Banks announced "huge" profit

|

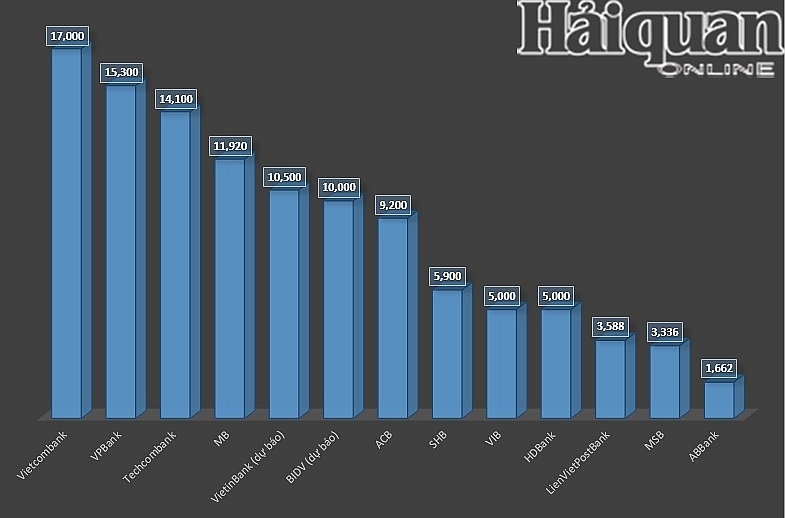

| Vietcombank has risen to regain the top position from VPBank. |

If in the first quarter of 2022, the top position in profit belonged to VPBank due to the recognition of an extraordinary income on insurance premiums with AIA, then after six months, Vietcombank has surpassed to regain the top position with estimated profit of more than VND17,000 billion.

Currently, Vietcombank has not released detailed financial statements for the second quarter of 2022 and six months, but according to SSI Research's estimate, the bank's profit in the quarter is estimated at VND7,000 - 7,300 billion. Thus, in the first 6 months, the bank's profit will range from VND17,000 to VND17,300 billion.

Notably, in addition to the recorded paper profit, Vietcombank also has set up large risk provisions as "savings" for future profits. Vietcombank's leaders said that the bank's bad debt coverage ratio as of the end of June 2022 was 514% – the highest in the market. This bank also said that the total outstanding loans to customers as of the end of June reached VND1.1 quadrillion.

The bank's total assets reached approximately VND1.6 quadrillion, up 13.4% compared to 2021.

The bad debt ratio at 0.6% is within the control plan of 1.5%. NIM reached 3.47%, a sharp increase compared to 2021, the highest among state-owned commercial banks. Profitability ratios ROA and ROE remained high.

Despite falling to second place, VP Bank's business results were also positive with pre-tax profit of more than VND15,300 billion, equivalent to 52% of the year plan, up 70% over the same period.

Consolidated bank credit balance reached VND436,000 billion, of which credit growth of the parent bank alone was 14.3%, higher than the industry average of 9.35%.

As a result, consolidated operating income reached VND31,600 billion, up 37% over the same period last year, of which net fee income increased by 34.5%, income from settled debt increased by 26% compared to the first 6 months.

|

| Six-month profit of some banks by the end of July. Chart: H.Diu. |

Techcombank consolidated the 3rd position in profit in the first six months of 2022 with VND14,100 billion. However, looking at the financial statements, the bank's profit decelerated in the second quarter of 2022, partly because the 7% decline in large corporate credit segment (including corporate bonds) due to the tightening market control by regulators. Techcombank's profit growth driver in the second quarter of 2022 was mainly due to the reduction in risk provisioning rather than the growth of core business activities.

Moreover, Techcombank has always had a stable growth in demand deposit ratio (CASA), but after the first six months of 2022, this rate decreased to 47.5% compared to 50.4% at the end of Q1 2022.

Explaining this decrease, Mr. Nguyen Anh Tuan, senior director of development and channel manager at Techcombank, said that after the Covid-19 pandemic, especially the bounce back of business activities since the second quarter, investment demand is strongly deployed, customers tend to shift cash flow to some other products such as real estate and securities investment.

Therefore, the impact is only temporary and Techcombank will have a solution so that CASA is expected to reach 50%.

Standing in the next position in the list of top bank profits so far is MB. As revealed by the bank's leaders, the group's revenue in the first six months of the year reached approximately VND29,900 billion with a profit of VND11,920 billion; in which, the bank's revenue reached nearly VND17,800 billion, up 23% and profit reached VND10,666 billion.

Next is VietinBank and BIDV, although the two have not yet officially announced, according to SSI Research's estimates, accumulated in six months, this amount is VND10,500 billion and VND10,000 billion in VietinBank and BIDV, respectively.

In addition, although not reaching the high profit of tens of trillions of dong, some mid-range banks also had impressive growth. For example, MSB announced its profit before tax in the first 6 months of the year reached nearly VND3,336 billion, up 7% compared to the same period; LienViet PostBank's 6-month profit reached VND3,588 billion, up 76% over the same period last year; AB Bank's profit before tax in the first 6 months of the year reached nearly VND1,662 billion, up 39.5% over the same period; estimated pre-tax profit of ACB in Q2 is VND5,000 billion, raising first half profit to VND9,200 billion; profit in the first 6 months of SHB is VND5,900 billion, VIB is VND5,000 billion.

According to estimates by SSI Research, profit growth in the first 6 months of 2022 of the analyzed banks could average around 26-29% over the same period which is driven by strong credit growth with an increase of 10.3% compared to the beginning of the year and an increase of 18% over the same period.

However, these experts also believe that the profit before tax in the second quarter of some banks is likely to decrease compared to the previous quarter.

In the second half of the year, banks still have high expectations for many growth drivers, especially from credit. According to experts, banks can record high profits in the last 6 months of 2022, because the State Bank (SBV) may increase the credit growth limit (if conditions are right) and Net profit (NIM) is stable compared to 2021. In addition to credit, growth will also be driven by digital banking services, fee income or commerce sponsorship activities.

Related News

Stimulate production and business, submit to the National Assembly to continue reducing 2% VAT

15:47 | 02/12/2024 Finance

Goods trading, being seen from Lang Son border gate

13:45 | 28/11/2024 Customs

7 key export groups bring in US$234.5 billion

13:54 | 28/11/2024 Import-Export

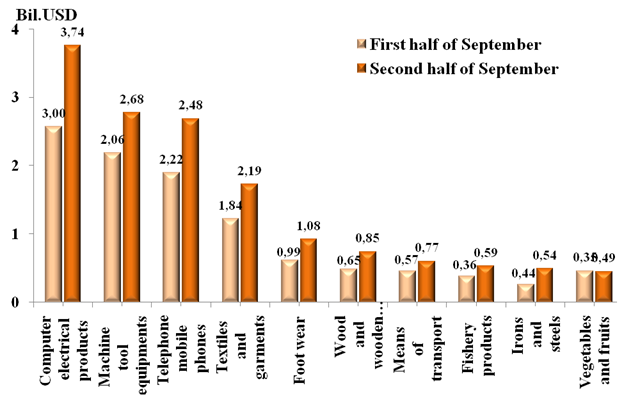

Preliminary assessment of Vietnam international merchandise trade performance in the second half of September, 2024

09:21 | 20/11/2024 Customs Statistics

Latest News

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

More News

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

PM urges stronger measures to manage interest rates

16:53 | 17/12/2024 Finance

Six SOEs to be transferred back to industry ministry

16:48 | 17/12/2024 Finance

Vietnamese products: Conquering foreign customers in supermarket systems

16:45 | 17/12/2024 Finance

Answering many questions from businesses at dialogue conference on tax and customs policies

10:01 | 17/12/2024 Finance

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Your care

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance