Budget expenditure estimate in 2021 should be appropriate with streamling and lean organisational structure

|

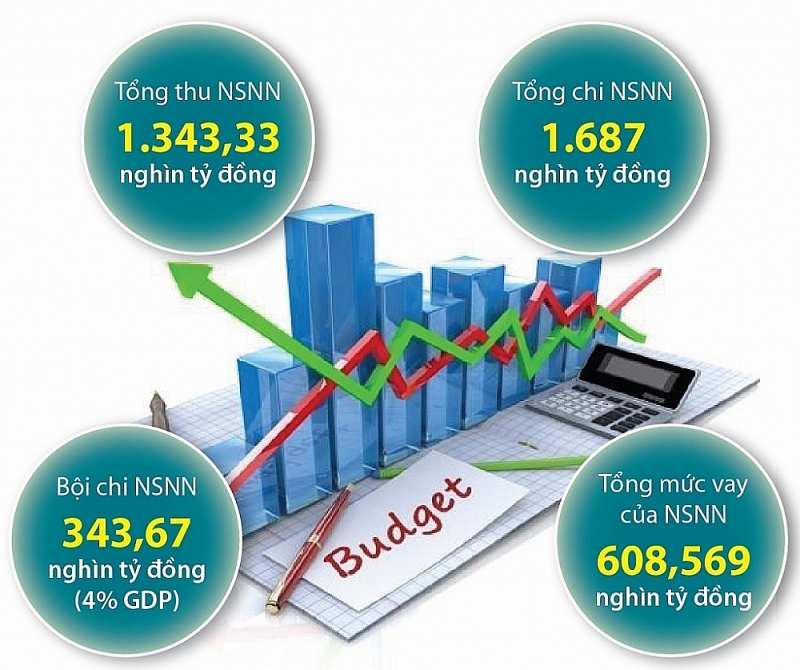

| The state budget estimate in 2021 has been approved by the National Assembly |

Saving 15% of expenditure compared to 2020

In the draft, the Ministry of Finance proposed that ministries, central agencies and People’s Committee of provinces and cities implement the assigned tasks of revenue collection in 2021 to units and subordinate authorities to ensure the minimum collection is equal to the rate of the estimate of revenue collection assigned by the Prime Minister.

Besides the assignment of the revenue collection estimate, the ministries, central authorities, People’s Committees of provincies and cities should allocate revenue collection from public non-business complying with the regulations of the law for subordinate unit (if any).

The assignment of State budget estimates in 2021 must be based on a full review, analysis and assessment of arising sources of revenue and the results of the implementation of revenue collection in 2020; based on policies and law on revenue collection; forecast economic growth of each industry, each field, production – business operation of the taxpayer in the locality; strengthen tax inspection and examination, combat tax loss; preventing smuggling, trade fraud, production and trading of counterfeit goods, transfer prices, and tax evasion; urging tax debt collection and apply tax coercive measures in accordance with regulations, limiting newly arising debts, promptly recover tax, fine and receivables according to the recommendations of the auditing agency and the conclusion of inspection agency and legal protection agencies.

Regarding the scope of the assigned amount of fees paid to State revenue and the number of fees left for expenditure as prescribed by the Ministry of Finance, the ministries and central agencies should assign the estimate to each agency or unit.

Within expenditure estimates from the retained fee collection sources assigned by the Ministry of Finance, ministries and central agencies should manage and use for contents as specified in Clauses 2, 3, 4 and 5, Article 5 of Decree No. 120/2016/ND-CP of the Government dated August 23, 2016 guiding the implementation of some articles of the Law on Fees and Charges and a specific financial mechanism in accordance with regulations of competent authorities for each attached agency or unit and send to the Ministry of Finance for examination together with the budget allocation plan.

For affiliated agencies and units applying a specific financial mechanism by professional revenue sources and other lawful sources, ministries and central agencies should instruct to establish the plan for revenue collection and expenditure in 2021 by following the current mechanism, requiring to hit 15% savings compared to 2020.

Local authorities reserve resources to pay off due debts

As for the estimate of recurrent expenditure, the Ministry of Finance is expected to stipulate that ministries, central agencies and localities that allocate and assign estimates of recurrent expenditures to units using budget must ensure compliance with the budget in total and detailed payment for each expenditure area; the distribution of expenditure estimates must be on time; strict compliance with budget expenditure regimes, criteria and norms set by State authorities, ensuring sufficient funding for the implementation of policies and regimes and important tasks in accordance with regulations, the tasks have been decided by authorities.

Funding for planning evaluation continues to be arranged with regular cost estimates in accordance with the Law on Planning.

At the same time, the allocation and assignment of recurrent expenditure estimates are in line with the progress and roadmap for streamlining payrolls, organisational structure, and reorganisation of administrative units of district and commune, increase the autonomy of public non-business units, price adjustment and fees, in accordance with the regulations of the Party and State.

Regarding allocation and assignment of development investment expenditure estimates, provinces and cities should pay attention to the basis of development investment expenditure estimates assigned by the Prime Minister, the Ministry of Planning and Investment and the Ministry of Finance so localities will allocate sources corresponding to the provincial budget deficit to repay principals of loans from the local budget due in 2021 (including overdue loans from Vietnam development banks, if any) and reserve additional resources to repay the interest of due loans in 2021 (if the assigned estimate of repayment of interest debts is insufficient); the rest will only allocate capital for works and projects, allocating and balancing sufficient capital for projects and programmes partly supported by the central budget.

Related News

VND 479 Billion contributed to state budget from violations handling

14:48 | 20/11/2024 Anti-Smuggling

Mong Cai Customs sets new record in revenue collection

19:39 | 16/11/2024 Customs

State revenue collection poised to surpass annual target

10:11 | 12/11/2024 Finance

Nghe An Customs surpasses challenges, achieves revenue target ahead of schedule

14:24 | 09/11/2024 Customs

Latest News

Amending the Law on Corporate Income Tax, not giving preferential treatment to overlapping and spreading industries

08:53 | 26/11/2024 Finance

Việt Nam's stock market recovers but outlook remains uncertain

14:59 | 25/11/2024 Finance

Bad debt at banks continues to rise in both amount and ratio

09:20 | 25/11/2024 Finance

Monetary policy forecast unlikely to loosen further

18:18 | 24/11/2024 Finance

More News

Green credit proportion remains low due to lack of specific evaluation criteria

09:02 | 24/11/2024 Finance

Launching virtual assistants to support taxpayers

17:50 | 23/11/2024 Finance

Banks increase non-interest revenue

10:51 | 23/11/2024 Finance

Monetary policy forecast unlikely to loosen further

15:51 | 22/11/2024 Finance

World Bank outlines path for Vietnam to reach high income status

13:44 | 22/11/2024 Finance

Strictly control public debt and ensure national financial security 2025

09:26 | 22/11/2024 Finance

Revising the title of a draft of 1 Law amending seven finance-related laws

14:33 | 21/11/2024 Finance

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance

State-owned securities company trails competitors

14:46 | 20/11/2024 Finance

Your care

Amending the Law on Corporate Income Tax, not giving preferential treatment to overlapping and spreading industries

08:53 | 26/11/2024 Finance

Việt Nam's stock market recovers but outlook remains uncertain

14:59 | 25/11/2024 Finance

Bad debt at banks continues to rise in both amount and ratio

09:20 | 25/11/2024 Finance

Monetary policy forecast unlikely to loosen further

18:18 | 24/11/2024 Finance

Green credit proportion remains low due to lack of specific evaluation criteria

09:02 | 24/11/2024 Finance