Training on software to manage electronic stamps for imported alcohol and tobacco products

| Long An: Smuggled cigarettes are stuck with domestic cigarette stamps | |

| Management on issuance and tracking of duty free stamps |

|

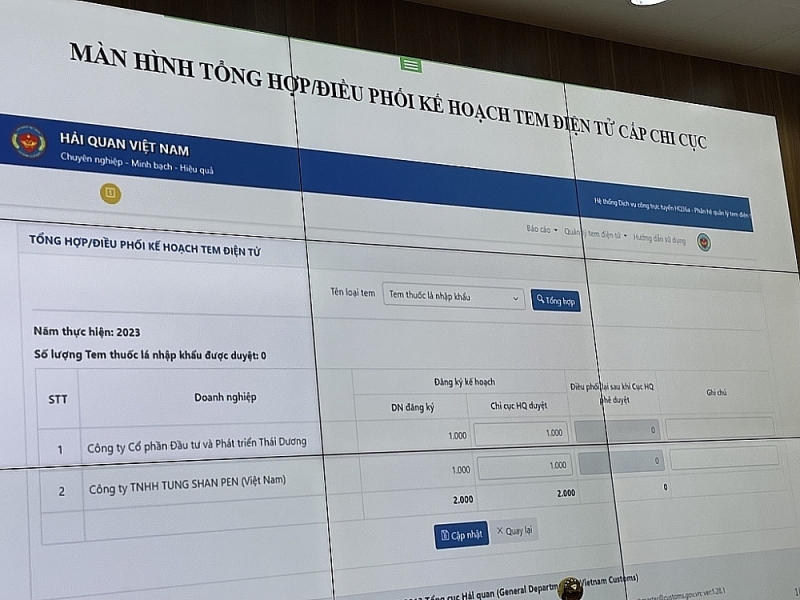

| The General Department of Customs guides the use of the management software of electronic stamps for imported alcohol and tobacco products. Photo: N.Linh |

Signs to identify electronic stamps

From June 21 to June 30, 2022, the General Department of Customs tested the running of the software to manage electronic stamps for imported alcohol and tobacco products at Hai Phong Customs Department.

To implement the software nationwide, the General Department of Customs continues to organize training sessions for local customs departments and enterprises that import alcohol and tobacco products through areas managed by local customs departments.

Circular 23 regulates the printing, issuance, management and use of electronic stamps for alcohol and tobacco products. Organizations, enterprises and individuals that produce and export products subject to excise tax (alcohol and tobacco products) are users of electronic stamps as prescribed by law.

This Circular also stipulates that electronic stamps show signs of recognition by the naked eye and contain electronic information and data that are activated and searched on the portal of the General Department of Taxation and General Department of Customs, to serve businesses, consumers and state management agencies.

The principle of electronic stamping is that tobacco products imported and produced for domestic consumption must be stamped according to the provisions of Decree 67/2013/ND-CP, dated June 27, 2013 of the Government and other revised documents (if any).

Tobacco products must be packed (including packages or boxes) and each package affixed with a stamp. In the case of a cigarette package wrapped with an outer cellophane film, the stamp must be affixed to the cigarette pack before wrapping the film. The stamp is affixed at a position that ensures that when opening the package, the stamp will be torn.

For imported alcohol and domestically produced alcohol products, stamps must be affixed according to the provisions of Decree 105/2017 dated September 14, 2017 of the Government and other revised documents (if any).

Domestically produced and imported alcohol products must be bottled, including jars, cans, bags, boxes and barrels (referred to as bottles). Each bottle of wine must affixed with a stamp. In case the bottle is covered with a cellophane film, the stamp must be affixed to the bottle before being sealed with the film. The stamp is sealed across where the alcohol can be removed on the packaging containing alcohol product (bottle cap, spout or similar position) to ensure that when the cap is opened, the stamp is torn and cannot be reused.

The General Department of Customs prints and issues electronic stamps for imported alcohol and tobacco products

Circular 23 stipulates that the General Department of Customs print and issue electronic stamps of imported alcohol and tobacco products and sell them to businesses and organizations that are allowed to import or purchase confiscated goods or goods in auction by the competent authority.

The General Department of Taxation shall print and issue electronic stamps for tobacco and alcohol products produced for domestic consumption, and sell them to organizations and individuals licensed for production.

Additionally, organizations and individuals producing or importing alcohol and tobacco products are fully responsible for managing, using and transmitting data and information on electronic stamps to the management agency according to regulations.

Circular 23 also specifies the unit in charge of electronic stamping. For imported tobacco products, the importer shall apply stamps in accordance with regulations for tobacco products at their locations before bringing the products to the market.

For bottled alcohol products and alcohol products in barrels or tanks imported for extraction, the Circular stipulates that the importer shall apply stamps and are responsible for the stamping for imported alcohol products before selling them on the market.

In the case the importer wants stamping at an overseas production facility, it must ensure that the stamping is in accordance with regulations before alcohol products imported to Vietnam for consumption.

For cigarettes produced for domestic consumption, the Circular clearly states that enterprises licensed for cigarette production must apply stamps in accordance with regulations for domestically produced tobacco products at the production site after the tobacco products are packed into packages and before they are sold domestically.

| Beer and alcohol enterprises: Find a way to avoid "double impact" VCN- In 2020, enterprises in the beer, wine and beverage industries will experience double difficulties due to ... |

| The General Department of Customs has announced the issuance of electronic stamps for imported alcohol and tobacco products as follow: Electronic stamps for imported cigar: 100,000 stamps. Electronic stamps for imported alcohol products with alcohol content ≥ 30 degrees: 600,000 stamps. Electronic stamps for imported alcohol products with alcohol content < 30 degrees: 17,000,000 stamps. |

Related News

Customs sector strengthens anti-smuggling for e-commerce products

19:09 | 21/12/2024 Anti-Smuggling

Preliminary assessment of Vietnam international merchandise trade performance in the second half of November, 2024

15:18 | 19/12/2024 Customs Statistics

Achievements in revenue collection are a premise for breakthroughs in 2025

09:57 | 18/12/2024 Customs

Ministry of Finance stands by enterprises and citizens

15:30 | 13/12/2024 Finance

Latest News

Ho Chi Minh City Customs: Satisfactorily resolving problems for Japanese businesses

11:07 | 23/12/2024 Customs

Minister of Finance Nguyen Van Thang: Facilitating trade, ensuring national security, and preventing budget losses

19:09 | 21/12/2024 Customs

Official implementation of the program encouraging enterprises to voluntarily comply with Customs Laws

18:31 | 21/12/2024 Customs

Proactive plan to meet customs management requirements at Long Thanh International Airport

18:30 | 21/12/2024 Customs

More News

An Giang Customs issues many notes to help businesses improve compliance

09:29 | 20/12/2024 Customs

Hai Phong Customs processes over 250,000 declarations in November

15:18 | 19/12/2024 Customs

Binh Duong Customs surpasses budget revenue target by over VND16.8 Trillion

09:39 | 18/12/2024 Customs

Director General Nguyen Van Tho: Customs sector strives to excellently complete 2025 tasks

16:55 | 17/12/2024 Customs

Customs sector deploys work in 2025

16:43 | 17/12/2024 Customs

Mong Cai Border Gate Customs Branch makes great effort in performing work

11:23 | 16/12/2024 Customs

Declarations and turnover of imported and exported goods processed by Lao Bao Customs surge

09:17 | 15/12/2024 Customs

General Department of Vietnam Customs prepares for organizational restructuring

19:28 | 14/12/2024 Customs

Revenue faces short-term difficulties but will be more sustainable when implementing FTA

19:27 | 14/12/2024 Customs

Your care

Ho Chi Minh City Customs: Satisfactorily resolving problems for Japanese businesses

11:07 | 23/12/2024 Customs

Minister of Finance Nguyen Van Thang: Facilitating trade, ensuring national security, and preventing budget losses

19:09 | 21/12/2024 Customs

Official implementation of the program encouraging enterprises to voluntarily comply with Customs Laws

18:31 | 21/12/2024 Customs

Proactive plan to meet customs management requirements at Long Thanh International Airport

18:30 | 21/12/2024 Customs

An Giang Customs issues many notes to help businesses improve compliance

09:29 | 20/12/2024 Customs