Customs finds difficulties because there is no e-cigarette management policy

| Confusion in management over next-generation tobacco products | |

| Which items are subject to excise tax? | |

| Ho Chi Minh City: dealing with many e-cigarette trading points |

|

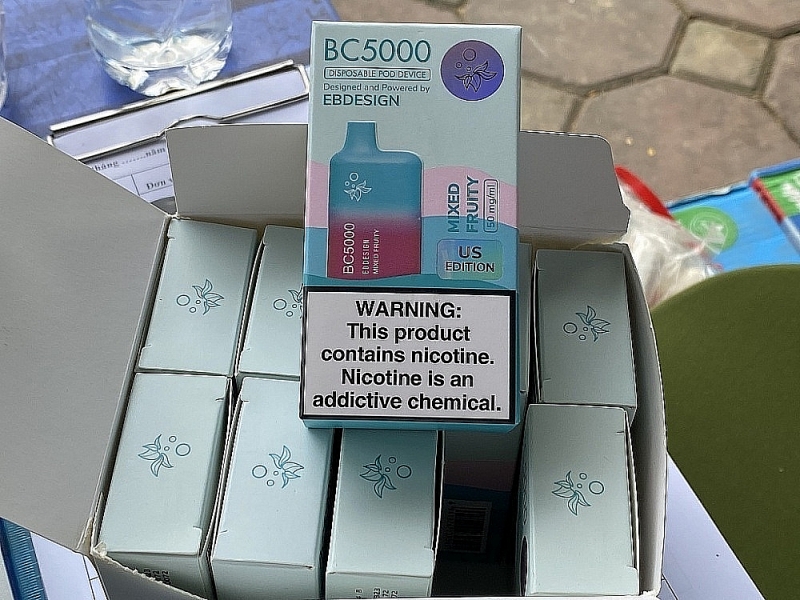

| Exhibits in the seizure of more than 100,000 e-cigarette products at the end of 2023 in Bac Ninh. |

Many types of e-cigarette products appear

According to statistics from the General Department of Customs, from 2020, local Customs have seized 28 cases related to e-cigarettes, confiscating and destroying thousands of e-cigarette products.

Most recently, on March 27, 2024, the interdisciplinary inspection team chaired by Market SurveillanceTeam No. 4, in coordination with the Economic Police Team (Mong Cai City Police), and the drug-related crime investigation police division (Quang Ninh Provincial Police), Drug Enforcement Team (Quang Ninh Customs Department) inspected and discovered many e-cigarettes and accessories at a shop in Mong Cai city, Quang Ninh province. On the labels of all the above goods there is no barcode, no information about origin, no invoices or documents, so there is no basis to determine the origin if they are used, they may be harmful to human health.

Previously, on February 20, 2024, at Noi Bai International Airport, Noi Bai Aviation Security Center coordinated with Noi Bai International Airport Border Gate Customs Branch to arrest a passenger carrying on bag containing 60 packs of IQOS brand electronic cigarettes (unused).

There are many smoke-free tobacco products that use electronic devices to heat a solution containing nicotine or tobacco ingredients to create nicotine-containing vapor without the combustion process upon using on the market. Among them, e-cigarettes and heated cigarettes are the most common products. However, the General Department of Customs said that current legal regulations do not define what electronic cigarettes and heated cigarettes are.

Analyzing current legal regulations on the management of electronic cigarettes and heated cigarettes, the General Department of Customs said, according to the provisions of the Law on Foreign Trade Management, Decree No. 69/2018/ND- CP detailing a number of articles of the Law on Foreign Trade Management, Decree No. 67/2013/ND-CP detailing a number of articles and measures to implement the Law on Prevention and Control of Harmful Effects of Tobacco on drug business (amended and supplemented in Decree No. 106/2017/ND-CP, No. 08/2018/ND-CP, No. 17/2020/ND-CP of the Government), new generation tobacco products have not yet been identified in the List of goods banned from export as well as the List of goods exported and imported according to licenses and conditions.

According to the assessment of many experts, new generation cigarettes are a potentially risky product that negatively affects human health and economic and social life, but are currently not specifically regulated in law. The Ministry of Finance (General Department of Customs) has repeatedly exchanged with the Ministry of Industry and Trade to clarify management policies and recommended that the Ministry of Industry and Trade soon develop or advise competent authorities to promulgate regulations to manage new generation cigarettes (e-cigarettes, heated cigarettes including components, assemblies, flavorings, chemicals...).

Regarding this issue, on October 26, 2021, the Government Office issued official dispatch No. 7830/VPCP-CN announcing the guidance of Deputy Prime Minister Le Van Thanh on developing management policies for new generation tobacco products in Vietnam, it requires: The Ministry of Industry and Trade to clarify the legal basis and authority to promulgate pilot policies to manage new generation tobacco products; coordinate with the Ministry of Health to continue researching and evaluating new generation tobacco products, on the basis of ensuring consumer health and harmonizing the interests of stakeholders. However, to Currently, the Ministry of Industry and Trade and the Ministry of Health have not issued or submitted to competent authorities for promulgation legal documents regulating new generation tobacco products, leading to difficulties and obstacles for the Customs in the handling import procedures for this item.

The policies must be issued soon to ensure management

From the perspective of state management of customs, strictly implementing the Government's direction, the General Department of Customs has issued a document directing local customs departments not to handle import procedures for e-cigarettes, heated cigarettes.

Regarding the import of electronic components to produce and assemble e-cigarette parts, a number of enterprises have been granted Investment Certificates to manufacture, process and assemble e- cigarette parts such as the punch core at the tip of the e-cigarette, heating module (the product is simply an electronic device, does not contain medicinal solution, does not contain tobacco), then export all products abroad, do not consume, use or sell in the Vietnamese market. According to the provisions of Article 5 and Article 42 of the Investment Law, "Investors have the right to conduct investment and business activities in industries and lines that this law does not prohibit" and "investors are responsible for complying with provisions of this law, and the investment certificate during the implementation of investment projects". Currently, the Customs agency only handles procedures for importing electronic components for processing and manufacturing products that are equipment used in e-cigarettes (not including tobacco solution or any tobacco products) to export abroad according to the investment fields licensed in the investment certificate.

According to the General Department of Customs, because there is no management policy for e- cigarettes and heated cigarettes, the Customs agency finds difficulties in defining violations and applying sanctions.

To resolve problems, competent authorities need to soon issue legal documents regulating imported e-cigarettes, heated cigarettes as well as imported electronic equipment and components to manufacturing, assembling and processing electronic devices used for e-cigarettes and heated cigarettes.

Related News

Promoting agricultural exports to the Japanese market

13:55 | 22/12/2024 Import-Export

Customs sector strengthens anti-smuggling for e-commerce products

19:09 | 21/12/2024 Anti-Smuggling

An Giang Customs issues many notes to help businesses improve compliance

09:29 | 20/12/2024 Customs

Preliminary assessment of Vietnam international merchandise trade performance in the second half of November, 2024

15:18 | 19/12/2024 Customs Statistics

Latest News

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

More News

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations

Customs tightens oversight on e-commerce imports

13:39 | 04/12/2024 Regulations

Bringing practical experience into customs management policy

13:48 | 03/12/2024 Regulations

Businesses anticipate new policies on customs procedures and supervision

15:41 | 29/11/2024 Regulations

Do exported foods need iodine supplementation?

11:06 | 29/11/2024 Regulations

Amendments to the Value-Added Tax Law passed: Fertilizers to be taxed at 5%

13:43 | 28/11/2024 Regulations

Proposal to change the application time of new regulations on construction materials import

08:52 | 26/11/2024 Regulations

Ministry of Finance proposed to reduce VAT by 2% in the first 6 months of 2025

09:00 | 24/11/2024 Regulations

Your care

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations