Need to specify counterfeit origin of goods

|

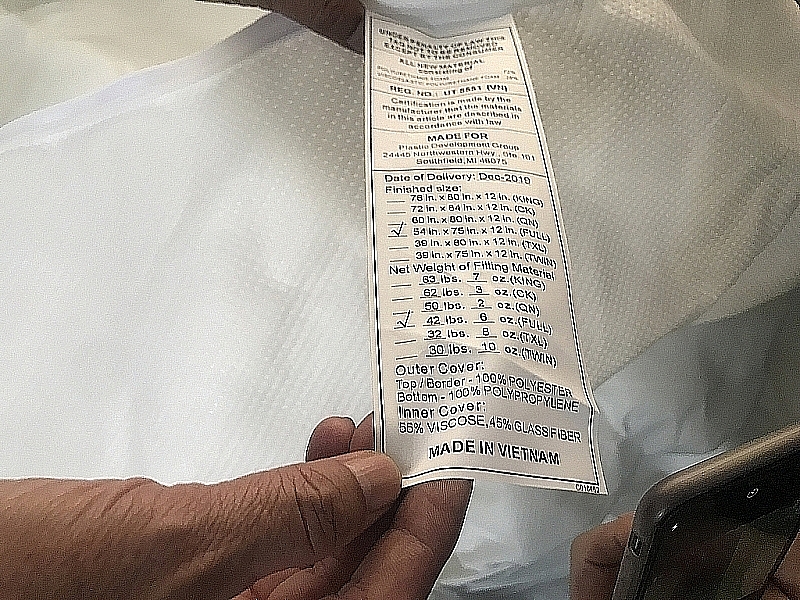

| Imported goods counterfeiting Vietnamese origin are detected by HCM City Customs Department. Photo: T.H |

Commenting on the draft of the guidance document of the General Department of Vietnam Customs (GDVC) on sanctioning violations of counterfeiting origin, HCM City Customs Department proposed the GDVC amend a number of contents.

According to the HCM City Customs Department to specify the act of counterfeiting origin, it is necessary to add the act of importing goods counterfeiting Vietnamese origin determined in the case of importing goods with labeling of the following phrases: “Made in Vietnam”, “produced in Vietnam”; “product of Vietnam”; “Vietnamese products” or another language corresponding to the content shown in Vietnamese printed in the products, but inspection results of the Customs authority identify the goods are not manufactured in Vietnam or made in Vietnam. And that goods do not satify the criteria of Vietnamese origin (according to international treaties that Vietnam has signed or participated in, as well as legal documents regulating the origin of goods).

In addition, importing goods counterfeiting Vietnamese origin is also determined in the case of importing goods where the information on the product or product packaging, on the warranty card, is Vietnamese including trademark, address of enterprise's head office, address of enterprise's factory, address of enterprise's place of production, enterprise's website, or warranty centre in Vietnam for domestic consumption or export.

According to HCM City Customs Department, there are cases where enterprises have performed counterfeit origin when importing goods by only stating information about the name of the enterprise in Vietnam, the address of the enterprise in Vietnam or the website or information of the enterprise's factory in Vietnam on the product and, or on the product packaging, on the warranty card of the goods. However it does not show "Made in Vietnam” or “Originating from Vietnam” on the product.

Unclear labelling on product packaging as mentioned above causes confusion for consumers. They could understand goods are manufactured products and originated from Vietnam, affecting the image and reputation of Vietnamese products.

This is taking advantage of trade agreements with preferential tariffs that Vietnam has signed with other countries to avoid trade remedies. This increases the risk importing countries will strengthen the application of trade remedies on Vietnamese goods, harming import and export turnover.

HCM City Customs Department proposed the GDVC to add this content to the draft document to unify in identifying acts of counterfeiting Vietnamese origin, helping to handle violations.

To tackle origin fraud and illegal transshipment of goods, HCM City Customs Department has focused on many solutions, initially discovered many cases of enterprises importing foreign goods counterfeiting Vietnamese origin. The unit has criminally prosecuted many cases of violation, transferred to HCM City Police to investigate, and is expanding and verifying the remaining cases.

Through cases of importing goods counterfeiting Vietnamese origin discovered by the HCM City Customs Department in recent years, origin fraud tricks are increasingly sophisticated. To counterfeit origin, the subject imports foreign goods and transship through Vietnam to legalise the dossiers or apply for a certificate of origin and then export goods to a third country if they are not detected and stopped at the border gate.

Related News

Rise in e-commerce violations sparks concern

09:31 | 20/12/2024 Anti-Smuggling

Customs sector strengthens anti-smuggling for e-commerce products

19:09 | 21/12/2024 Anti-Smuggling

Lang Son intensifies crackdown on smuggling and trade fraud

15:19 | 19/12/2024 Anti-Smuggling

Binh Duong Customs surpasses budget revenue target by over VND16.8 Trillion

09:39 | 18/12/2024 Customs

Latest News

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

More News

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations

Customs tightens oversight on e-commerce imports

13:39 | 04/12/2024 Regulations

Bringing practical experience into customs management policy

13:48 | 03/12/2024 Regulations

Businesses anticipate new policies on customs procedures and supervision

15:41 | 29/11/2024 Regulations

Do exported foods need iodine supplementation?

11:06 | 29/11/2024 Regulations

Amendments to the Value-Added Tax Law passed: Fertilizers to be taxed at 5%

13:43 | 28/11/2024 Regulations

Proposal to change the application time of new regulations on construction materials import

08:52 | 26/11/2024 Regulations

Your care

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations