Conditions for price reduction of imported goods

| Ministry of Finance’s comments on electricity price reduction for three months | |

| Gasoline price reduction - reducing cost burden |

|

| Officers of Vinh Phuc Customs Branch at work. Photo: Ngoc Linh |

The General Department of Vietnam Customs has given a specific response to FCC Vietnam Co., Ltd. on reducing prices of imported components between the company and some export partners.

The GDVC cites Point d, Clause 2, Article 15 of Circular 39/2015/TT-BTC stipulating discount, discount conditions, documents, declaration procedures, and application for price discount.

According to the regulations, the GDVC said that the company does not meet requirements of price reduction.

In the sales contract, the company's price reduction agreement shows the unit price that has not been reduced and the unit price has been reduced, but does not show the reason for the price reduction. Therefore, there is no basis to determine discounts as per item d.1.1, point d, clause 2, Article 15 of Circular 39/2015/TT-BTC.

In addition, the payment terms in the sales contract and commercial invoice show that the payment method is TT, which is inconsistent with regulations specified in item d.1.4, point d, clause 2, Article 15 of the Circular. 39/2015/TT-BTC (the payment method must be L/C or TTR).

The GDVC said that the company has not yet met requirements of price reduction.

Related News

Promoting agricultural exports to the Japanese market

13:55 | 22/12/2024 Import-Export

An Giang Customs issues many notes to help businesses improve compliance

09:29 | 20/12/2024 Customs

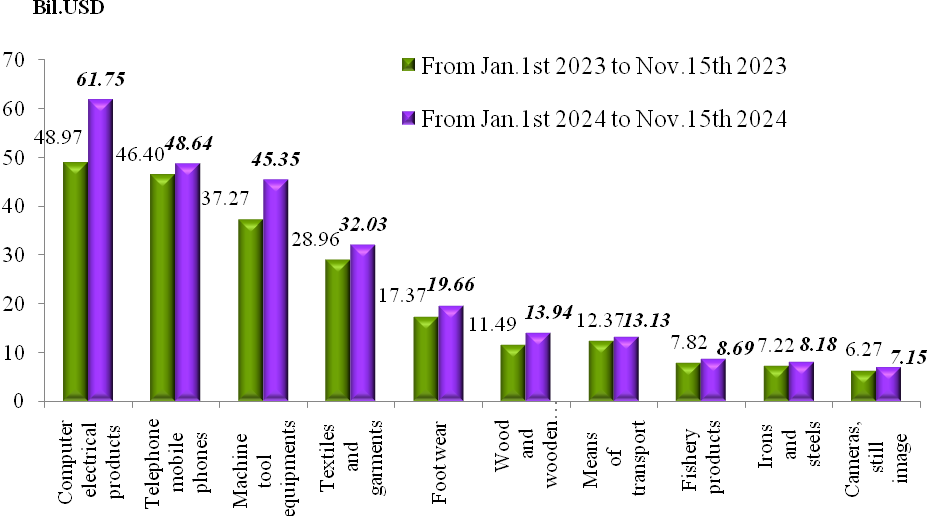

Total import-export turnover reaches US$715.55 billion in 11 months

10:23 | 13/12/2024 Import-Export

Preliminary assessment of Vietnam international merchandise trade performance in the first half of November, 2024

09:40 | 12/12/2024 Customs Statistics

Latest News

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

More News

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations

Customs tightens oversight on e-commerce imports

13:39 | 04/12/2024 Regulations

Bringing practical experience into customs management policy

13:48 | 03/12/2024 Regulations

Businesses anticipate new policies on customs procedures and supervision

15:41 | 29/11/2024 Regulations

Do exported foods need iodine supplementation?

11:06 | 29/11/2024 Regulations

Amendments to the Value-Added Tax Law passed: Fertilizers to be taxed at 5%

13:43 | 28/11/2024 Regulations

Proposal to change the application time of new regulations on construction materials import

08:52 | 26/11/2024 Regulations

Ministry of Finance proposed to reduce VAT by 2% in the first 6 months of 2025

09:00 | 24/11/2024 Regulations

Your care

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations