Anti-origin fraud continues to be implemented

| 7,200 C/Os form EUR.1 issued in first month of running EVFTA | |

| HCM City Customs trains on rules of origin for European enterprises | |

| 3.2 million dossiers implemented via National Single Window |

|

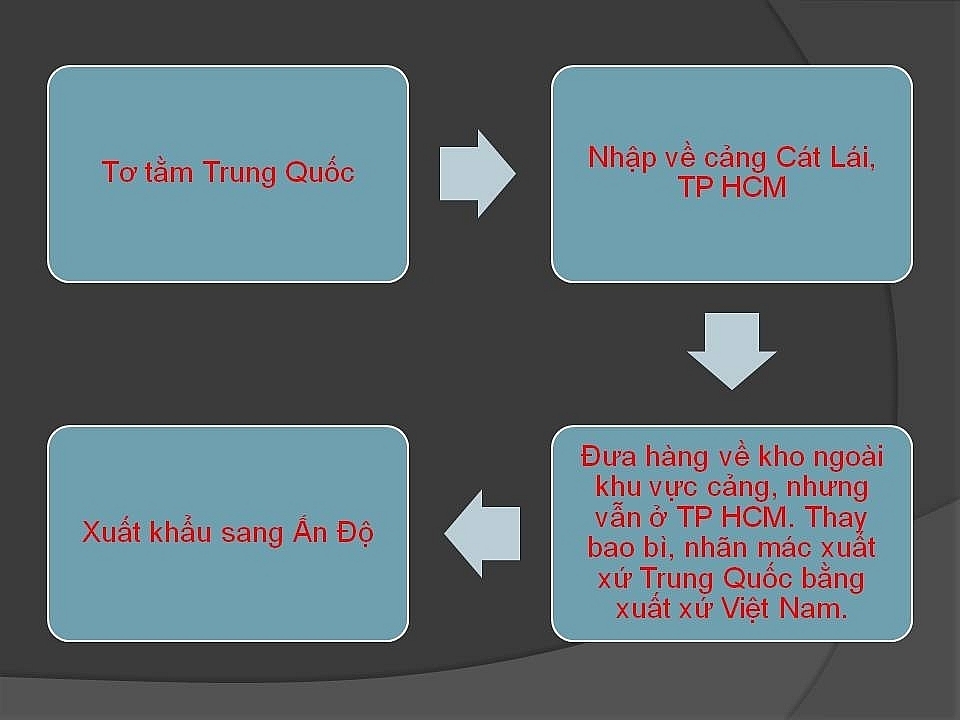

| Process of Chinese silk under guise of Vietnamese goods. Chart by T.B |

Chinese silk are under guise of Vietnamese goods

The leader of the Post-Clearance Audit Department (under the General Department of Vietnam Customs) said that to implement the plan on anti-origin fraud, especially markets that Vietnam has signed bilateral and multilateral trade agreements with, the department has detected violations related to silk products imported from China.

During the post clearance audit at the headquarters of company M., Customs detected that this company applied for eight C/O form Al to export silk to India with signs of violations on origin and illicit transshipment.

| Director of Post-Clearance Audit Department Nguyen Tien Loc: During combat for acts of origin fraud andillicit transshipment, the post clearance audit force has faced difficulties and problems. The Ministry of Industry and Trade admitted that when Vietnam implements international integration, the country lacks a sufficient legal basis to classify and handle origin fraud. Recently, Customs has proposed to competent authorities to amend and supplement regulations related to the goods origin. In the short term, it is necessary to amend Vietnamese origin conditions and standards according to international practice. If goods fail to meet conditions and standards of Vietnamese origin when carrying out export procedures, how do businesses have to declare?Customs has also proposed to amend and supplement regulations on labelling. |

This company’s act aims to evade high tax rates, as if the company directly importedsilk products from China to India, it wouldbe subject to 25% import tax. However, the item exported from Vietnam to Indiais subject to a 5% import tax rate.Through inspection and verification, Customs proved the company imported finished silk from China to HCMCity-based Cat Lai Port. After goods arrived at the port, the company stored the goods ina warehouse outside the port area but did not bring the goods to its factory. The company replaced Chinese packages andlabels withVietnamese packages, labels of the goods to export to India.

Through investigation of the Post-Clearance Audit Department, the company admitted its violation. The department wasfined VND 60 million and collected and remitted nearly VND 550 million to the State budget.

Expand inspected subjects

According to the Director of the Post Clearance Audit Department Nguyen Tien Loc, Vietnam has acceded to many FTAs, the combat and prevention of origin fraud of Vietnam’s goods should be implemented drastically and in long term protect the prestige of Vietnamese goods, creating equal competition between foreign investors in Vietnam.

In addition to fighting businesses that have signs of violation in importing and exporting goods to the US market, the post clearance audit department will expand information and inspect high-risk businesses in importing and exporting with countries and territories that Vietnam has signed FTAs with such as the the EU, India andJapan. Especially, in new FTAs such as the EVFTA orCPTPP when origin issues are particularly paid attention to and strict regulations are provided.

For example, regarding originsforthe textile and garment industry, this is the major export commodity group of Vietnam for many years and is one of commodities expected to benefit from the FTAs that Vietnam has acceded to. According to the Ministry of Industry and Trade, the EVFTA requires two stages for textiles and garments. It means that to enjoy preferential tariffs under the EVFTA, Vietnam's textiles and garments must be made from fabrics of Vietnamese origin. In addition, for textile products in Chapters 61 and 62 of the tariff, the EU also allows Vietnam to use fabrics imported from South Korea to produce final products for export to the EU and still enjoy preferential tax rates of EVFTA.

Director of the Post-Clearance Audit Department said the effective prevention for origin fraud and illicit transshipment not only creates unification in revenue collection, but also protects the prestige and brand of Vietnamese goods, protect and develop domestic production; contribute to increasing attraction of foreign direct investment; ensuringthe implementation of Vietnam's commitments in the FTAs.

At the same time, to raise awareness of law compliance of import and export businesses to prevent violation; the business community has beenwarned about the risks of violations to prevent and ensure compliance with Vietnamese regulations, after detecting errors, the business has invested fully in machinery and equipment for production to meet Vietnamese origin criteria.

| Phase 1: Customs inspected and verified 76 cases, discovered 29 cases; workedwith the Ministry of Public Security to investigate onecase of fake C/O. Seized 3,590 bicycles, more than 4,000 bicycle partsand 12,000 sets of accessories to assemble kitchen cabinets; collected and contributed VND 47 billion to the State budget. Phase 2: The Post Clearance Audit Department issued a decision to inspect 20 businesses and detected 15 violating enterprises; collected and contributed VND 30 billion to the State budget. It proposed the VCCI revoke 803 C/O. |

Related News

Hai Phong Customs’ revenue rises about VND 1,000 billion

14:52 | 14/02/2025 Customs

Import and export turnover reaches about US$29 billion in the second half of January 2025

14:52 | 14/02/2025 Import-Export

State revenue in first month of the year equal to 14% of the estimate

10:12 | 11/02/2025 Finance

Ho Chi Minh City: Foreign visitors spend more than VND1,500 billion to buy goods upon exit

10:01 | 07/02/2025 Customs

Latest News

An Giang Customs Department escalates multiple tax fraud cases to law enforcement

16:30 | 15/02/2025 Anti-Smuggling

Customs crackdown nets 1,430 violations in first month

14:50 | 14/02/2025 Anti-Smuggling

Customs administrations coordinate to seize nearly 20,000 endangered wildlife

09:15 | 14/02/2025 Anti-Smuggling

An Giang Customs strictly controls goods moving across the border

08:45 | 09/02/2025 Anti-Smuggling

More News

Remodel cars to hide drugs

20:47 | 30/01/2025 Anti-Smuggling

Illegal transportation of gemstones by air to handled

18:36 | 28/01/2025 Anti-Smuggling

Routine security screening uncovers hidden weapons at point of entry

20:30 | 25/01/2025 Anti-Smuggling

Strictly handling illegal transportation of gemstones by air

14:16 | 21/01/2025 Anti-Smuggling

Nearly 18,000 cases of smuggling, trade fraud and counterfeit goods detected

20:58 | 05/01/2025 Anti-Smuggling

Customs seizes smuggled goods and infringing products worth VND31,000 billion

06:36 | 05/01/2025 Anti-Smuggling

India launches anti-dumping investigation on nylon yarn imports from Việt Nam

13:32 | 01/01/2025 Anti-Smuggling

Hanoi Customs: 92% of post-clearance audits reveal violations

07:53 | 31/12/2024 Anti-Smuggling

Noi Bai International Border Gate Customs Sub-department: "Blocking" drugs via air

07:42 | 31/12/2024 Anti-Smuggling

Your care

An Giang Customs Department escalates multiple tax fraud cases to law enforcement

16:30 | 15/02/2025 Anti-Smuggling

Customs crackdown nets 1,430 violations in first month

14:50 | 14/02/2025 Anti-Smuggling

Customs administrations coordinate to seize nearly 20,000 endangered wildlife

09:15 | 14/02/2025 Anti-Smuggling

An Giang Customs strictly controls goods moving across the border

08:45 | 09/02/2025 Anti-Smuggling

Remodel cars to hide drugs

20:47 | 30/01/2025 Anti-Smuggling