New regulation on import-export border gate for temporary import and re-export goods

|

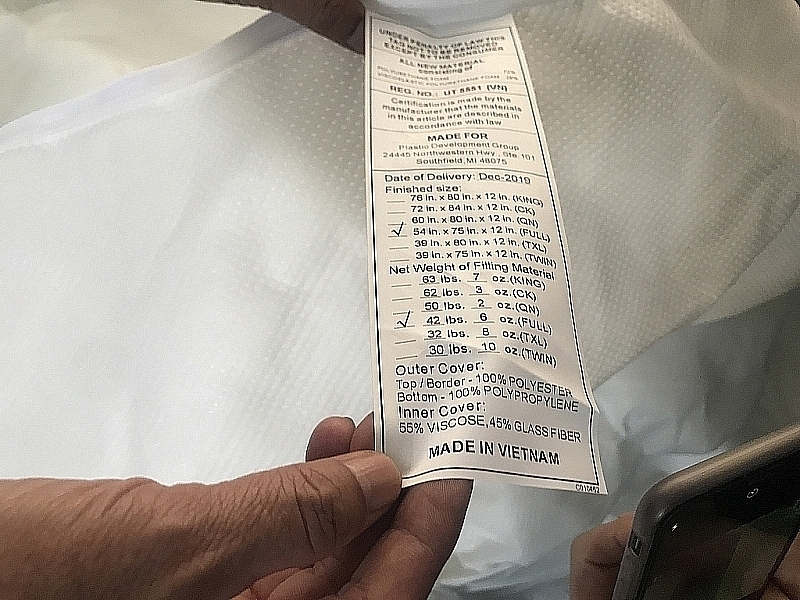

| Hai Phong Customs officials inspected temporary import and re-export goods. Photo: T.Bình |

Accordingly, from January 1st, 2020, regarding goods temporarily imported and re-exported, or transshipment, if it is imported or re-exported from Vietnam through land border gate, the import or re-export will only be carried out through international border gates, main border gates (bilateral border gates) that are opened in accordance with regulations in Decree No.112/2014/NĐ-CP dated November 21, 2014 of the Government stipulating land border gates management.

This provision is also applied to foreign goods that are temporarily imported and re-exported and deposited in bonded warehouses if goods are imported or re-exported from Vietnam through land borders.

This Circular applies to traders engaged in business activities of temporary import and re-export, transshipment and depositing into bonded warehouse. Organizations and authorities managing business activities of temporary import and re-export, transshipment, depositing in bonded warehouses and agencies, organizations and individuals related to these business activities.

Related News

Can Gio transshipment port will be an international trade gateway

14:34 | 03/08/2023 Import-Export

Detecting abuse of independent transport to smuggle

20:21 | 17/02/2022 Anti-Smuggling

Need to specify counterfeit origin of goods

20:35 | 23/07/2021 Regulations

Strengthen the management of goods deposited in bonded warehouses, temporarily imported and re-exported

11:43 | 14/07/2021 Anti-Smuggling

Latest News

Seafood exporters are worried about some inadequacies from the two new decrees

06:47 | 30/04/2024 Regulations

Risk prevention solutions for processing and export manufacturing businesses

07:52 | 29/04/2024 Regulations

Reporting to the National Assembly for considering VAT reduction in the second half of 2024

17:09 | 14/04/2024 Regulations

The Prime Minister requested that before April 25, complete the revision of regulations on import and export of medicinal materials

10:33 | 13/04/2024 Regulations

More News

No need to reduce the output of manufacturing and assembling automobile to enjoy preferential tariff

09:09 | 11/04/2024 Regulations

Hundreds of tons of cinnamon essential oil are left in inventory due to export regulations

09:31 | 10/04/2024 Regulations

Business suspension of temporary import and re-export of Monazite ores and ore concentrates will be valid on May 13th

20:09 | 07/04/2024 Regulations

Improving the customs legal system to be modern, synchronous, unified and transparent

10:33 | 07/04/2024 Regulations

New points about rules of origin in AKFTA

08:05 | 03/04/2024 Regulations

It is necessary to build a national database on cross-border trade and transport

15:23 | 29/03/2024 Regulations

Removing difficulties in tax exemption and refund policies for export processing enterprises

14:48 | 27/03/2024 Regulations

Reviewing the list of scrap that is temporarily suspended from temporary import and re-export business

15:41 | 24/03/2024 Regulations

New law expected to boost financial leasing

14:05 | 22/03/2024 Regulations

Your care

Seafood exporters are worried about some inadequacies from the two new decrees

06:47 | 30/04/2024 Regulations

Risk prevention solutions for processing and export manufacturing businesses

07:52 | 29/04/2024 Regulations

Reporting to the National Assembly for considering VAT reduction in the second half of 2024

17:09 | 14/04/2024 Regulations

The Prime Minister requested that before April 25, complete the revision of regulations on import and export of medicinal materials

10:33 | 13/04/2024 Regulations

No need to reduce the output of manufacturing and assembling automobile to enjoy preferential tariff

09:09 | 11/04/2024 Regulations