VAMC targets to settle VND50 trillion of bad debts this year

|

It also planned to issue VND15 trillion worth of special bonds to buy non-performing loans of credit institutions and spend VND5 trillion in cash to buy another VND5 trillion of NPLs at market prices.

According to Doan Van Thang, VAMC’s General Director, VAMC was also promoting the foundation of a debt trading platform together with an AMC club to exchange experience and information so as to establish a centralised market for trading bad debts.

This year, VAMC also expected to get the Government's approval to double its charter capital to VND10 trillion to improve its financial capacity.

Under the project of restructuring the system of credit institutions in association with handling bad debts in the 2016-2020 period approved by the Prime Minister on July 19, 2017, VAMC planned to raise its charter capital to VND10 trillion. However, in November 2017, the Prime Minister only allowed VAMC to increase its charter capital to VND5 trillion.

According to VAMC’s recent report, the company reclaimed bad debts worth around VND69.78 trillion in 2019 compared to the sum of VND30.9 trillion in 2018.

Last year, VAMC bought 381 bad debts of nine credit institutions worth more than VND20.5 trillion by special bonds at the price of nearly VND19.8 trillion.

The company also bought 37 bad debts at market prices and helped credit institutions handle more than VND2.13 trillion of bad debts.

Since its foundation in 2013 to the end of December 2019, VAMC used special bonds to buy bad debts worth VND359.39 trillion at the price of VND327.4 trillion. In addition, it spent VND8.2 trillion to buy bad debts worth VND8 trillion at market prices.

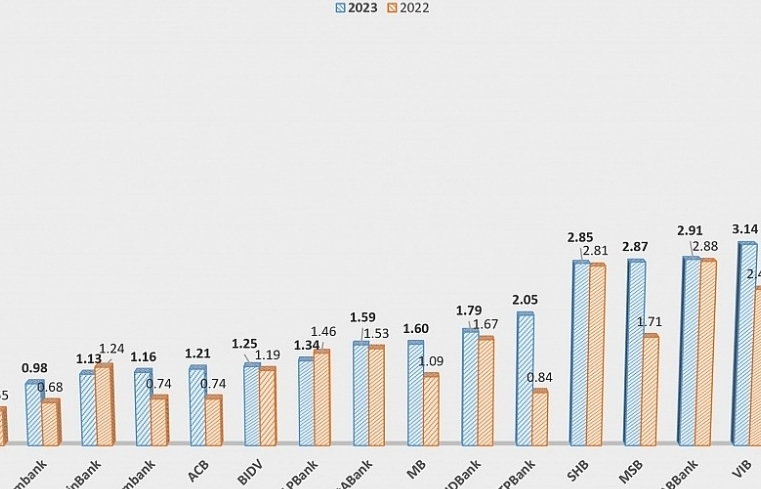

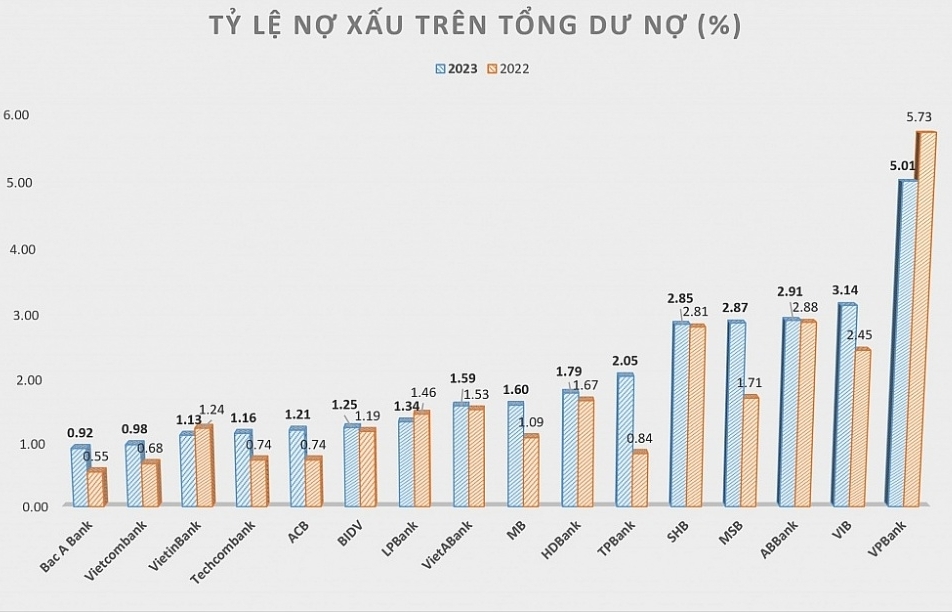

The central bank predicted that bad debts would increase this year due to the impacts of the COVID-19 pandemic, given that 23% of the total outstanding loans, or VND2 quadrillion, were in sectors suffering from the pandemic. In the best scenario, the ratio of bad debts would be at around 2.6-3% by the year end.

Related News

Accumulating bad debt ratio put pressure on banks

09:53 | 11/03/2024 Import-Export

The bad debt ratio has increased, putting pressure on banks

08:42 | 03/03/2024 Finance

Credit quality suffer from objective factors declining bad debt handling effectiveness

00:00 | 28/10/2023 Finance

The WB highlights a series of challenges, the banking system must enhance resilience

13:57 | 25/08/2023 Finance

Latest News

M&A activities show signs of recovery

13:28 | 04/11/2024 Finance

Fiscal policy needs to return to normal state in new period

09:54 | 04/11/2024 Finance

Ensuring national public debt safety in 2024

17:33 | 03/11/2024 Finance

Removing many bottlenecks in regular spending to purchase assets and equipment

07:14 | 03/11/2024 Finance

More News

Continue to handle cross-ownership in banks

10:35 | 02/11/2024 Finance

Striving for average CPI not to exceed 4%

16:41 | 01/11/2024 Finance

Delegating the power to the government to waive, lower, or manage late tax penalties is suitable

16:39 | 01/11/2024 Finance

Removing difficulties in public investment disbursement

09:30 | 31/10/2024 Finance

State-owned commercial banking sector performs optimistic growth, but more capital in need

09:28 | 31/10/2024 Finance

Stipulate implementation of centralized bilateral payments of the State Treasury at banks

09:29 | 29/10/2024 Finance

Rush to finalize draft decree on public asset restructuring

09:28 | 29/10/2024 Finance

Inspection report on gold trading activities being complied: SBV

14:37 | 28/10/2024 Finance

Budget revenue in 2024 is estimated to exceed the estimate by 10.1%

10:45 | 28/10/2024 Finance

Your care

M&A activities show signs of recovery

13:28 | 04/11/2024 Finance

Fiscal policy needs to return to normal state in new period

09:54 | 04/11/2024 Finance

Ensuring national public debt safety in 2024

17:33 | 03/11/2024 Finance

Removing many bottlenecks in regular spending to purchase assets and equipment

07:14 | 03/11/2024 Finance

Continue to handle cross-ownership in banks

10:35 | 02/11/2024 Finance