New regulations on promulgating the list of narcotics and pre-substances

|

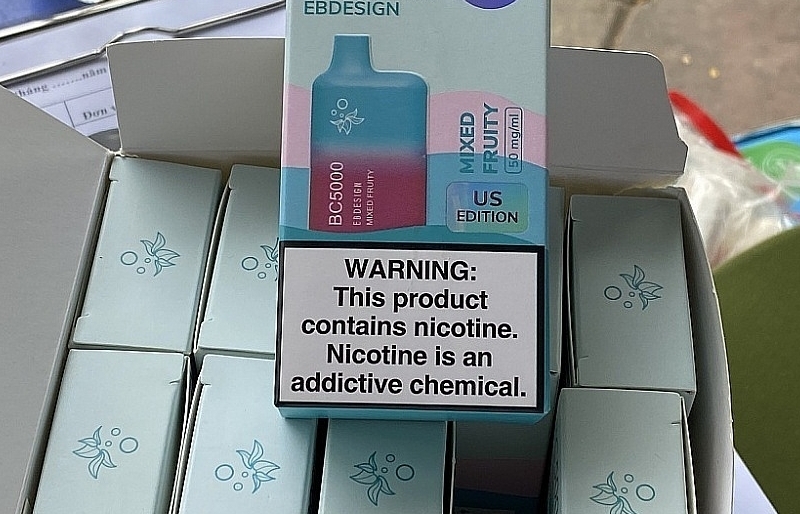

| Smuggled narcotics was imported to Vietnam. Photo: Quang Hùng |

According to the Decree, the List I: Narcotics are strictly prohibited for use in medicine and social life; the use of these substances in the analysis, testing, scientific research, criminal investigation must comply to special provisions of the competent authority.

List II: Narcotics are restricted to analysis, testing, scientific research, criminal investigation or in the health sector in accordance with the regulations of the competent agencies.

List III: Narcotic substances are used in analysis, testing, scientific research, criminal investigation or in the field of health and veterinary must comply to the regulations as stipulated by the competent authority.

Category IV: Pre-substances.

The decree clearly states that pre-substances used for national defense and security purposes are managed and licensed by the Ministry of Public Security and granting permits for export or import. The pre-substances used in the veterinary field managed by the Ministry of Agriculture and Rural Development and licensed for export or import.

This decree takes effect on 15/5/2018 replacing the Government Decree No. 82/2013 / ND-CP of the Government dated 19/7/2013 promulgating lists of narcotics and pre-substances and Decree No. 126 Decree No. 82/2013 / ND-CP dated 9/12/2015 of the Government amending and supplementing the list of narcotics and pre-substances, issued together with Decree No. 82/2013 / ND-CP of the Government dated 19/7/2013.

Organizations and individuals dealing in two precursors of N-Phenethyl-4-piperidinone (NPP) and 4-ANPP shall implement the regulations on management of pre-substances under this Decree and relevant documents as from 1/7/2018.

Related News

Launching Demeter X Operation about hazardous scrap and waste prevention

14:41 | 06/05/2024 Anti-Smuggling

Three groups of export commodities achieved billions of USD

10:36 | 05/05/2024 Import-Export

Seaports increase services to attract goods

19:35 | 01/05/2024 Import-Export

Notice for businesses exporting watermelons to China

09:40 | 25/04/2024 Customs

Latest News

Small, low-value items imported on e-commerce platforms should be taxed

14:43 | 09/05/2024 Regulations

Customs finds difficulties because there is no e-cigarette management policy

09:56 | 09/05/2024 Regulations

Are goods imported on-spot for export production eligible for tax refund?

09:32 | 08/05/2024 Regulations

Risk prevention solutions for export processing and production enterprises

09:12 | 07/05/2024 Regulations

More News

Conditions for price reduction of imported goods

15:38 | 06/05/2024 Regulations

Circular 83/2014/TT-BTC will be abolished from June 8

14:29 | 06/05/2024 Regulations

Proposal to continue reducing VAT by 2% in the last 6 months of 2024

10:35 | 05/05/2024 Regulations

Seafood exporters are worried about some inadequacies from the two new decrees

06:47 | 30/04/2024 Regulations

Risk prevention solutions for processing and export manufacturing businesses

07:52 | 29/04/2024 Regulations

Reporting to the National Assembly for considering VAT reduction in the second half of 2024

17:09 | 14/04/2024 Regulations

The Prime Minister requested that before April 25, complete the revision of regulations on import and export of medicinal materials

10:33 | 13/04/2024 Regulations

No need to reduce the output of manufacturing and assembling automobile to enjoy preferential tariff

09:09 | 11/04/2024 Regulations

Hundreds of tons of cinnamon essential oil are left in inventory due to export regulations

09:31 | 10/04/2024 Regulations

Your care

Small, low-value items imported on e-commerce platforms should be taxed

14:43 | 09/05/2024 Regulations

Customs finds difficulties because there is no e-cigarette management policy

09:56 | 09/05/2024 Regulations

Are goods imported on-spot for export production eligible for tax refund?

09:32 | 08/05/2024 Regulations

Risk prevention solutions for export processing and production enterprises

09:12 | 07/05/2024 Regulations

Conditions for price reduction of imported goods

15:38 | 06/05/2024 Regulations