MoF responds to VAT policy on stone products

| Vietnam’s taxman says VAT collection related to L/Cs lawful | |

| Avoiding taking advantage and fraud of value added tax | |

| Hanoi: Successfully destroy the line of illegal trading VAT invoice |

The MoF stated for the period before January 1, 2014, Clause 6, Article 1 of Decree 121/2011/ND-CP dated December 27, 2011 of the Government amending and supplementing the Government's Decree 123/2008/ND-CP dated December 8, 2008 details and guides the implementation of the VAT Law. Specifically, unprocessed natural resources and minerals specified in Clause 23, Article 5 of the Law on Value-Added Tax are natural resources and minerals not yet processed into other products.

The Ministry of Finance will assume the prime responsibility for and coordinate with agencies in guiding the determination of exploited natural resources and minerals not yet processed into other products mentioned in this clause.

Clause 23, Article 4 of Circular 06/2012/TT-BTC dated 11/01/2012 of the Ministry of Finance guiding implementation of Decree 123/2008/ND-CP dated December 8, 2008 and Decree 121/2011/ ND-CP amending and supplementing articles of Decree 123/2008/ND specifies objects not subject to VAT. Accordingly: “Exported products being unprocessed exploited natural resources, minerals. Unprocessed exploited natural resources, minerals are natural resources, minerals having not been processed into other products, including minerals being filtered, selected, grinded, crushed, processed for content increase, or natural resources being cut and split.”

Also, Clause 3, Article 9 of Circular 06/2012/TT-BTC guides: "Export products are exploited natural resources and minerals that have not been processed into other products" and are not entitled to the tax rate of 0% upon export.”

|

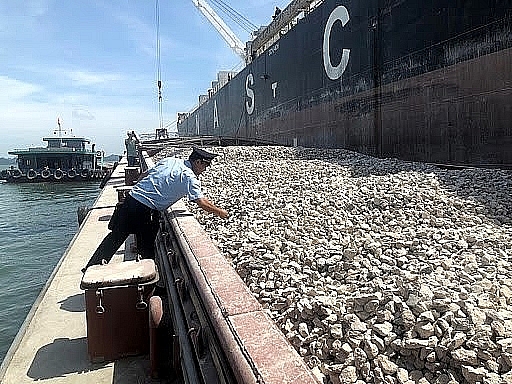

| Customs officers inspect exported limestone product |

Based on the above regulations and the opinions of the Ministries of Science and Technology, Industry and Trade, and Construction, the Ministry of Finance has issued Official Letter No. 15906/BTC-CST dated November 18, 2013 to reply in detail for firms.

For the period from January 1, 2014 to before July 1, 2016, Clause 11 Article 3 of Decree 209/2013/ND-CP dated December 18, 2013 of the Government on non-VAT subjects provides that: “Export products being exploited natural resources and minerals not yet processed into other products. The Ministry of Finance shall assume the prime responsibility for, and coordinate with relevant agencies in providing specific guidance on determining the exploited natural resources and minerals not yet processed into other products stated in this clause.”

Clause 23, Article 4 of Circular 219/2013/TT-BTC dated December 31, 2013 of the Ministry of Finance guiding non-VAT subjects says: “Exported natural resources that are not processed into other products. The natural resources that are not processed into other products include the minerals that have been filtered, grinded, refined, or the resources that have been cut and split.”

Also, Clause 3, Article 9 of Circular 219/2013/TT-BTC dated December 31, 2013 of the Ministry of Finance stipulates: “Exported products as exploited natural resources and minerals that have not been processed into other products” and do not enjoy tax rate of 0% upon export.

Therefore, from January 1, 2014 to before July 1, 2016, the VAT policy on exported resources and minerals under provisions of Decree 209/2013/ND-CP and Circular 219/2013/TT-BTC is no different from Decree 121/2011/ND-CP and Circular 06/2012/TT-BTC.

For the period from July 1, 2016, Clause 1, Article 1 of Law No. 106/2016/QH13 amending and supplementing the VAT Law, the Law on Special Consumption Tax and the Law on Tax Administration defines: “Exports that are raw natural resources or minerals which have not been processed into other products; exports that are goods processed from natural resources or minerals where the total value of natural resources or minerals plus energy costs makes up at least 51% of the product price,” and are not subject to VAT.

According to the Ministry of Finance, Clause 4, Article 1 of Decree 100/2016/ND-CP dated July 1, 2016 amending and supplementing Decree 209/2013/ND-CP; Clause 1, Article 1 of Decree 146/2017/ND-CP dated December 15, 2017, effective from February 1, 2018, amending and supplementing Clause 11 Article 3 of Decree 209/2013/ND-CP which is amended and supplemented at Decree 100/2016/ND-CP; and Point c, Clause 1, Article 1 of Circular 130/2016/TT-BTC dated August 12, 2016; Article 1 of Circular 25/2018/TT-BTC dated March 16, 2018 of the Ministry of Finance also provide specific guidance on non-VAT subjects.

Therefore, the Ministry of Finance proposes enterprises base on the above regulations and guidelines, export products and their actual production process of export products to perform exports.

Related News

MoF Steering Committee 389 launches a peak campaign against smuggling during Lunar New Year 2025

13:44 | 06/12/2024 Anti-Smuggling

Stimulate production and business, submit to the National Assembly to continue reducing 2% VAT

15:47 | 02/12/2024 Finance

Abolishing regulations on tax exemption for small-value imported goods must comply with international practices

13:54 | 15/11/2024 Regulations

Ensure harmony of interests of “3 parties” when applying 5% VAT on fertilizers

08:54 | 30/10/2024 Regulations

Latest News

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

More News

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations

Customs tightens oversight on e-commerce imports

13:39 | 04/12/2024 Regulations

Bringing practical experience into customs management policy

13:48 | 03/12/2024 Regulations

Businesses anticipate new policies on customs procedures and supervision

15:41 | 29/11/2024 Regulations

Do exported foods need iodine supplementation?

11:06 | 29/11/2024 Regulations

Amendments to the Value-Added Tax Law passed: Fertilizers to be taxed at 5%

13:43 | 28/11/2024 Regulations

Proposal to change the application time of new regulations on construction materials import

08:52 | 26/11/2024 Regulations

Ministry of Finance proposed to reduce VAT by 2% in the first 6 months of 2025

09:00 | 24/11/2024 Regulations

Your care

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations