Proposing to have information sharing mechanism in price management

| Control inflation expectations | |

| Contribute to price management from combating smuggling and trade fraud | |

| Ensure flexibility, proactivity in price management to control inflation |

Accordingly, in the regulations on the implementation of price stabilization according to Clause 1, Article 20 of the Price Law, the draft Decree requires ministries and ministerial-level agencies to issue written requests for price stabilization for commodities and services under their management sent to the Ministry of Finance for synthesis to submit to the Government for approval of the price stabilization policy.

Specifically, ministries and ministerial-level agencies must make a report on price stabilization when there are abnormal changes of prices of goods and services.

This report includes information on the legal basis, the need to implement price stabilization with analysis of developments and causes of abnormal changes in market prices of goods and services for a certain period and propose price stabilization measures and send them to the Ministry of Finance.

Accordingly, the Ministry of Finance reviews and synthesizes the report to the Government for consideration and approval of the price stabilization policy. If necessary, the Ministry of Finance will request relevant agencies and organizations to report other information to serve the synthesis and report to the Government for approval of the price stabilization policy.

|

| It is necessary to implement methods to determine the causes of price fluctuations, as a basis for choosing to apply price stabilization measures. Illustrative photo: H.Anh |

In particular, the draft Decree also proposes that the Government decide on the price stabilization policy, assign presiding responsibilities to ministries to implement price stabilization, and assign responsibilities of coordination to relevant ministries, ministerial-level agencies and provincial-level People's Committees.

Based on the Government's policy of price stabilization, ministries and ministerial-level agencies are responsible for presiding over the implementation and guiding the provincial People's Committees to implement several methods to determine the cause of price fluctuation as basis for choosing appropriate measures, application period and scope of price stabilization.

Methods include: checking price formation factors as described or requiring businesses to report some price formation factors; controlling inventory of production and business organizations and individuals; assessing supply and demand prices of goods and services.

Ministries and ministerial-level agencies shall issue decisions on price stabilization including the following contents: names of goods and services approved by the Government with price stabilization policy; applicable price stabilization measures according to the provisions of Article 19 of the Price Law; application period of application of price stabilization measures; scope of application of price stabilization; assign responsibility for carrying out and reporting the results of price stabilization implementation to local agencies and relevant units, organizations and individuals.

In addition, the draft Decree also clearly stipulates the authority and responsibility of price stabilization implementation. In particular, the Ministry of Finance coordinates with other ministries and agencies in advising the Government and implementing price stabilization measures in accordance with the provisions of law to stabilize prices.

Responding to price fluctuations in a timely manner

Regarding the coordination of implementing the tasks of synthesizing, analyzing, and forecasting market prices, the draft Decree detailing and implementing measures for a number of articles of the 2023 Price Law sets out the requirement to develop a mechanism on regular, continuous, timely and effective information sharing based on the functions, tasks, powers of ministries and agencies and the participation of local agencies.

Along with that, it is necessary to advise the Government and the Prime Minister to promulgate measures and solutions to manage and regulate prices in each period. Responding promptly to market price fluctuations, contributing to controlling inflation, supporting the macro economy, and serving state management.

The draft Decree proposes that, based on the functions, tasks and scope of management, ministries and agencies are responsible for coordinating in providing and sharing information on prices of goods, services and policy mechanisms, measures and solutions for price management and regulatory; activities of collecting market price information of goods and services.

In addition, ministries and ministerial-level agencies should work closely together in information analysis and evaluation; forecasting market prices of goods and services; making recommendations on inflation control goals and proposing measures and solutions on price management to achieve inflation control goals; developing price reports to serve the price direction and administration of the Government, the Prime Minister, the Prime Minister's Steering Committee for Price Management and ministries and central agencies.

Ministries and central agencies are responsible for disseminating price information and market price forecasts, price management policy mechanisms to control expected inflation; summarizing, evaluating and exchanging experiences on synthesizing, analyzing and forecasting market prices; strengthening international cooperation on market price synthesis, analysis and forecasting.

Related News

Goods trading, being seen from Lang Son border gate

13:45 | 28/11/2024 Customs

7 key export groups bring in US$234.5 billion

13:54 | 28/11/2024 Import-Export

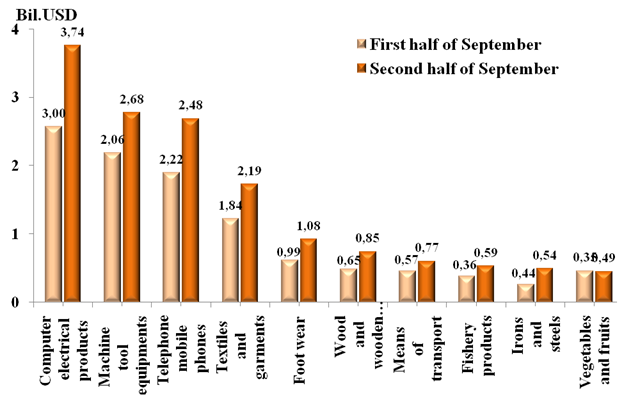

Preliminary assessment of Vietnam international merchandise trade performance in the second half of September, 2024

09:21 | 20/11/2024 Customs Statistics

Do exported foods need iodine supplementation?

11:06 | 29/11/2024 Regulations

Latest News

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

More News

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations

Customs tightens oversight on e-commerce imports

13:39 | 04/12/2024 Regulations

Bringing practical experience into customs management policy

13:48 | 03/12/2024 Regulations

Businesses anticipate new policies on customs procedures and supervision

15:41 | 29/11/2024 Regulations

Amendments to the Value-Added Tax Law passed: Fertilizers to be taxed at 5%

13:43 | 28/11/2024 Regulations

Proposal to change the application time of new regulations on construction materials import

08:52 | 26/11/2024 Regulations

Ministry of Finance proposed to reduce VAT by 2% in the first 6 months of 2025

09:00 | 24/11/2024 Regulations

Hanoi Customs resolves tax policy queries for enterprises

09:26 | 22/11/2024 Regulations

Regularly check tax obligations to avoid temporary exit suspension

09:47 | 21/11/2024 Regulations

Your care

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations