Reviewing the list of scrap that is temporarily suspended from temporary import and re-export business

|

| Officials at Cai Mep Port Border Gate Customs Branch inspect imported scrap goods. Photo: N.H |

In 2019, in order to strengthen management measures for scrap temporary import and re-export, and transhipment business activities according to the direction of the Prime Minister in Directive No. 27/CT-TTg to prevent risks of congestion at ports and arising trade fraud and smuggling into the domestic market when countries in the region continued to tighten the import of scrap, the Ministry of Industry and Trade issued Circular No. 27/2019 /TT-BCT dated November 15, 2019 stipulated the list of scrap temporarily suspended from temporary import and re-export, and transhipment business.

Circular 27/2019/TT-BCT is effective until December 31, 2024, issued with the List of scrap temporarily suspended from temporary import and re-export, and transhipment business with 32 scrap product codes.

Accordingly, some items on the list of scrap are temporarily suspended from temporary import and re-export, and transhipment business such as:

Gypsum; Anhydrite; Plasters (consisting of calcined gypsum or calcium sulphate) whether or not coloured, with or without small quantities of accelerates or retarders (code 2520);

Granulated slag (slag sand) from the manufacture of iron or steel. (code 2618);

Slag, dross (other than granulated slag), scalings and other waste from the manufacture of iron or steel. (code 2619);

Chemical elements doped for use in electronics, in the form of discs, wafers or similar forms; chemical compounds doped for use in electronics. (Code 3818);

Recovered (waste and scrap) paper or paperboard (Item code 4707);

Silk waste (including cocoons and unsuitable for reeling, yarn waste and garneted stock) (Item code 5003);

Cullet and other waste and scrap of glass; glass in the mass

Broken glass and other scrap and scrap of glass; glass in block form (Item code 7001);…

The validity of Circular 27/2019/TT-BCT lasts until the end of this year, after more than 3 years of implementation, to have a basis to evaluate and consider continuing to propose state management measures for scrap business activities of temporary import and re-export and shipment in accordance with the actual situation. Currently, the Ministry of Industry and Trade is consulting with relevant ministries, People's Committees of provinces and cities and the Vietnam Federation of Commerce and Industry evaluate the results of implementing Circular 27/2019/TT-BCT.

Regarding this issue, the Ministry of Finance has sent a document to the Ministry of Industry and Trade assessing the necessity of continuing to maintain the policy of temporarily suspending the temporary import, re-export and shipment business of scrap.

The Ministry of Finance believes that scrap is a sensitive item with many potential risks of environmental pollution, directly affecting human health and the ecosystem. Therefore, to avoid the risk of becoming a scrap gathering country in the world, it is still necessary to continue to maintain the policy of temporarily suspending temporary import, re-export and transhipment business for scrap.

However, to develop appropriate and effective management policies for temporary import, re-export and transhipment business of scrap, the Ministry of Finance requests the Ministry of Industry and Trade to review bilateral international commitments, multilateral (if any), and research scrap management policies of developed countries to complete the appropriate list of temporary suspension of temporary import and re-export business of scrap, and scrap transhipment business in the next time.

Besides, the Ministry of Finance said that no problems arise related to the implementation of Circular 27/2019/TT-BTC; At the same time, there are no data on temporary import and re-export of scrap goods in the list in the Circular.

Related News

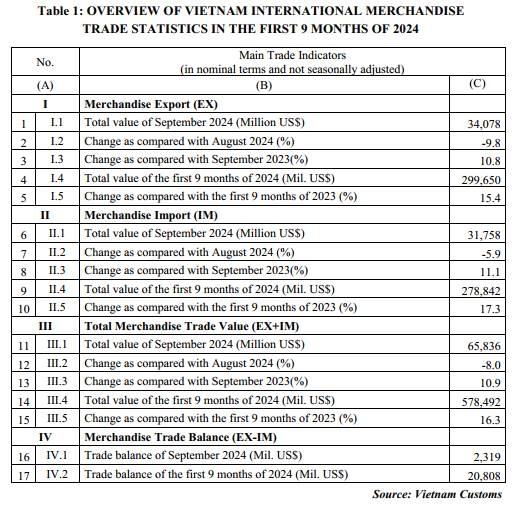

Preliminary assessment of Vietnam international merchandise trade performance in the first 9 months of 2024

09:22 | 20/11/2024 Customs Statistics

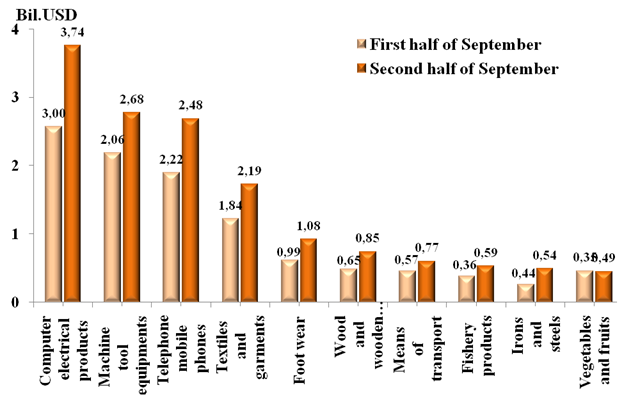

Preliminary assessment of Vietnam international merchandise trade performance in the second half of September, 2024

09:21 | 20/11/2024 Customs Statistics

Latest News

Hanoi Customs resolves tax policy queries for enterprises

09:26 | 22/11/2024 Regulations

Regularly check tax obligations to avoid temporary exit suspension

09:47 | 21/11/2024 Regulations

Implementing the SAFE framework in Vietnam: Assessment through the lens of international standards

09:14 | 20/11/2024 Regulations

Proposing the Tax Authority be flexible in applying tax debt enforcement measures simultaneously

09:40 | 19/11/2024 Regulations

More News

Many shortcomings in process and manual book on handling administrative violations

15:53 | 18/11/2024 Regulations

Implementing the SAFE Framework in Vietnam: Lessons from practice

10:03 | 18/11/2024 Regulations

Implementing the SAFE Framework in Vietnam: Solutions and Recommendations

09:18 | 17/11/2024 Regulations

Abolishing regulations on tax exemption for small-value imported goods must comply with international practices

13:54 | 15/11/2024 Regulations

Policy adaptation and acceleration of digital transformation in tax and customs management

10:03 | 14/11/2024 Regulations

Implement regulations on special preferential import tariffs under VIFTA

08:32 | 13/11/2024 Regulations

Perfecting tax policy for goods traded via e-commerce

09:24 | 10/11/2024 Regulations

Are belongings of foreigners on business trip to Vietnam exempt from tax?

14:23 | 09/11/2024 Regulations

Amending regulations on enforcement measures in tax administration

10:05 | 08/11/2024 Regulations

Your care

Hanoi Customs resolves tax policy queries for enterprises

09:26 | 22/11/2024 Regulations

Regularly check tax obligations to avoid temporary exit suspension

09:47 | 21/11/2024 Regulations

Implementing the SAFE framework in Vietnam: Assessment through the lens of international standards

09:14 | 20/11/2024 Regulations

Proposing the Tax Authority be flexible in applying tax debt enforcement measures simultaneously

09:40 | 19/11/2024 Regulations

Many shortcomings in process and manual book on handling administrative violations

15:53 | 18/11/2024 Regulations