Amendment to management procedures for cars and motorbikes of beneficiaries of privileges and immunities

| 5,000 cars imported in first half of May | |

| MoF rejects VAMA’s proposal to reduce auto registration fee by 50% | |

| VAMA’s proposal of reducing registration fee for domestically-produced cars rejected |

|

| Head of Customs Control and Supervision Division No.3 Nguyen Thi Kim Que |

Could you please tell us the need to issue Circular 27/2021/TT-BTC amending and supplementing Circular 19/2014/TT-BTC and abolishing Circular 93/2018/TT-BTC?

- The promulgation of Circular 27/2021/TT-BTC by the Ministry of Finance is based on the Prime Minister’s Decision 14/2021/QD-TTg amending Decision 53/2013/QD-TTg on temporary import, re-export, disposal, transfer of cars, motorbikes of beneficiaries of privileges and immunities in Vietnam. Decision 14 amends and supplements some contents, thereby, Circular 27 also needs to be amended to instruct customs procedures.

Three contents are revised as follows:

Firstly, Decision 14/2021/TT-TTg allows car owners (not subject to beneficiary of privileges and immunities) to carry out procedures for transferring cars that are temporarily imported and sold for them by beneficiaries of privileges and immunities but have not yet gone through customs procedures. To comply with regulations in Decision 14, Circular 27/2021/TT-BTC specify procedures for transferring these cars.

Second, Decision 14/2021/TT-TTg allows the beneficiaries who are ending their term in Vietnam but have not implemented procedures for liquidation of cars or motorbikes, to authorize the agency where they work to carry out the liquidation procedures for these vehicles. Accordingly, Circular 27/2021/TT-BTC also stipulates procedures related to authorization for this case.

Thirdly, Decision 14/2021/TT-TTg specifies that receivers of automobile transfer shall implement tax declaration and payment. Accordingly, Circular 27/2021/TT-BTC regulating procedures related to the implementation of procedures by the receivers of automobile transfer. The Circular also provides responsibilities of car buyers in the process of car transfer procedures.

Will the revised key contents related to management procedures for automobiles and motorbikes of beneficiaries of privileges and immunities in Vietnam remove problems on vehicles that have not yet gone through customs procedures?

- The amendments to contents related to the management and use of cars and motorbikes of beneficiaries stem from shortcomings in reality.

The problem has been instructed for handling by the Government. However, in order to legalize it, this content is supplemented in Decision 14/2021/TT-TTg for handing. Circular 27 specifies transfer procedures so that the car users shall implement these procedures, tax payment, and use them legally.

To effectively implement the provisions of Circular 27/2021/TT-BTC, what should local Customs and declarants pay attention to during performance?

- Regulations related to management from the temporary import to the transfer for re-export for these cars and motorbikes by customs in Circular 27/2021/TT-BTC do not have many fundamental changes. However, the handling for the backlog of these vehicles is the new contents in Decision 14/QD-TTg and Circular 27/2021/TT-BTC. The local customs units must check whether these vehicles are on the list of unsold vehicles announced by the Ministry of Finance or not during transfer procedures.

In addition, the local Customs units implementing the transfer procedures must note that the vehicle buyer will implement customs declaration and tax payment.

The vehicle buyers that have not yet carried out transfer procedures must look up these vehicles whether they are on the list of vehicles subject to be transferred or not. If the vehicles are on this list, the buyers must perform the write-off at the police office and transfer procedures at the customs branches.

If the vehicles are not gone through transfer procedures, they will be subject to stop the registration and handled by the Police.

If the vehicle is not transferred, the registration will be stopped. In case of being detected by the traffic police agency, they will be handled according to regulations.

Related News

Automobile localization: rapid development from internal strength

07:44 | 31/12/2024 Headlines

Ha Nam Ninh Customs embraces digital transformation in administrative procedures

08:56 | 11/11/2024 Customs

Tax sector focuses on simplifying tax administrative procedures

09:22 | 06/10/2024 Finance

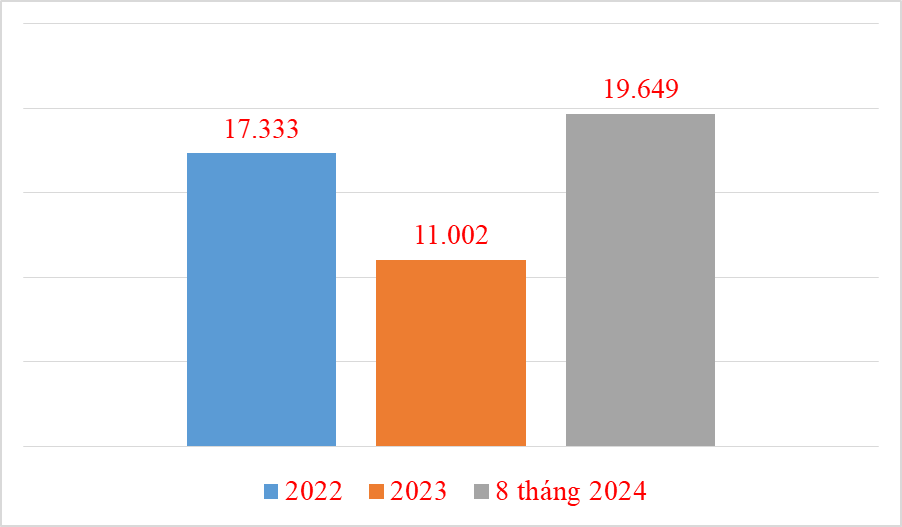

20,000 Chinese cars imported in 8 months

09:13 | 30/09/2024 Import-Export

Latest News

Vietnam Customs forms implementation task force on developing customs procedures

16:29 | 15/02/2025 Customs

Quang Tri Customs launches business support initiatives

16:29 | 15/02/2025 Customs

Hai Phong Customs’ revenue rises about VND 1,000 billion

14:52 | 14/02/2025 Customs

Administrative reform: Khanh Hoa Customs delivers impressive results

14:52 | 14/02/2025 Customs

More News

GDVC sets goal of widely disseminating Customs policies

07:49 | 12/02/2025 Customs

Hai Phong Customs sets out 15 tasks to achieve the revenue target of VND 72,000 billion

10:12 | 11/02/2025 Customs

Over 1,500 customs declarations processed by Hai Phong Customs during Tet

14:36 | 10/02/2025 Customs

Hai Phong Customs strives to perform tasks from the beginning of the year

08:45 | 09/02/2025 Customs

Ho Chi Minh City: Foreign visitors spend more than VND1,500 billion to buy goods upon exit

10:01 | 07/02/2025 Customs

3,500 customs declarations handled in Lang Son over Tet

09:57 | 06/02/2025 Customs

Hai Phong Customs processes more than 1,500 declarations during 2025 Lunar New Year holiday

14:09 | 05/02/2025 Customs

US$10.5 million in trade flows through Binh Duong Customs during Tet During the 2025 Lunar New Year

14:08 | 05/02/2025 Customs

Proactive customs measures for express parcels: Tightening control over import-export goods

22:09 | 27/01/2025 Customs

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Vietnam Customs forms implementation task force on developing customs procedures

16:29 | 15/02/2025 Customs

Quang Tri Customs launches business support initiatives

16:29 | 15/02/2025 Customs

Hai Phong Customs’ revenue rises about VND 1,000 billion

14:52 | 14/02/2025 Customs

Administrative reform: Khanh Hoa Customs delivers impressive results

14:52 | 14/02/2025 Customs

GDVC sets goal of widely disseminating Customs policies

07:49 | 12/02/2025 Customs