Bad debt at banks continues to rise in both amount and ratio

|

| BIDV currently has the highest bad debt balance in the system. Photo: BIDV |

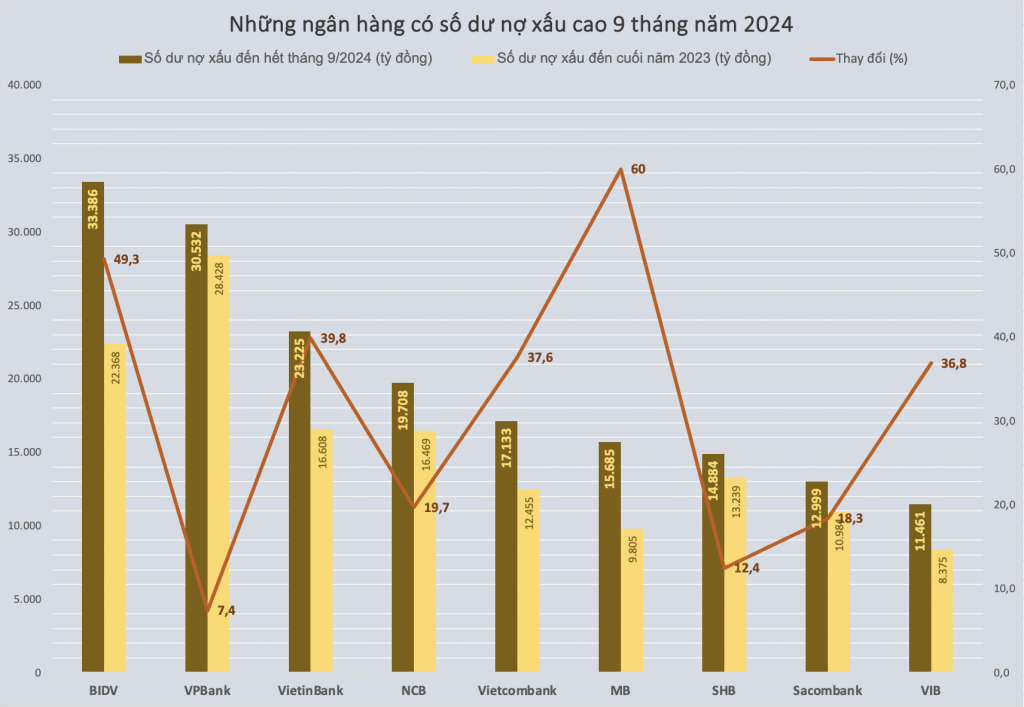

Consolidated financial statement data from 29 banks for the first nine months of 2024 reveal that total bad debt reached over VND 259 trillion as of September 30, 2024, a nearly 28% increase compared to the end of 2023.

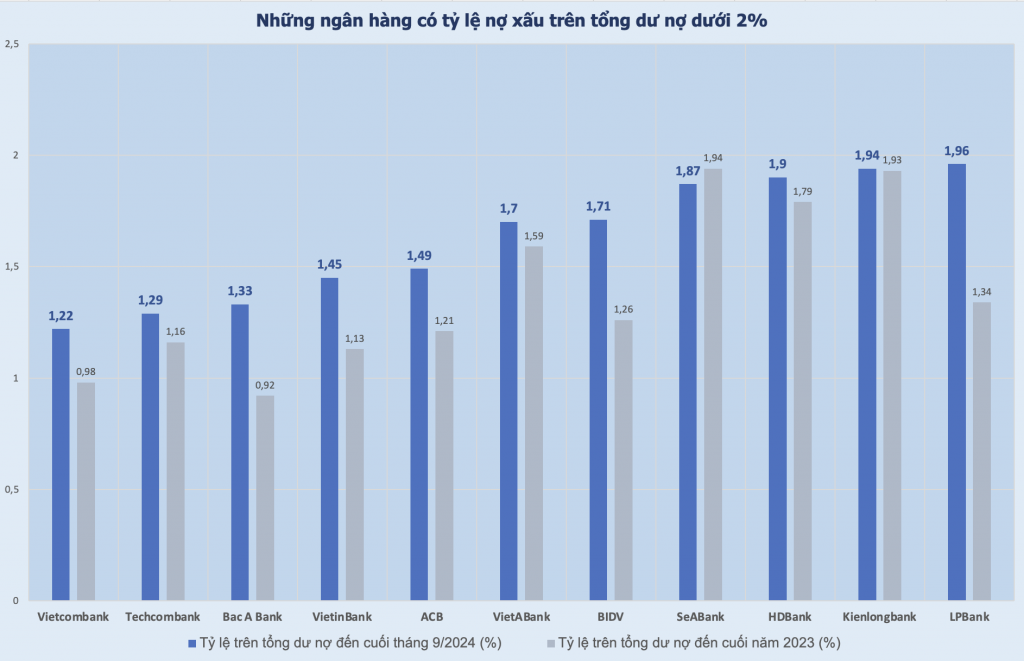

BIDV leads with over VND 33.386 trillion in bad debt, a more than 49% increase compared to the end of 2023. However, due to its high total outstanding credit, BIDV's non-performing loan (NPL) ratio remains relatively low at 1.71%, although higher than the 1.26% recorded at the end of the previous year.

VietinBank also recorded a significant increase in bad debt, up nearly 40% to VND 23.225 trillion. Similar to BIDV, its high credit volume keeps the NPL ratio at 1.45%, up from 1.13% at the end of 2023.

Vietcombank's bad debt increased by over 37% to VND 17.133 trillion, but it boasts the lowest NPL ratio in the system at 1.22%, albeit higher than the sub-1% figure at the end of the previous year.

|

| Source: Banks' financial statements. Chart: H. Diu |

Among private banks, VPBank has the highest bad debt balance, nearing VND 30.532 trillion, a 7% increase compared to the end of 2023. However, its NPL ratio is high at 4.81%, with Group 5 debt (potentially irrecoverable debt) surging by 68.5% to over VND 7.354 trillion compared to the previous year-end.

LPBank recorded the fastest growth in bad debt, increasing by 70% in the first nine months to VND 6.272 trillion. MB followed with a 60% increase, Nam A Bank with 56.3%, BVBank with 55.7%, and Bac A Bank with 50.1%.

Conversely, OCB was the only bank to reduce its bad debt, decreasing from VND 6.883 trillion at the end of 2023 to VND 6.540 trillion at the end of Q3 2024.

Regarding NPL ratios, 11 banks currently exceed 3%: SHB, PGBank, ABBank, VietBank, PVComBank, VIB, OCB, BaoVietBank, BVBank, VPBank, and NCB.

For instance, PVComBank reported pre-tax profits of nearly VND 89 billion in the first nine months of 2024, a 74.3% decrease year-on-year. Its total bad debt reached VND 3.775 trillion as of September 30, 2024, with Group 5 debt accounting for nearly VND 2.851 trillion, or 75.5% of the total. Its NPL ratio stands at 3.69%.

PVComBank also holds VND 7.75 trillion in special bonds classified as bad debt at the Vietnam Asset Management Company (VAMC), with VND 865 billion provisioned for this debt.

However, several banks, despite having NPL ratios below the permissible limit, experienced significant increases in specific debt groups.

LPBank's NPL ratio increased from 1.34% to 1.96% in the first nine months of 2024, but its Group 5 debt surged by 132% from VND 1.169 trillion to VND 2.717 trillion. Group 3 (substandard) and Group 4 (doubtful) debts also increased by nearly 70% and 27.4%, respectively.

TPBank's total bad debt increased by almost 28% to VND 5.369 trillion, raising its NPL ratio from 2.05% at the beginning of the year to 2.29%.

While Group 5 debt decreased slightly by 10% to over VND 1 trillion, Group 3 debt surged by 63% to over VND 2.709 trillion, and Group 4 debt increased by 16% to over VND 1.659 trillion, driving the NPL ratio higher.

|

| Source: Banks' financial statements. Chart: H. Diu |

Bac A Bank's on-balance sheet bad debt increased by over 50% compared to the beginning of the year, reaching VND 1.375 trillion, due to a nearly 57% increase in potentially irrecoverable debt and a more than 73% increase in doubtful debt. Its NPL ratio reached 1.33% at the end of Q3 2024, compared to 0.92% at the beginning of the year.

Experts predict that the upward trend in NPL ratios will continue due to numerous loans restructured with extended repayment terms but unchanged debt classifications under the SBV's support mechanism.

In its report to the 8th session of the 15th National Assembly, the SBV stated that as of August 31, 2024, 72 credit institutions had restructured repayment terms for 290,370 customers, with a total outstanding principal and interest of VND 249.705 trillion. As of the same date, 226,764 customers still had outstanding restructured loans totaling VND 126.403 trillion.

During the question and answer session at the National Assembly's 8th session on November 11, 2024, SBV Governor Nguyen Thi Hong addressed the rising bad debt, attributing it to the difficulties faced by businesses and individuals since 2020, leading to reduced income and loan repayment challenges.

In order to control bad debt, the Governor outlined several solutions for credit institutions, including thorough borrower assessment and evaluation of repayment capacity.

Regarding existing bad debts, credit institutions should actively pursue debt recovery and asset disposal. However, the Governor acknowledged the current difficulties in these efforts.

The SBV has also established a legal framework for VAMC and debt trading companies to participate in bad debt resolution.

The Governor emphasized that controlling bad debt is challenging when it stems from external factors or business-specific issues. She urged businesses and individuals to strengthen their financial capabilities and restructure their management practices, particularly cash flow management, noting that some businesses struggle despite having funds due to poor cash flow management.

Related News

Banks still "struggling" to find tools for handling bad debt

13:47 | 28/12/2024 Finance

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance

Credit continues to increase at the end of the year, room is loosened to avoid "surplus in some places - shortage in others"

10:23 | 13/12/2024 Finance

There is still room for credit growth at the end of the year

09:43 | 08/12/2024 Finance

Latest News

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

More News

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance

Fiscal, monetary policies support demand stimulation, price stabilisation

14:49 | 14/02/2025 Finance

Vietnam secures VND 157 billion from state enterprise divestment in 2024

09:16 | 14/02/2025 Finance

Vietnam gears up for potential inflation impact in 2025

14:26 | 11/02/2025 Finance

VN’s credit conditions in 2025 expected to be stable

14:24 | 11/02/2025 Finance

State revenue in first month of the year equal to 14% of the estimate

10:12 | 11/02/2025 Finance

Securities 2025 expects a breakthrough in scale and quality

14:37 | 10/02/2025 Finance

Cash reserves in stock accounts at six-quarter low amid margin rise

08:23 | 10/02/2025 Finance

Five solutions for developing stock market in 2025

10:01 | 07/02/2025 Finance

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance