The WB highlights a series of challenges, the banking system must enhance resilience

| Australia, WB extend partnership to support Vietnam"s development | |

| Challenges persist for Vietnam"s growth: WB report | |

| Government convenes law-building session |

Asset quality worsens, bad debts increase

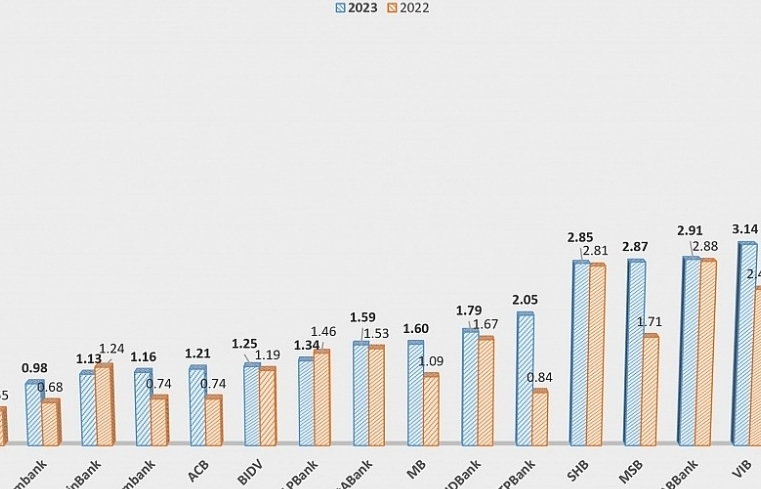

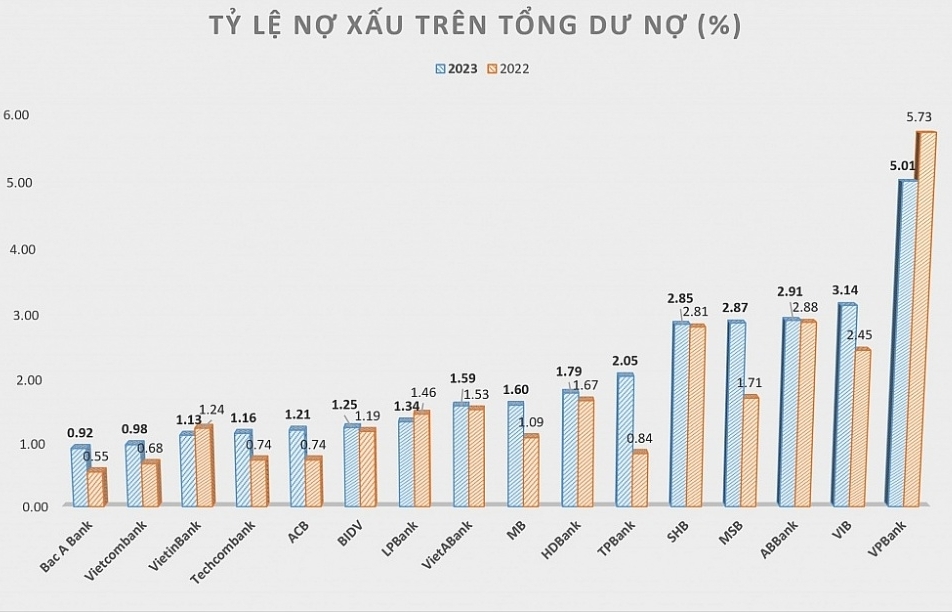

Although the average Capital Adequacy Ratio (CAR) of the banking sector was at 11.4% in 2022, which was higher than the minimum safety level, the capital buffer at some large State-owned commercial banks and small private banks remains low. This limits the ability to absorb shocks or increased bad debts.

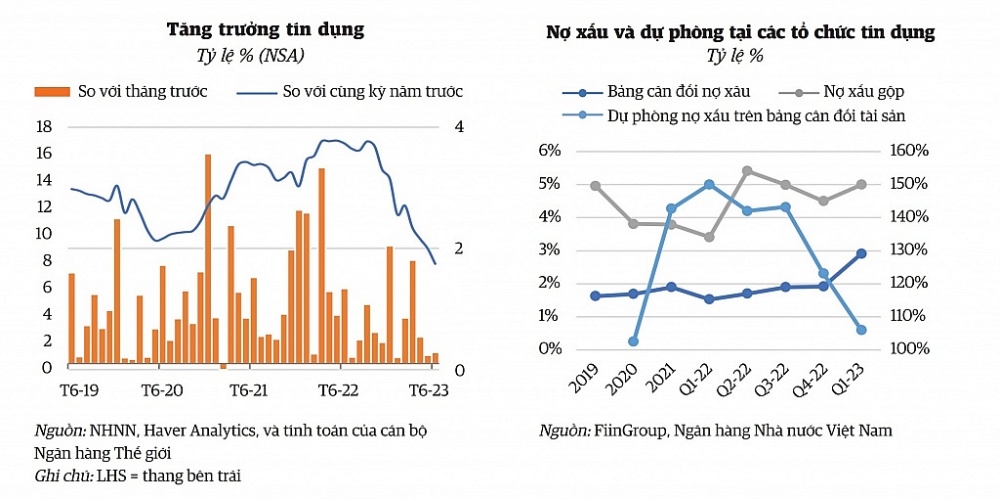

According to WB's recently released macroeconomic review report, credit growth was slower compared to the same period in previous years, reflecting weakened credit demand and investment activities due to economic deterioration.

Dorsati Madani, Senior Economic Expert at the WB, noted that the asset quality in the financial sector has worsened and bad debts were on the rise. The corporate bond market continues to stagnate with issuance volume only about 1/4 of that in the same period of 2022, and 98 companies are unable to repay their corporate bonds, with a total amount of up to VND128.5 trillion, equivalent to about 11.1% of the total corporate bond market debt.

|

| Slow credit growth and rising bad debts are significant challenges to the banking system. |

Not long ago, the survey of Vietnamese banks by Vietnam Report also identified the seven biggest challenges facing the banking industry in 2023. Among them, the increase in bad debts and the potential risks to the safety of the system were recognized by banks as the greatest challenges to be faced in the near future. Additionally, the recession in the stock market, real estate, bonds, and the impact of the cross-selling insurance crisis also raise concerns among banks, as they are expected to directly affect the banking business activities from the perspective of asset quality risks and erosion of trust.

According to the WB, to stimulate credit growth and address the pressure on the balance sheets of the banking sector, authorities have passed numerous support policies, including the reissuance of regulations on debt restructuring timelines.

In March 2023, the Government issued regulations allowing for the restructuring of corporate bonds and postponed the enforcement of previously issued additional regulations on issuance, thereby reducing short-term pressure on borrowers and eliminating difficulties in refinancing maturing bonds. Simultaneously, the Government also relaxed regulations related to credit institutions' purchase of corporate bonds to alleviate liquidity issues in the bond market.

Improvement for enhancing resilience

However, the WB assessed that the instability would persist if the global financial market had the potential to cause tension in the global banking sector. Tighter monetary policies in large-scale developed economies to counter prolonged inflation could increase the interest rate differential between domestic and international markets. This could exert pressure on the domestic currency.

Therefore, Dorsati Madani asserted that fundamental aspects of the financial sector need to be improved in several directions to enhance the resilience of the banking system. While measures such as interest rate cuts, liquidity relaxation, debt restructuring timelines, and debt groups help address short-term credit market difficulties, they could also increase bad debt and the loan-to-deposit ratio, raising concerns about imbalances in the asset balance sheet of banks.

In the medium term, WB experts recommended that structural reform was crucial to handling emerging financial risks and positioning this sector for sustainable development. Simultaneously, capital adequacy ratios of banks must be strengthened to ensure sufficient capital for absorbing potential losses and maintaining stability when facing economic shocks.

The WB experts also believed that regulatory agencies needed to enhance mechanisms and frameworks for safety supervision, early intervention, dealing with weak banks, and crisis management. This is to effectively monitor and intervene with financially troubled institutions, prevent escalating crises, and minimize systemic risks. Moreover, a strict mechanism for dealing with weak banks is of paramount importance to orderly address banks with repayment incapacity, protect depositors, and ensure financial stability.

Emphasizing the amendment of the Law on Credit Institutions, Dorsati Madani stated that this was an opportunity to strengthen the legal authority of the State Bank of Vietnam as a State management and banking supervisory authority, enhancing independence in operations and improving the functions and powers of banking supervision. Additionally, this should establish a legal framework to facilitate the handling of weak banks to ensure the stability of the financial system.

Hence, the WB's report recommended that this Law needed to be amended in a manner harmonious with international standards and practices, enabling risk-based financial organization oversight. It should empower the State Bank of Vietnam to require credit institutions to establish, maintain, and periodically review recovery plans, allowing these banks to proactively respond to rising tensions. Addressing weak banks should be conducted through stringent legal processes, policies, and procedures.

Related News

Bad debt at banks continues to rise in both amount and ratio

09:20 | 25/11/2024 Finance

Closely and effectively managing State fund

08:56 | 31/08/2024 Finance

Accumulating bad debt ratio put pressure on banks

09:53 | 11/03/2024 Import-Export

The bad debt ratio has increased, putting pressure on banks

08:42 | 03/03/2024 Finance

Latest News

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

More News

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

PM urges stronger measures to manage interest rates

16:53 | 17/12/2024 Finance

Six SOEs to be transferred back to industry ministry

16:48 | 17/12/2024 Finance

Vietnamese products: Conquering foreign customers in supermarket systems

16:45 | 17/12/2024 Finance

Answering many questions from businesses at dialogue conference on tax and customs policies

10:01 | 17/12/2024 Finance

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Strengthen the management and use of electronic invoices for e-commerce

11:24 | 16/12/2024 Finance

Ministry of Finance proposes comprehensive amendments to the Personal Income Tax Law

11:23 | 16/12/2024 Finance

Your care

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance