The bad debt ratio has increased, putting pressure on banks

Bad debt increased, risk provisions "eroded" profits

Analysis of banks' 2023 financial statements shows that, among 28 banks, only one bank had a decrease in bad debt volume, VietBank (down nearly 11%), the rest all increased, even the increase level is equal to the previous year.

The strongest increase is TPBank, when bad debt increased from 1,357 billion VND in 2022 to more than 4,200 billion VND in 2023, which is more than 3 times increase after 1 year.

At Techcombank, credit quality also shows signs of decline. Financial reports show that the total volume of bad debt of this bank nearly doubled compared to 2022, to nearly 6,000 billion VND.

Similarly, by the end of 2023, Sacombank's total bad debt was VND 10,984 billion, an increase of 155.5% compared to the beginning of the year.

MSB's total bad debt was VND 4,281 billion, an increase of more than 106% compared to 2022.

MB's total bad debt also increased by nearly 95% to VND 9,805 billion; ACB increased by more than 93%, to more than 5,887 billion VND, etc. Even the "big guy" Vietcombank also had an increase of more than 59%, to 12,455 billion VND of bad debt.

Other banks with a strong double-digit increase in bad debt volume include NCB, BacABank, Eximbank, VIB, BaoVietBank, OCB, etc, only 3 banks with a single-digit increase are Saigonbank, LPBank, VietinBank.

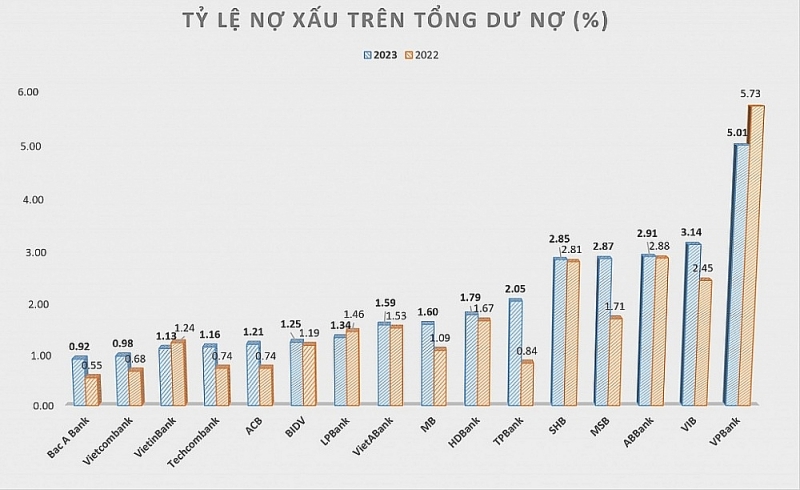

In terms of the ratio of bad debt to total outstanding loans, most banks increased compared to the previous year, some banks even increased the bad debt ratio to nearly 30% of total outstanding loans. 5 banks with a ratio exceeding the 3% threshold are NCB, VPBank, BaoVietBank, BVBank, VIB. 2 banks with bad debt ratios below 1% are Vietcombank and BacABank.

|

| The ratio of bad debt out of total outstanding loans of some banks. Chart: HD |

Because the volume of bad debt increased, banks had to put effort into risk provisions, thereby causing this cost to "erode" profits.

For example, in 2023, TPBank will set aside double the risk provisions compared to 2022, with more than 3,900 billion VND. In the fourth quarter of 2023 alone, this bank had to set aside more than 1,970 billion VND for risk provisions, while in the same period last year, it only deducted more than 114 billion VND. As a result, TPBank only has a pre-tax profit of VND 5,589 billion in 2023, down 29% compared to 2022.

Similarly, in 2023, MSB must also increase risk provisions by more than 3.4 times compared to the previous year, up to nearly 1,647 billion VND, so profit after tax for the whole year will only increase very slightly by 0.6%, reaching more than 4,646 billion VND. But in the fourth quarter of 2023 alone, MSB had to increase risk provisions from more than 69 billion VND to nearly 328 billion VND, causing the bank's fourth-quarter after-tax profit to decrease by more than 37% compared to the same period in 2022.

Techcombank must also increase its risk provision buffer, from VND 1,936 billion in 2022 to more than VND 3,920 billion in 2023. ACB also has a "huge" increase in risk provisions from VND 70 billion in 2022 to more than 1,804 billion VND in 2023. In addition, significant increases include VIB increasing by 279%, Eximbank increasing by more than 5.6 times, ABBank increasing by more than 92%, etc.

Need a solution to reduce the burden of bad debt

The volume of bad debt at banks has increased, but according to experts, with the current difficult economic situation, customers' ability to repay debt is still affected. While old bad debts have not been resolved, there may be new bad debts when Circular 02/2023/TT-NHNN of the State Bank (SBV) on debt restructuring and debt postponement expires at the end of this June, so the pressure of bad debt will weigh even more heavily on banks.

Economic expert Associate Professor, PhD. Dinh Trong Thinh assessed that when Circular 02 expires, restructured debts will return to the correct classification, causing bad debts to increase, thereby increasing the pressure on banks to set up risk provisions for restructured debts or non-restructured bad debts will greatly affect banks' 2024 profits.

Because of the above problem, in the recent meeting on promoting credit growth of the State Bank, representatives of many commercial banks' leaders proposed to extend Circular 02.

Mr. Pham Quang Thang, Deputy General Director of Techcombank, said that Techcombank's bad debt by the end of January 2024 is equal to the end of 2023, with a rate of 1.2%. The restructured debt of customers at Techcombank according to Circular 02 by the end of January 2024 is about VND 6,000 billion and customers are also starting to pay gradually. Therefore, Techcombank representatives proposed to extend the deadline of Circular 02 to create conditions for businesses to have time to repay debt.

Similarly, Mr. Ho Nam Tien, Vice Chairman of the Board of Directors and General Director of LPBank, said that the bank has restructured about VND 2,500 billion of outstanding debt according to Circular 02, but repaying the debt until this Circular expires is difficult. With many customers, they also want to have more time to restructure their debt. MB representatives also proposed to extend Circular 02 for another year.

In response to the proposals of the banks, Deputy Governor of the State Bank Dao Minh Tu also agreed that it is necessary to consider extending Circular 02, but the issue of extending it for another 6 months or 1 year needs to be considered carefully. The Deputy Governor also emphasized that although credit slowed down in the first month of this year, banks should not lend at all costs, but they cannot tighten credit. Credit needs to be directed to priority areas, promoting support for businesses in difficulty but with conditions to recover.

But along with the above problem, to handle bad debt effectively and substantially, experts and banks believe that there needs to be a solution for the economy and businesses to recover more actively, and at the same time, there must be a solution to help the real estate market be "warm" again. Besides, there are solutions to improve the legal mechanism related to bad debt handling and operate the bad debt trading floor more effectively and practically.

Related News

Banks still "struggling" to find tools for handling bad debt

13:47 | 28/12/2024 Finance

Credit continues to increase at the end of the year, room is loosened to avoid "surplus in some places - shortage in others"

10:23 | 13/12/2024 Finance

Bad debt at banks continues to rise in both amount and ratio

09:20 | 25/11/2024 Finance

Green credit proportion remains low due to lack of specific evaluation criteria

09:02 | 24/11/2024 Finance

Latest News

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

More News

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance

Fiscal, monetary policies support demand stimulation, price stabilisation

14:49 | 14/02/2025 Finance

Vietnam secures VND 157 billion from state enterprise divestment in 2024

09:16 | 14/02/2025 Finance

Vietnam gears up for potential inflation impact in 2025

14:26 | 11/02/2025 Finance

VN’s credit conditions in 2025 expected to be stable

14:24 | 11/02/2025 Finance

State revenue in first month of the year equal to 14% of the estimate

10:12 | 11/02/2025 Finance

Securities 2025 expects a breakthrough in scale and quality

14:37 | 10/02/2025 Finance

Cash reserves in stock accounts at six-quarter low amid margin rise

08:23 | 10/02/2025 Finance

Five solutions for developing stock market in 2025

10:01 | 07/02/2025 Finance

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance