The Prime Minister requested that before April 25, complete the revision of regulations on import and export of medicinal materials

|

| Difficulties in implementing some regulations of the Ministry of Health lead to difficulties in exporting cinnamon essential oil. Photo: Illustration |

Prime Minister Pham Minh Chinh signed Official Telegram 35/CD-TTg dated April 10, 2024 to the Minister of Health and Minister of Finance on removing difficulties for export activities of medicinal materials.

Recently, the press has reported that the export of some medicinal herbs has encountered difficulties, affecting the production and business activities of many enterprises.

In addition to the difficult market and falling prices, there are also problems in implementing some regulations of the Ministry of Health in Circular No. 48/2018/TT-BYT dated December 28, 2018 and Circular No. 03/2021/TT-BYT dated March 4, 2021.

In order to promptly remove difficulties and obstacles in the field of pharmaceutical export and create momentum to promote production and business activities for businesses in this field, the Prime Minister requested the Ministry of Health according to its functions, assigned tasks and authorities, preside over and coordinate with the Ministry of Finance and relevant agencies to urgently review, research, amend and complete the Ministry's regulations on import and export of medicinal materials, ensuring solutions quickly solve problems to facilitate production and business activities of enterprises according to regulations; The amendment of regulations for this activity will be completed before April 25, 2024.

Previously, many businesses reported that they were facing difficulties due to regulations on pharmaceutical business of the Ministry of Health. In particular, businesses exporting cinnamon essential oil reflect that due to policy problems, hundreds of tons of essential oil are being stored in raw material areas.

This issue has been reflected by the Customs Magazine. Mr. Vu Van Thang, Director of Trieu Duong Company Limited - an enterprise specializing in producing and exporting cinnamon essential oil in Lao Cai province, said that it is now the time to start the cinnamon harvest, but the company does not dare to produce a lot, signing export orders is also very cautious. The cause of this situation comes from the fear of not being able to export cinnamon essential oil due to regulations.

Mr. Thang said that in 2018, the Ministry of Health issued Circular No. 48/2018/TT-BYT promulgating the List of medicinal materials; extracts from medicinal herbs and essential oils for medicinal purposes; Traditional drugs and imported and exported herbal drugs are determined with product codes according to Vietnam's List of Exported and Imported Goods. Accordingly, many products such as garlic, ginger, onions, lemongrass; Cinnamon, orange, lemon, lemongrass essential oils, etc must go through import and export procedures similar to medicinal herbs. Specifically, when carrying out export procedures, the Customs authority will require businesses to present a license to meet pharmaceutical business conditions.

This means that businesses must meet a series of criteria regarding factories, vehicles, processing equipment, sanitary conditions, staff qualifications, etc according to the provisions of Circular 35/2018/TT-BYT of the Ministry of Health regulating Good Manufacturing Practices for drugs and medicinal ingredients. While cinnamon essential oil products are mainly used in the fields of food, beverages, home cleaning, etc., such management is unnecessary and causes great difficulties for businesses.

After many requests, the Ministry of Health has removed the problems for businesses by allowing businesses to declare according to their intended use. However, by November 2023, the Ministry of Health requires export items declared under HS code 3301.29.10 (HS code for essential oils of cinnamon, lemongrass, ginger, etc) to comply with legal regulations about medicine. Thus, the cinnamon essential oil product has returned to the same problem as the previous period.

According to the Vietnam Pepper and Spice Association (VPSA), businesses exporting cinnamon essential oil in Lao Cai and Yen Bai are currently facing difficulties in exporting due to having to meet regulations on trading in medicinal herbs. Accordingly, this regulation is not suitable for production conditions, products and consumer markets as well as the small-scale processing capacity of Vietnam's cinnamon essential oil processing industry today. Therefore, it incurs a lot of costs, requiring additional conditional business licenses while this is a value-added product, helping to exploit and maximize 100% of the value of the cinnamon tree.

Related News

An Giang Customs issues many notes to help businesses improve compliance

09:29 | 20/12/2024 Customs

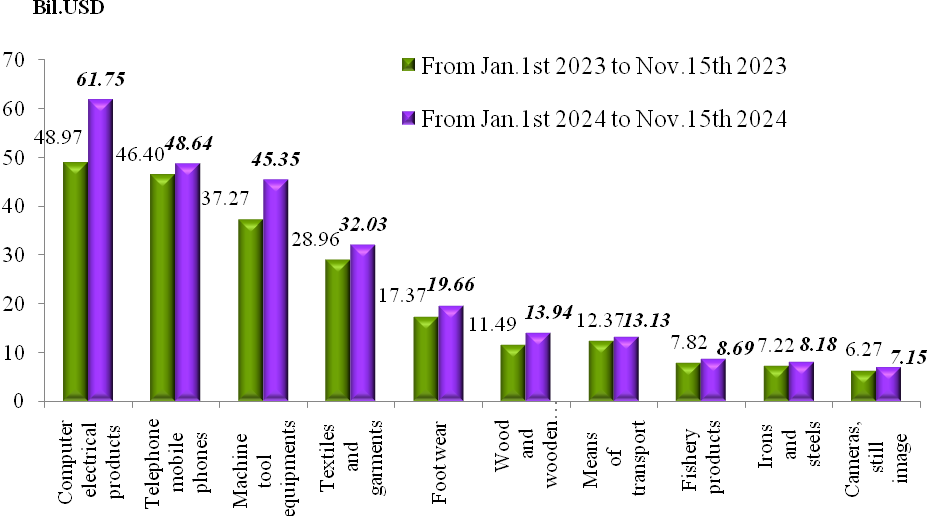

Total import-export turnover reaches US$715.55 billion in 11 months

10:23 | 13/12/2024 Import-Export

Preliminary assessment of Vietnam international merchandise trade performance in the first half of November, 2024

09:40 | 12/12/2024 Customs Statistics

Latest News

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

More News

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations

Customs tightens oversight on e-commerce imports

13:39 | 04/12/2024 Regulations

Bringing practical experience into customs management policy

13:48 | 03/12/2024 Regulations

Businesses anticipate new policies on customs procedures and supervision

15:41 | 29/11/2024 Regulations

Do exported foods need iodine supplementation?

11:06 | 29/11/2024 Regulations

Amendments to the Value-Added Tax Law passed: Fertilizers to be taxed at 5%

13:43 | 28/11/2024 Regulations

Proposal to change the application time of new regulations on construction materials import

08:52 | 26/11/2024 Regulations

Ministry of Finance proposed to reduce VAT by 2% in the first 6 months of 2025

09:00 | 24/11/2024 Regulations

Hanoi Customs resolves tax policy queries for enterprises

09:26 | 22/11/2024 Regulations

Your care

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations