Banks dominate Top 10 most profitable enterprises in Vietnam in 2021

|

| Statistics from PROFIT500 Ranking, made by Vietnam Report in the 2017 – 2021 period. Source Vietnam Report |

Specifically, in the top 10 of the 500 most profitable enterprises in Vietnam in 2021, there are three banks, which are Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank); Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank); Vietnam Technological and Commercial Joint Stock Bank (Techcombank), and in the Top 10 of the Top 500 Most Profitable Private Enterprises in Vietnam in 2021, there are Techcombank; Vietnam Prosperity Joint Stock Commercial Bank (VPBank); Military Commercial Joint Stock Bank (MB); Asia Commercial Joint Stock Bank (ACB); Ho Chi Minh City Development Joint Stock Commercial Bank - HDBank (HDBank); and Vietnam International Commercial Joint Stock Bank (VIB).

This shows that bank profits have grown strongly. At the end of July 2021, many banks such as Vietcombank, VietinBank, Techcombank, VPBank, MB, HDBank and VIB all announced their profits in the first six months of the year increased sharply, some banks even increased 3 - 5 times compared to the same period last year.

Economic experts said that this is due to many credit institutions improving their financial health by increasing charter capital and ensuring the capital adequacy ratio (CAR) in accordance with the international risk management standards Basel II.

At the same time, many banks have reduced operating costs through digital banking and electronic payments. With the promotion of non-cash payments, the amount of cash in circulation mainly circulates between accounts at banks, helping to increase demand for deposits with low interest rates. As a result, credit institutions are able to reduce the cost of raising input capital.

Overall, the bank's performance during this period is a positive sign. For the first time, when there was a crisis, the health of the banking and financial sector was maintained, helping to stabilize the macro economy and making great contributions to the State budget.

For non-financial businesses, the business results of the first six months of 2021 of 281 companies listed in this year's PROFIT500 table showed an average increase of 144.3% in profit compared to the same period last year.

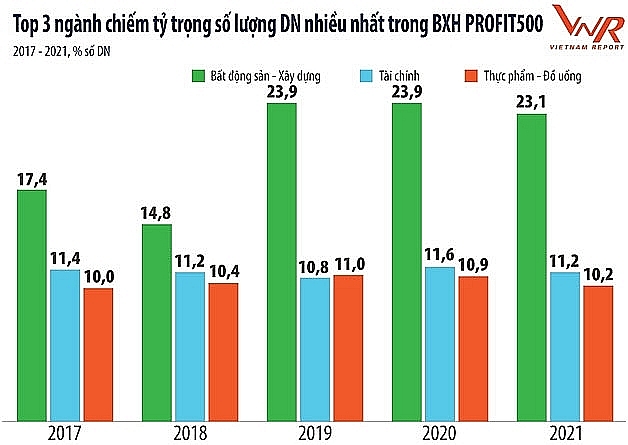

Not only keeping the "top position" in 2021, according to Vietnam Report's research, during the past five years, the Finance sector and the Real Estate - Construction sector, and the Food - Beverage industry, have always maintained their positions as the Top 3 industries with the largest number of enterprises in the PROFIT500 Ranking.

This year, in the top 10 of the Top 500 Most Profitable Enterprises in Vietnam, representatives of the Real Estate - Construction industry (Vingroup - Joint Stock Company) and Food - Beverage (Vietnam Dairy Products Joint Stock Company) were also named. And these two representatives were also named in the Top 10 Ranking of Top 500 Best Profitable Private Enterprises in Vietnam in 2021.

However, in the above three groups of industries, notably, the Finance sector and the Food - Beverage industry have always maintained a stable level in development, fluctuating around 11% and 10%, respectively. The Property – Construction sector had a big leap in 2019 when it increased sharply from 14.8% (in 2018) to 23.9%, accounting for nearly a quarter of the total number of businesses in the table.

Regarding the compound annual growth rate (CAGR), during the past five years, the average of all businesses in PROFIT500 is 10.12%. In which, the Finance sector (17.3%) ranked third in the Top 7 industries with the highest CAGR and made a great contribution to overall growth, just behind the Steel industry (34.5%) and Retail sector (17.5%); following is the Agriculture sector (16.0%); Food – Beverage industry (11.9%); Chemical industry (11.7%) and Real estate – Construction industry (10.8%).

These groups of industries are considered potential growth industries and contribute positively to the recovery momentum of the Vietnamese economy in the future.

Related News

Banks still "struggling" to find tools for handling bad debt

13:47 | 28/12/2024 Finance

Enterprises focus on Tet care for employees

18:59 | 22/12/2024 Headlines

Numerous FDI enterprises face suspension of customs procedures due to tax debt

09:57 | 18/12/2024 Anti-Smuggling

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Latest News

Forecast upbeat for banking industry in 2025

14:30 | 27/12/2024 Finance

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

More News

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Your care

Banks still "struggling" to find tools for handling bad debt

13:47 | 28/12/2024 Finance

Forecast upbeat for banking industry in 2025

14:30 | 27/12/2024 Finance

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance