Accumulating bad debt ratio put pressure on banks

| Bad debt remains big concern for banking system in 2024 | |

| Pressure of bad debts in banks | |

| Bad debt recovery faces many challenges in 2024 |

Risk provisions "eroded" profits due to increasing bad debt

Analysis of banks' 2023 financial statements shows that, only one out of 28 banks had a decrease in bad debt volume, VietBank (down nearly 11%), the rest all witnessed an increase, which even was equal to the previous year.

Reparably, TPBank hit the score with an increase from 1,357 billion VND in 2022 to more than 4,200 billion VND in 2023, which was more than 3 times increase after 1 year.

Techcombank’s credit quality also shows signs of decline. Financial reports show that the total volume of bad debt of this bank nearly doubled compared to 2022, to nearly 6,000 billion VND.

Similarly, by the end of 2023, Sacombank's total bad debt was VND 10,984 billion, an increase of 155.5% compared to the beginning of the year.

MSB's total bad debt was VND 4,281 billion, an increase of more than 106% compared to 2022.

MB's total bad debt also increased by nearly 95% to VND 9,805 billion; ACB also recorded an uptrend of more than 93%, to more than 5,887 billion VND... Even the "big guy" Vietcombank also had an increase of more than 59%, to 12,455 billion VND of bad debt.

Bad debt volume leaped to double digits in other banks including NCB, BacABank, Eximbank, VIB, BaoVietBank, and OCB..., only 3 banks with a single-digit increase were Saigonbank, LPBank, VietinBank.

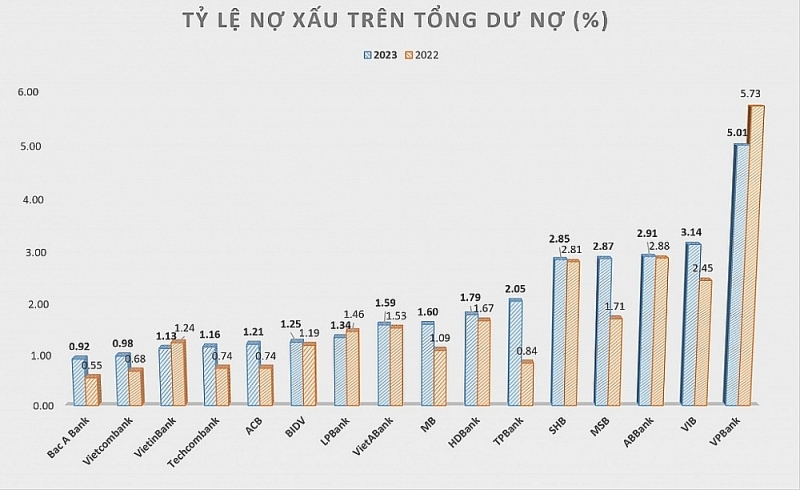

In terms of the ratio of bad debt to total outstanding loans, most banks witnessed an upward trend compared to the previous year, some banks have even increased the bad debt ratio to nearly 30% of total outstanding loans. Typically, 5 banks with a ratio exceeding the 3% threshold were NCB, VPBank, BaoVietBank, BVBank, VIB. Two banks with bad debt ratios below 1% were Vietcombank and BacABank.

|

| The ratio of bad debt to total outstanding loans of some banks. Chart: HD |

Bad debt increase forced banks to put effort into risk provisions, thereby causing this cost to "eat away" into profits.

For example, in 2023, TPBank set aside double the risk provisions compared to 2022, with more than 3,900 billion VND. In the fourth quarter of 2023 alone, this amount was set aside more than 1,970 billion VND, while in the same period last year it only deducted more than 114 billion VND. As a result, TPBank only had pre-tax profit of VND 5,589 billion in 2023, down 29% compared to 2022.

Similarly, in 2023, MSB must also increase risk provisions by more than 3.4 times compared to the previous year, up to nearly 1,647 billion VND, so profit after tax for the whole year was up very slightly by 0.6%, to more than 4,646 billion VND. In the fourth quarter of 2023 alone, MSB had to increase risk provisions from more than 69 billion VND to nearly 328 billion VND, causing the bank's fourth quarter after-tax profit to decrease by more than 37% compared to the same period in 2022.

Techcombank must also increase its risk provision buffer, from VND 1,936 billion in 2022 to more than VND 3,920 billion in 2023. ACB also set aside a "huge" amount from VND 70 billion in 2022 to more than 1,804 billion VND in 2023. In addition, some other banks also got an impressive results such as VIB, Eximbank and ABBank by 279%, more than 5.6 times and more than 92%, respectively.

A solution in need to reduce the burden of bad debt

The volume of bad debt at banks has plummeted, but according to experts, amid the current difficult economic situation, customers' ability to repay debt is still affected. While old bad debts have not been resolved, there may be new bad debts when Circular 02/2023/TT-NHNN of the State Bank (SBV) on debt restructuring and debt postponement expires at the end of June, so the pressure of bad debt will weigh even more heavily on banks.

Economic expert Associate Professor, PhD. Dinh Trong Thinh assessed that when Circular 02 expires, restructured debts will return to the correct classification, causing bad debts to increase, thereby banks are suffered from setting up risk provisions for restructured debts or non-restructured bad debts. As a result, banks' 2024 profits will be affected.

Therefore, in the recent meeting on promoting credit growth of the State Bank, representatives of many commercial banks' leaders proposed to extend Circular 02.

Mr. Pham Quang Thang, Deputy General Director of Techcombank, said that Techcombank's bad debt by the end of January 2024 was equal to the end of 2023, with a rate of 1.2%. The restructured debt of customers at Techcombank according to Circular 02 by the end of January 2024 was about VND 6,000 billion and customers are also starting to pay in installments. Therefore, Techcombank representatives proposed to extend the deadline of Circular 02 to facilitate businesses to have time to repay debt.

Similarly, Mr. Ho Nam Tien, Vice Chairman of the Board of Directors and General Director of LPBank, said that the bank has restructured about VND 2,500 billion of outstanding debt according to Circular 02, but repaying the debt until this Circular expires is difficult. Therefore, they also want to have more time to restructure their debt. MB representatives also proposed to extend Circular 02 for another year.

In response to the proposals of the banks, Deputy Governor of the State Bank Dao Minh Tu also agreed that it is necessary to consider extending Circular 02, but the issue of extending it for another 6 months or 1 year needs to be considered carefully. The Deputy Governor also emphasized that although credit slowed down in the first month of this year, banks should not lend at all costs or tighten credit. Credit needs to be directed to priority areas, promoting support for businesses in need of capital but are capable of recorvery.

Along with such above problems, to handle bad debt effectively and substantially, experts and banks believe that there needs to be a overall solution for the bounce back of the economy and businesses, and at the same time, a particular solution for the revitality of the real estate market. Besides, it is necessary to fullfill the legal mechanism related to bad debt handling and operate the bad debt trading floor more effectively and practically.

Related News

There is still room for credit growth at the end of the year

09:43 | 08/12/2024 Finance

Bad debt at banks continues to rise in both amount and ratio

09:20 | 25/11/2024 Finance

Banks increase non-interest revenue

10:51 | 23/11/2024 Finance

Latest News

Seafood exports expected to exceed $10 billion in 2025: expert

20:28 | 21/12/2024 Import-Export

Top 10 Reputable Animal Feed Companies in 2024: Efforts to survive the challenges of nature

18:30 | 21/12/2024 Import-Export

Vietnam's import-export surges 15.3%

09:44 | 20/12/2024 Import-Export

More Vietnamese firms interested in Saudi Arabia: Ambassador

09:43 | 20/12/2024 Import-Export

More News

“Give and Take” in the Value Chain of the CPTPP Market

09:30 | 20/12/2024 Import-Export

Binh Dinh province works to attract investment from Japan

15:44 | 19/12/2024 Import-Export

Agricultural, forestry and fishery exports “reach the target” early

15:20 | 19/12/2024 Import-Export

Thailand remains Vietnam’s biggest trading partner in ASEAN

15:35 | 18/12/2024 Import-Export

Rubber value soars in 2024: VRA

15:33 | 18/12/2024 Import-Export

Vietnamese businesses struggle to access green finance

09:58 | 18/12/2024 Import-Export

E-commerce: a gateway to boost Vietnamese commodities in the UK market

16:55 | 17/12/2024 Import-Export

Agro-forestry-fisheries exports top 62 billion USD in 2024

16:51 | 17/12/2024 Import-Export

Removing “bottlenecks” for digital transformation in industrial production

10:00 | 17/12/2024 Import-Export

Your care

Seafood exports expected to exceed $10 billion in 2025: expert

20:28 | 21/12/2024 Import-Export

Top 10 Reputable Animal Feed Companies in 2024: Efforts to survive the challenges of nature

18:30 | 21/12/2024 Import-Export

Vietnam's import-export surges 15.3%

09:44 | 20/12/2024 Import-Export

More Vietnamese firms interested in Saudi Arabia: Ambassador

09:43 | 20/12/2024 Import-Export

“Give and Take” in the Value Chain of the CPTPP Market

09:30 | 20/12/2024 Import-Export