Enterprises don’t need to submit CFS paper in customs dossiers

|

| Enterprises implement procedure at Investment - Processing Customs Branch (Hanoi). Photo: N.Linh |

Accordingly, the guidance of the General Department of Customs solved problems for local customs when implementing the Decree No.69/2018/ND-CP of the Government relating to the CFS.

Specifically, the provisions in Articles 10 and 11 of Decree 69/2018 / ND-CP do not require enterprises to submit or present a CFS to Customs authority when carrying out customs procedures.

In Article 16 of Circular 38/2015 / TT-BTC (amended and supplemented in Clause 5, Article 1 of Circular No. 39/2018 / TT-BTC), CFS is not a document to be submitted in the customs dossier for import-export goods.

Accordingly, the General Department of Vietnam Customs directed the local customs units in accordance with the provisions of Decree 69/2018 / ND-CP, Circular 39/2018 / TT-BTC, guiding customs branches to implement unitedly and not request enterprises to submit and present the CFS in the customs dossier when carrying out the customs procedures for export or import goods.

Related News

Supplement 44 procedures connected to National Single Window mechanism, but which ministry has the most procedures?

18:30 | 02/09/2020 Customs

Many regulations on customs dossiers continued to research for amending

12:27 | 17/07/2020 Regulations

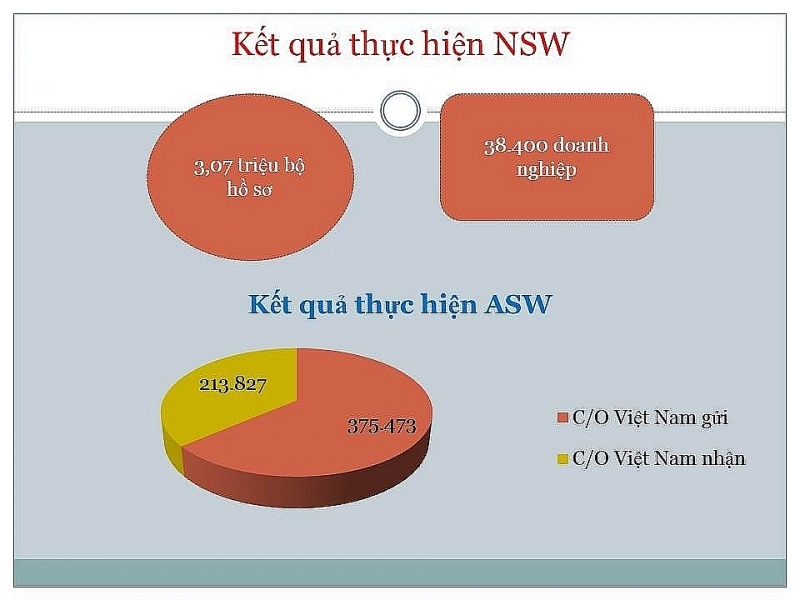

More than 3 million dossiers implemented via National Single Window Mechanism

15:27 | 15/06/2020 Customs

Suggest suspending inclusion of CFS in dossier of animal feed quality inspection

10:57 | 25/03/2020 Regulations

Latest News

Is animal feed containing Formic Acid precursors "helpless" in management?

16:09 | 15/05/2024 Regulations

Businesses and people expect VAT cut extension to be approved

17:06 | 13/05/2024 Regulations

Proposal to continue reducing VAT by 2% to support people and businesses

08:16 | 12/05/2024 Regulations

Research and correct customs supervision processes at international airports

10:05 | 11/05/2024 Regulations

More News

Small, low-value items imported on e-commerce platforms should be taxed

14:43 | 09/05/2024 Regulations

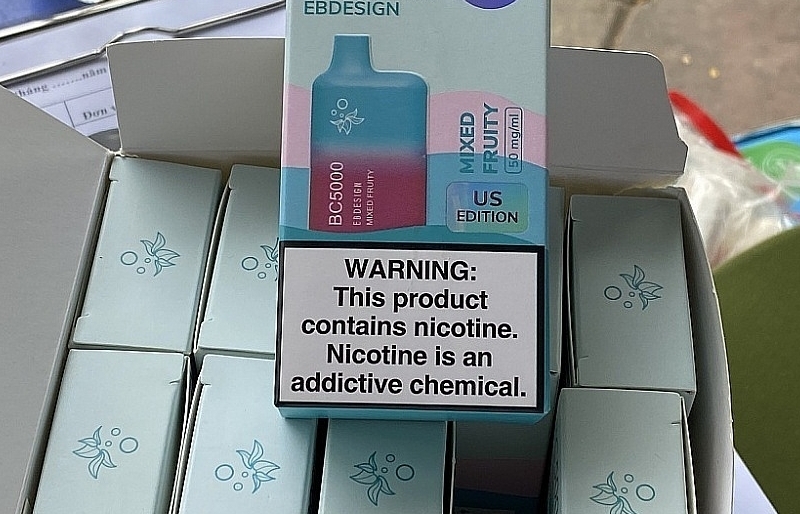

Customs finds difficulties because there is no e-cigarette management policy

09:56 | 09/05/2024 Regulations

Are goods imported on-spot for export production eligible for tax refund?

09:32 | 08/05/2024 Regulations

Risk prevention solutions for export processing and production enterprises

09:12 | 07/05/2024 Regulations

Conditions for price reduction of imported goods

15:38 | 06/05/2024 Regulations

Circular 83/2014/TT-BTC will be abolished from June 8

14:29 | 06/05/2024 Regulations

Proposal to continue reducing VAT by 2% in the last 6 months of 2024

10:35 | 05/05/2024 Regulations

Seafood exporters are worried about some inadequacies from the two new decrees

06:47 | 30/04/2024 Regulations

Risk prevention solutions for processing and export manufacturing businesses

07:52 | 29/04/2024 Regulations

Your care

Is animal feed containing Formic Acid precursors "helpless" in management?

16:09 | 15/05/2024 Regulations

Businesses and people expect VAT cut extension to be approved

17:06 | 13/05/2024 Regulations

Proposal to continue reducing VAT by 2% to support people and businesses

08:16 | 12/05/2024 Regulations

Research and correct customs supervision processes at international airports

10:05 | 11/05/2024 Regulations

Small, low-value items imported on e-commerce platforms should be taxed

14:43 | 09/05/2024 Regulations