterprises in the coming time. Along with that, the utilities to list enterprises engaging in electronic tax payment 24/7 and the number of transactions and the tax amount implemented on the system and to integrate into the centralized tax accounting program.

| The General Department of Customs is continuing to maintain a support team for both banks and businesses in the implementation of e-tax payment 24/7 on the Customs e-payment gateway at the following phone numbers: 024 37.824.754 , 024 37.824.756, 024 37.824.757, 024 37.842.182, 024 37.842.183, 024 37.842.184 |

| 32 of 35 Customs Departments have deployed the e-tax payment 24/7 (3 Department have not yet deployed: Dien Bien, Ca Mau and Kien Giang), focusing on a number of large localities such as Hanoi, Ho Chi Minh City, Hai Phong, Bac Ninh, Binh Duong, Vung Tau, Can Tho, Quang Ngai. Of which, Dong Nai Customs Department has increased its revenue from VND 67 billion to VND 266 billions after one month of implementation. |

Related News

Customs sector strengthens anti-smuggling for e-commerce products

19:09 | 21/12/2024 Anti-Smuggling

Preliminary assessment of Vietnam international merchandise trade performance in the second half of November, 2024

15:18 | 19/12/2024 Customs Statistics

Achievements in revenue collection are a premise for breakthroughs in 2025

09:57 | 18/12/2024 Customs

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Latest News

Minister of Finance Nguyen Van Thang: Facilitating trade, ensuring national security, and preventing budget losses

19:09 | 21/12/2024 Customs

Official implementation of the program encouraging enterprises to voluntarily comply with Customs Laws

18:31 | 21/12/2024 Customs

Proactive plan to meet customs management requirements at Long Thanh International Airport

18:30 | 21/12/2024 Customs

An Giang Customs issues many notes to help businesses improve compliance

09:29 | 20/12/2024 Customs

More News

Hai Phong Customs processes over 250,000 declarations in November

15:18 | 19/12/2024 Customs

Binh Duong Customs surpasses budget revenue target by over VND16.8 Trillion

09:39 | 18/12/2024 Customs

Director General Nguyen Van Tho: Customs sector strives to excellently complete 2025 tasks

16:55 | 17/12/2024 Customs

Customs sector deploys work in 2025

16:43 | 17/12/2024 Customs

Mong Cai Border Gate Customs Branch makes great effort in performing work

11:23 | 16/12/2024 Customs

Declarations and turnover of imported and exported goods processed by Lao Bao Customs surge

09:17 | 15/12/2024 Customs

General Department of Vietnam Customs prepares for organizational restructuring

19:28 | 14/12/2024 Customs

Revenue faces short-term difficulties but will be more sustainable when implementing FTA

19:27 | 14/12/2024 Customs

Customs sector collects over VND384 trillion in revenue

17:13 | 12/12/2024 Customs

Your care

Minister of Finance Nguyen Van Thang: Facilitating trade, ensuring national security, and preventing budget losses

19:09 | 21/12/2024 Customs

Official implementation of the program encouraging enterprises to voluntarily comply with Customs Laws

18:31 | 21/12/2024 Customs

Proactive plan to meet customs management requirements at Long Thanh International Airport

18:30 | 21/12/2024 Customs

An Giang Customs issues many notes to help businesses improve compliance

09:29 | 20/12/2024 Customs

Hai Phong Customs processes over 250,000 declarations in November

15:18 | 19/12/2024 Customs