Abolishing regulations on tax exemption for small-value imported goods must comply with international practices

|

| International trade activities have changed a lot, many countries have abolished regulations on VAT exemption for small-value imported shipments. Photo: H.Anh |

According to the Ministry of Finance, to simplify customs procedures and implement international commitments, in 2010, the Ministry of Finance submitted to the Prime Minister a draft Decision on the tax-exempt quota for imported goods sent via express delivery services (Decision No. 78/2010/QD-TTg).

Accordingly, "a tax-exempt quota of VND 1 million (equivalent to about USD 50) was applied to suit reality".

However, recently, international trade activities have changed a lot. Many countries and regions have abolished the VAT exemption regulations for small-value imported goods.

Specifically, EU countries have abolished the VAT exemption regulations for shipments of 22 euros or less.

Along with that, the United Kingdom (England, Scotland and Wales) also abolished the VAT exemption regulations for imported goods with a total value of 135 pounds or less from January 1, 2021.

In Singapore, from January 1, 2023, the VAT exemption for low-value goods, especially in the e-commerce sector, has been also abolished.

|

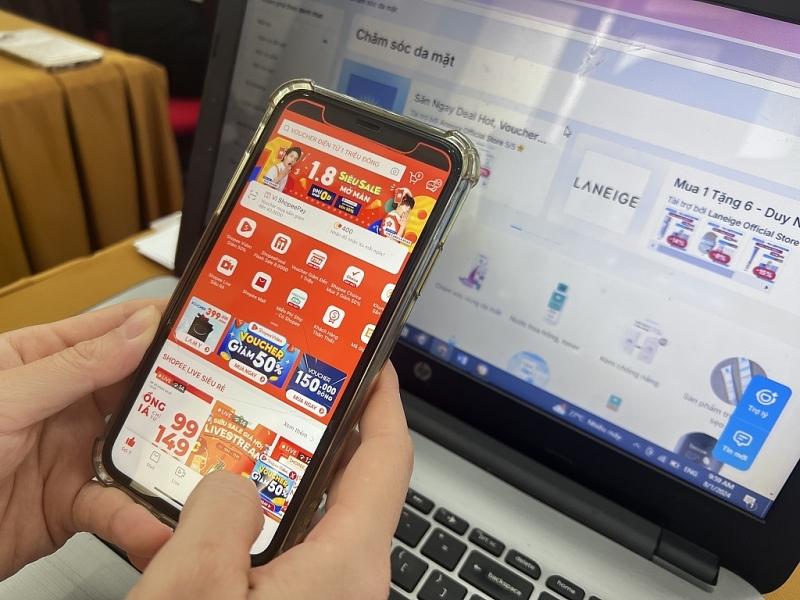

| With the e-commerce development, the volume of imported small-value goods is increasing. Photo: H.Anh |

To ensure fair trade practices, from May 1, 2024, Thailand has also collected VAT on all imported goods, regardless of value.

In addition, at seminars, experts from the Trade Facilitation Project (TFP) also recommended that Vietnam consider abolishing the regulations of VAT exemption on low-value imported goods.

In this trend, the Ministry of Finance has submitted to the Government a draft Decree on customs management of exported and imported goods traded via e-commerce, in which it proposes to abolish the VAT exemption for imported goods sent via express delivery services with a value of less than VND1 million.

This content has been consulted with organizations and individuals according to regulations, has been appraised by the Ministry of Justice and reported to the Government and the Prime Minister.

However, according to the Ministry of Finance, the issuance and implementation of the Decree on customs management of exported and imported goods traded via e-commerce needs to be carried out synchronously with the completion of the IT infrastructure system, so it needs more time for preparation.

To comply with the new requirements and basing on the recommendations of a number of agencies in the process of developing the draft Law on VAT (amended), the Ministry of Finance is coordinating with relevant units to urgently make an application to submit to the competent authority to issue legal documents to abolish Decision No. 78/2010/QD-TTg in accordance with the order and procedures.

Regarding this issue, in the discussion session on October 29, 2024 on the draft Law on Value Added Tax (amended), many National Assembly deputies agreed with non-tax exemption for small –value goods imported through e-commerce platforms.

According to the deputy Hoang Minh Hieu (Nghe An delegation), with the development of e-commerce, imported small-value goods is increasing, so for each order, the value may be small but the total volume of goods imported in this form accounts for a fairly large volume.

Therefore, if tax exemption is applied, it will lead to missing a fairly large amount of tax, not to mention the situation of "splitting" orders to avoid tax.

At the discussion session, explaining this issue, the Deputy Prime Minister and Minister of Finance said that the Government will abolish Decision 78/2010/QD-TTg and include in the draft Law on Value Added Tax (amended) the regulation that all goods with small value must pay tax.

Related News

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

Stimulate production and business, submit to the National Assembly to continue reducing 2% VAT

15:47 | 02/12/2024 Finance

Are belongings of foreigners on business trip to Vietnam exempt from tax?

14:23 | 09/11/2024 Regulations

Perfecting the law on import and export tax towards exemption and reduction for the right subjects

15:00 | 05/11/2024 Customs

Latest News

Consulting on customs control for e-commerce imports and exports

14:50 | 14/02/2025 Regulations

Flexible tax policy to propel Việt Nam’s economic growth in 2025

14:14 | 06/02/2025 Regulations

Brandnew e-commerce law to address policy gaps

18:44 | 29/01/2025 Regulations

From January 1, 2025: 13 product codes increase export tax to 20%

14:23 | 29/12/2024 Regulations

More News

Export tax rates of 13 commodity codes to increase to 20% from January 1, 2025

13:46 | 28/12/2024 Regulations

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations

Customs tightens oversight on e-commerce imports

13:39 | 04/12/2024 Regulations

Bringing practical experience into customs management policy

13:48 | 03/12/2024 Regulations

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Consulting on customs control for e-commerce imports and exports

14:50 | 14/02/2025 Regulations

Flexible tax policy to propel Việt Nam’s economic growth in 2025

14:14 | 06/02/2025 Regulations

Brandnew e-commerce law to address policy gaps

18:44 | 29/01/2025 Regulations

From January 1, 2025: 13 product codes increase export tax to 20%

14:23 | 29/12/2024 Regulations

Export tax rates of 13 commodity codes to increase to 20% from January 1, 2025

13:46 | 28/12/2024 Regulations