Ho Chi Minh City Customs proposed to reduce VAT

20/03/2024 09:54 Regulations

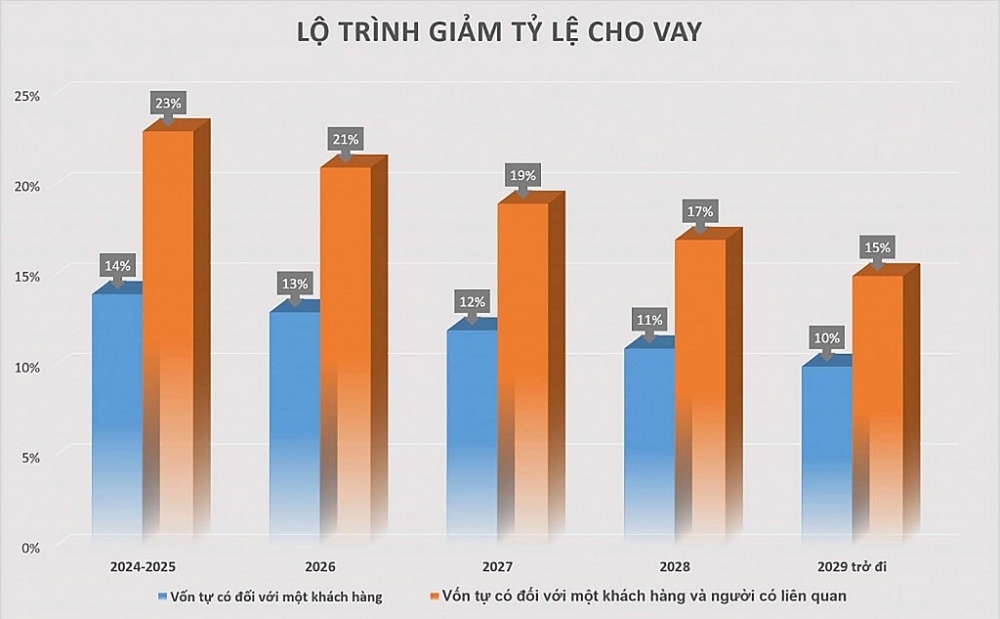

Limiting the "power" of major shareholders under the Law on Credit Institutions (amended)

15/03/2024 13:52 Regulations

VCCI proposes zero tax rate to be maintained for exported services

13/03/2024 15:59 Regulations

Ministry of Finance anwser voters about on-spot imports and exports

13/03/2024 09:41 Regulations

Customs instructs C/O submission for imported cane sugar products

13/03/2024 09:38 Regulations

SBV drafts regulations on a testing mechanism for Fintech

11/03/2024 09:52 Regulations

Finance sector abolishes 40 administrative procedures

09:23 | 10/03/2024 Regulations

Automate the registration fee management process

10:54 | 05/03/2024 Regulations

Mixed tax regime not yet applied on beer and alcohol products

19:27 | 03/03/2024 Regulations

General Department of Taxation reviews draft regulations on loan interest expense cap

16:11 | 19/02/2024 Regulations

The Government regulated four land valuation methods

15:47 | 15/02/2024 Regulations

Government issues new regulations on land valuation

05:42 | 09/02/2024 Regulations

Proposing to have information sharing mechanism in price management

09:13 | 06/02/2024 Regulations

Policy on imported goods for export processing without a processing facility

17:27 | 05/02/2024 Regulations

Proposing for state-owned enterprises to divest capital from loss-making enterprises

14:40 | 02/02/2024 Regulations

Untangling procedures for companies to import new products

11:46 | 29/01/2024 Regulations

Your care

Promoting review, classification and management of tax debt

09:53 | 21/07/2024 Regulations

Documents required for vehicles transporting cargo across Lang Son Border Gate from August 1

09:50 | 20/07/2024 Regulations

Does goods imported for investment incentives project subjected to tax exemption?

09:38 | 12/07/2024 Regulations

Border gate area planning associated with digital transformation needs to prioritize human resources, equipment, and infrastructure

09:43 | 09/07/2024 Regulations

Proposal to reduce registration fees to restore growth of domestic automobile industry

09:33 | 07/07/2024 Regulations