Customs sector strengthens connection to National Public Service Portal

|

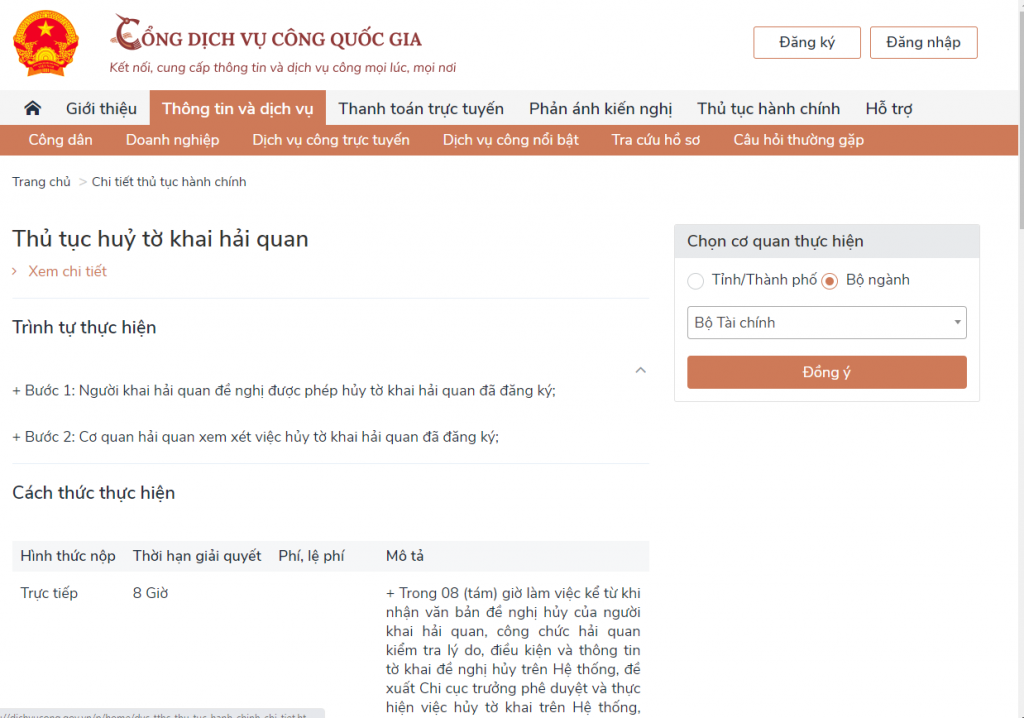

| The procedure for cancelling customs declarations on the National Public Service Portal. |

Deputy Director of the Customs IT and Statistics Department (under the GDVC) Le Duc Thanh said that according to the plan in 2020, the Customs sector must connect 60 online public services to the National Public Service Portal. The sector must connect six online public services by the end of the second quarter, 18 in the third quarter and 36 in the fourth quarter.

However, on July 21, the Ministry of Finance issued Notification No. 482/TB-BTC requesting units complete the connection of online public services to the National Public Service Portal before August 15,2020. In which, the GDVC must connect 10 more procedures. Thus, the whole Customs sector will have to connect 70 online public services to the portal by the end of 2020.

To connect the GDVC’s online public services to the National Public Service Portal, there arefour steps as follows:

Step1: the Customs IT and Statistics Department integrates online public services to in the Integrated Module (installed at the GDVC’s headquarters) to connect and share on the National Public Service Portal.

Step 2: TheAdministrative Procedure Control Department under the Government Officetests the steps of login, submitting the application, processing the application, returning processing result andsearching processing result.

Step 3: Correct arising errors and retest.

Step 4: TheAdministrative Procedure Control Department confirms the integration and officially connects to the National Public Service Portal.

By July 31 the GDVC hadconnected and shared 60 online public services to the National Public Service Portal.

According to the GDVC, in addition to the initiative of Customs in step 1, to complete the plan of the connection of online public services, the GDVC needs close and effective coordination of the Administrative Procedure Control Department, Department of Financial Informatics and Statistics (Ministry of Finance) and telecommunications companies.

Regarding benefits of connecting online public services to the National Public Service Portal, Deputy Director of theCustoms IT and Statistics Department Le Duc Thanh said online public services always brings many benefits to businesses. Businesses can carry out administrative procedures anytime, anywhere, by any means; it reduces costs for firmsbecause they do not have to use paper documents, reduce time for moving because businesses do not have to implement directly at Customs office; improve openness and transparency in implementation of administrative procedures.

The connection of the online public services to the National Public Service Portal will helppeople and businesses have more plans to carry out administrative procedures in the customs area, in addition to the implementation through the online public service system of the Customs sector.

The connection of the online public services to the National Public Service Portal will helppeople to implement many procedures at the same time through a focal point. Previously, businesses implementingonline public services of the Customs sector will login to the Customs sector. If businesses want to implement online public services in other fields, they must log into each system of the management agency.

Until the end of July, the sector has provided 198 of 219 online public services at level 3 and level 4 (accounting for 90.4%, including 70 online public services connected to the National Public Service Portal). Of which 192 customs procedures have been provided online public services at level 4 (reaching 87.6%).

Recently, the GDVC strengthened the IT application to support people and businesses such as continuing to deploy a new version of the GDVC’s portal (tongcuc.customs.gov.vn). The management, supervision and operation of VNACCS/VCIS and centralised IT systems of the Customs sector are stable 24/7, ensuring security, safety, and smooth connection for customs clearance forimport and export goods.

Regarding e-payments, the GDVC has coordinated with 43 banks in revenue collection, of which 30 have participated in e-tax payment and customs clearance 24/7; the State budget revenue collected electronically exceeded 97% of total revenue of the whole customs sector.

| Some online public services of Customs sector have been connected to the National Public Service Portal as follows: Procedure for cancelling customs declarations; Customs procedure for goods brought in or out of the port of transit; Customs procedure for goods traded by mode of border gate transfer; Customs procedure for the establishment of a checkpoint at a construction site, warehouse of construction site ormanufacturing site. Procedure for classification of machinery and equipment in the form of completely built units and completely knocked down.Customs procedure for classification of combined machines or combinations of machines under Chapters (84, 85, and 90) in the Vietnam export and import Classification Nomenclature; Procedure for inspection of goods before customs declaration. |

Related News

Consulting on customs control for e-commerce imports and exports

14:50 | 14/02/2025 Regulations

Customs administrations coordinate to seize nearly 20,000 endangered wildlife

09:15 | 14/02/2025 Anti-Smuggling

Hai Phong Customs sets out 15 tasks to achieve the revenue target of VND 72,000 billion

10:12 | 11/02/2025 Customs

GDVC sets goal of widely disseminating Customs policies

07:49 | 12/02/2025 Customs

Latest News

Vietnam Customs forms implementation task force on developing customs procedures

16:29 | 15/02/2025 Customs

Quang Tri Customs launches business support initiatives

16:29 | 15/02/2025 Customs

Hai Phong Customs’ revenue rises about VND 1,000 billion

14:52 | 14/02/2025 Customs

Administrative reform: Khanh Hoa Customs delivers impressive results

14:52 | 14/02/2025 Customs

More News

Over 1,500 customs declarations processed by Hai Phong Customs during Tet

14:36 | 10/02/2025 Customs

Ho Chi Minh City: Foreign visitors spend more than VND1,500 billion to buy goods upon exit

10:01 | 07/02/2025 Customs

3,500 customs declarations handled in Lang Son over Tet

09:57 | 06/02/2025 Customs

Hai Phong Customs processes more than 1,500 declarations during 2025 Lunar New Year holiday

14:09 | 05/02/2025 Customs

US$10.5 million in trade flows through Binh Duong Customs during Tet During the 2025 Lunar New Year

14:08 | 05/02/2025 Customs

Proactive customs measures for express parcels: Tightening control over import-export goods

22:09 | 27/01/2025 Customs

Best covers of Vietnam Customs songs: 15 winners revealed

10:58 | 22/01/2025 Customs

Vietnam Customs kicks off campaign for innovation, breakthrough, and growth

14:15 | 21/01/2025 Customs

Researching and proposing amendments to 2014 Customs Law to meet the requirements of innovation

11:18 | 20/01/2025 Customs

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Vietnam Customs forms implementation task force on developing customs procedures

16:29 | 15/02/2025 Customs

Quang Tri Customs launches business support initiatives

16:29 | 15/02/2025 Customs

Hai Phong Customs’ revenue rises about VND 1,000 billion

14:52 | 14/02/2025 Customs

Administrative reform: Khanh Hoa Customs delivers impressive results

14:52 | 14/02/2025 Customs

GDVC sets goal of widely disseminating Customs policies

07:49 | 12/02/2025 Customs