Limiting the "power" of major shareholders under the Law on Credit Institutions (amended)

| Vietnam’s taxman says VAT collection related to L/Cs lawful |

|

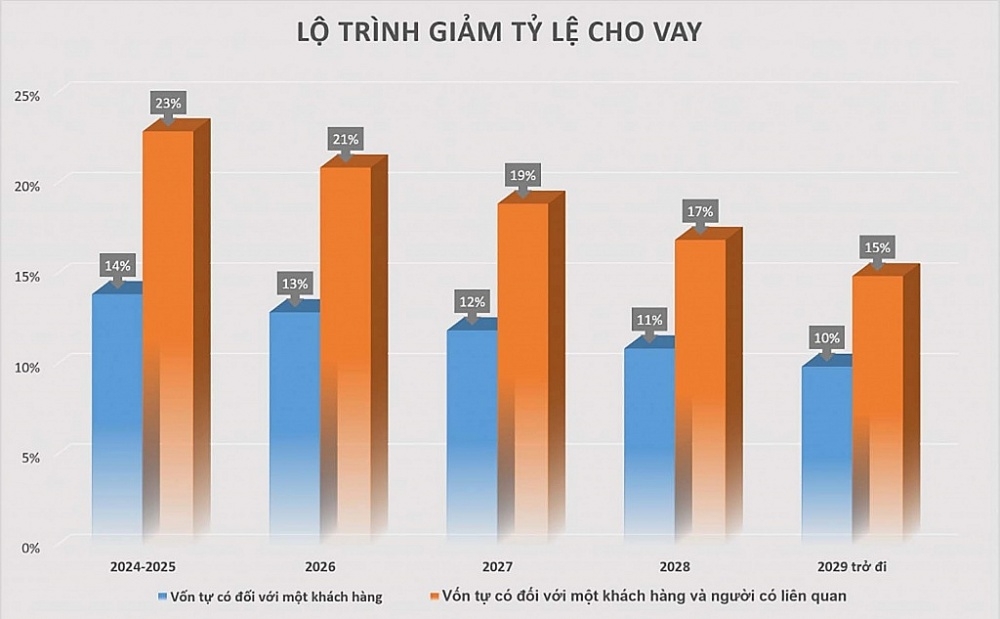

| According to the provisions of the Law on Credit Institutions (amended). Chart: H.Diu |

Accordingly, regarding the ownership rate of credit institutions, the Law on Credit Institutions (amended) has stipulated a reduction in the maximum ownership rate at a credit institution from 15% to 10% of charter capital for an institutional shareholder; reduced from 20% to 15% of charter capital for a group of related shareholders, while expanding related subjects. The maximum ownership ratio of an individual is kept at 5%.

In addition, domestic shareholders whose ownership ratio exceeds the regulations may continue to maintain their shares but may not increase their shares until they comply with the regulations on ownership ratio. Shareholders owning 1% or more of the charter capital of a credit institution must provide information and the credit institution must publicly announce the information of these shareholders. Previously, shareholders would only have to disclose information about transactions, ownership, and related persons when holding 5% of charter capital or more. In addition, "related persons" under the Law on Credit Institutions (amended) is also expanded.

According to the assessment of Dr. Can Van Luc and the BIDV Institute of Training and Research Authors, the regulations on the maximum ownership ratio of one shareholder and a group of related shareholders at a credit institution have been changed to be stricter. Along with that, the regulations on related persons are also clarified and significantly broader than the current regulations, especially for related parties that are individuals. This regulation contributes to limiting the ability of a group of shareholders to own a majority of shares, thereby contributing to reducing cross-ownership and manipulating the operations of credit institutions.

In addition, the Law also provides transitional regulations for this content (shareholders whose ownership ratio is higher than the allowable limit, before the Law takes effect) will still be kept intact (shares are not required to be sold), but will not be allowed to participate in the bank's new share issuances to ensure that the current ownership ratio will gradually decrease to the limit according to the roadmap until 2029, thereby ensuring the rights, obligations of existing shareholders. However, according to the Research Team, the effectiveness and efficiency of this regulation depends largely on future implementation, especially compliance with information disclosure, ensuring substance, openness, transparency and timeliness.

Sharing the same opinion, according to Mr. Nguyen Quoc Hung, Vice Chairman of the Vietnam Banking Association, these regulations will have a positive impact on preventing cross-ownership and bank manipulation. For example, in the incident that happened at SCB bank, one individual actually held over 90% of the bank's shares through hundreds of people in their names, but the management agency did not know who that representative was until the investigation agency gets involved. However, Mr. Nguyen Quoc Hung emphasized that to effectively handle the situation of bank manipulation, it is necessary to enhance the supervisory role of the Board of Directors and Supervisory Board at credit institutions.

Previously, in a report sent to the National Assembly in October 2023, the State Bank (SBV) said that over the past years, the SBV has continued to improve the legal basis and drastically implement solutions to prevent, handle share ownership exceeding the prescribed limit, cross-ownership, lending, and investing in contravention of regulations along with the process of restructuring credit institutions. Thanks to that, ownership of shares exceeding the limit, cross-ownership between credit institutions, credit institutions and enterprises has been limited and gradually controlled, the number of pairs of credit institutions that directly cross-own each other has been overcome; Shareholders, stockholders and related people who own shares exceeding the prescribed limit (mainly in corporations and state-owned enterprises) need to continue to direct and handle measures to focus capital on main business activities and use capital more effectively.

The State Bank also said that some credit institutions have a concentration of share ownership in a number of shareholders and related persons. Although not violating legal regulations, attention should be paid to prevent potential risks which can occur. Therefore, the State Bank has supplemented regulations in the Law on Credit Institutions (amended) to effectively handle the abuse of major shareholder rights, management and executive rights to manipulate the operations of credit institutions.

Along with the regulations related to ownership ratio, also according to the provisions of the Law on Credit Institutions (amended), for credit limit, total loan balance for one customer and related person is regulated to be gradually reducing according to the roadmap from 2024 to 2029. Accordingly, from 2029 onwards, the total outstanding loan balance for a customer will not exceed 10% of the bank's equity capital, loans to one customer and related person must not exceed 15% of equity capital.

In addition, the total outstanding credit balance for a customer must not exceed 15% of the non-bank credit institution's equity capital; The total outstanding credit balance for a customer and related persons of that customer must not exceed 25% of the non-bank credit institution's equity capital.

Experts from SSI Securities Company assess that after the incident at SCB and Van Thinh Phat, strict monitoring of lending to related parties and satellite companies is necessary to ensure capital flow to be served for the right purpose. However, SSI believes that closely monitoring lending to related parties and satellite companies is necessary to ensure capital flows to be served for the right purpose. Therefore, effective enforcement of regulations requires strict and regular supervision from regulatory agencies.

In addition, experts also believe that credit institutions will have to diversify their credit portfolios and minimize concentration risks. However, in the short term, banks lending to related customer groups will face pressure to restructure their loans, etc.

Related News

Aiming for 16% credit growth and removing credit room allocation

09:17 | 14/02/2025 Import-Export

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Banks increase non-interest revenue

10:51 | 23/11/2024 Finance

A “picture” of bank profits in the first nine months of 2024

09:42 | 19/11/2024 Finance

Latest News

Consulting on customs control for e-commerce imports and exports

14:50 | 14/02/2025 Regulations

Flexible tax policy to propel Việt Nam’s economic growth in 2025

14:14 | 06/02/2025 Regulations

Brandnew e-commerce law to address policy gaps

18:44 | 29/01/2025 Regulations

From January 1, 2025: 13 product codes increase export tax to 20%

14:23 | 29/12/2024 Regulations

More News

Export tax rates of 13 commodity codes to increase to 20% from January 1, 2025

13:46 | 28/12/2024 Regulations

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations

Customs tightens oversight on e-commerce imports

13:39 | 04/12/2024 Regulations

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Consulting on customs control for e-commerce imports and exports

14:50 | 14/02/2025 Regulations

Flexible tax policy to propel Việt Nam’s economic growth in 2025

14:14 | 06/02/2025 Regulations

Brandnew e-commerce law to address policy gaps

18:44 | 29/01/2025 Regulations

From January 1, 2025: 13 product codes increase export tax to 20%

14:23 | 29/12/2024 Regulations

Export tax rates of 13 commodity codes to increase to 20% from January 1, 2025

13:46 | 28/12/2024 Regulations