The General Department of Taxation points out a number of value-added tax refund fraud

| Machinery only used for agriculture not subject to VAT | |

| Revamping State management would boost private economic sector: workshop | |

| HCM City aims to support 1,000 innovative start-ups in next five years |

|

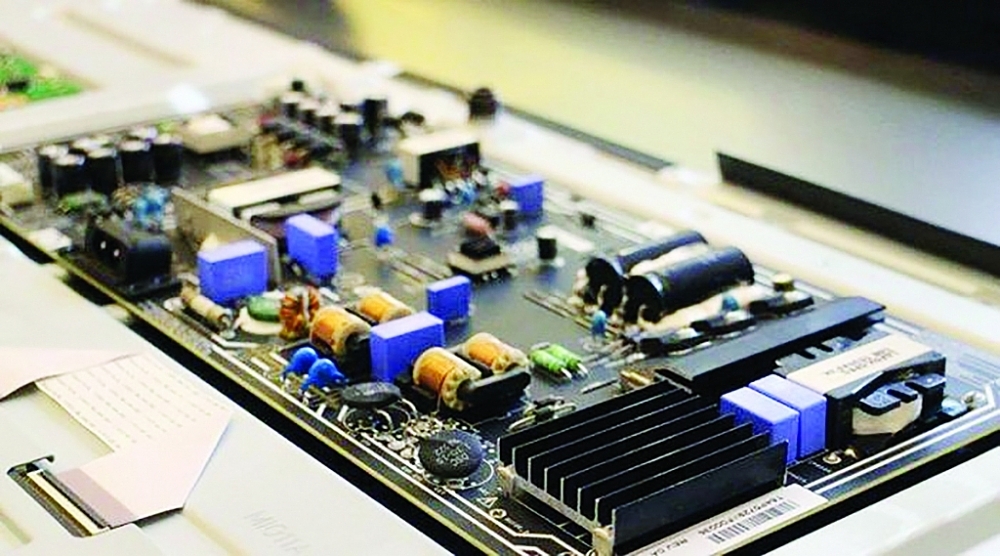

| The import of electronic components has many risks regarding VAT refund Photo: Internet |

Warning on VAT refund risks

According to the General Department of Taxation, there have been reports of tax departments with high-risk VAT refunds in some firms that have imported goods (electronic components and computers) with similar design and specifications.

Regarding appropriating VAT refunds, smuggling, and illegally transporting goods across the border of some enterprises in the south, Customs authorities have identified several companies that have appropriated VAT refunds. Customs authorities and C03-Ministry of Public Security agreed with the Supreme People's Procuracy to prosecute the case on smuggling (Article 188); illegally transporting goods and currencies across the border (Article 189); forging seals and documents of agencies or organisations; and using fake seals and documents of agencies or organisations (Article 341).

Through these above violations, the General Department of Taxation synthesised a number of typical and appropriating tax refunds. For example, in some enterprises that import goods (electronic components, computers) with the same design and technical characteristics, the declared value was low when import, but about 50 times higher than that when exported.

Declaring higher export value is another example. Shipments weighing only a few to several tens of kilograms were declared as up to several or tens of billions VND. This posed a risk of buying and selling domestic invoices to increase the value of export goods, leading to illegal money transfer and VAT refund appropriation.

The General Department of Taxation also specified objects with high potential risks such as firms selling products to electronic component exporters not at the registered business address, or frequently change head office address, business owners, legal representatives and information about registered tax administration.

Especially, there are cases of money transfer back and forth between related people (such as family members) in the purchase/sale of goods, and exchange if cash.

Notably, export records including contracts, invoices, accounting books and payment documents do not match the economic nature in accordance with the provisions of the Law on Tax Administration, Law on VAT and legal documents guiding management and use of invoices. Or cases where electronic component exporters do not have real transactions with foreign parties but only receive commissions for export services.

"Tighten" high-risk goods trading enterprises

To prevent the aforementioned violations, the General Department of Taxation asked provincial and municipal tax departments to seriously review enterprises trading in high-risk goods (electronic components, wood products, and agricultural, forestry, and aquatic products) for inspection. After that, based on the actual records; compare them with the provisions of law to handle VAT refunds according to regulations.

It should be noted that when inspecting and examining VAT refunds, the General Department of Taxation needs compare the actual record and nature of the transaction with the provisions of the tax law to quickly detect the violation for handling according to regulations.

VAT refund inspections and examinations must comply with the order and procedures prescribed by law on inspection and examination. At the end of the inspection and examination after the refund, the tax departments of provinces and cities should focus on the recovery of VAT refunds and handling tax violations according to regulations.

If detecting signs of tax law violations, tax departments must collect and consolidate full legal documents to transfer information of law violations to the police.

If the case is complex, it is necessary to report to the People's Committee of the province or city to coordinate with agencies in the same area to punctually inspect and verify the violation.

Tax departments also have to review similar cases for items with high risk of VAT refund; and publicise information about companies that violated tax laws, had illegal acts of buying and selling invoices to taxpayers to prevent and handle similar cases, avoiding loss of State budget revenue.

In the future, the tax office will coordinate with the customs office to rapidly exchange and provide information related to risks of VAT refund.

Related News

Tax policies drive strong economic recovery and growth

07:55 | 31/12/2024 Finance

Stimulate production and business, submit to the National Assembly to continue reducing 2% VAT

15:47 | 02/12/2024 Finance

Decree on the implementation of global minimum tax: Ensuring a clear and transparent legal framework

11:06 | 30/11/2024 Finance

Amendments to the Value-Added Tax Law passed: Fertilizers to be taxed at 5%

13:43 | 28/11/2024 Regulations

Latest News

An Giang Customs Department escalates multiple tax fraud cases to law enforcement

16:30 | 15/02/2025 Anti-Smuggling

Customs crackdown nets 1,430 violations in first month

14:50 | 14/02/2025 Anti-Smuggling

Customs administrations coordinate to seize nearly 20,000 endangered wildlife

09:15 | 14/02/2025 Anti-Smuggling

An Giang Customs strictly controls goods moving across the border

08:45 | 09/02/2025 Anti-Smuggling

More News

Remodel cars to hide drugs

20:47 | 30/01/2025 Anti-Smuggling

Illegal transportation of gemstones by air to handled

18:36 | 28/01/2025 Anti-Smuggling

Routine security screening uncovers hidden weapons at point of entry

20:30 | 25/01/2025 Anti-Smuggling

Strictly handling illegal transportation of gemstones by air

14:16 | 21/01/2025 Anti-Smuggling

Nearly 18,000 cases of smuggling, trade fraud and counterfeit goods detected

20:58 | 05/01/2025 Anti-Smuggling

Customs seizes smuggled goods and infringing products worth VND31,000 billion

06:36 | 05/01/2025 Anti-Smuggling

India launches anti-dumping investigation on nylon yarn imports from Việt Nam

13:32 | 01/01/2025 Anti-Smuggling

Hanoi Customs: 92% of post-clearance audits reveal violations

07:53 | 31/12/2024 Anti-Smuggling

Noi Bai International Border Gate Customs Sub-department: "Blocking" drugs via air

07:42 | 31/12/2024 Anti-Smuggling

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

An Giang Customs Department escalates multiple tax fraud cases to law enforcement

16:30 | 15/02/2025 Anti-Smuggling

Customs crackdown nets 1,430 violations in first month

14:50 | 14/02/2025 Anti-Smuggling

Customs administrations coordinate to seize nearly 20,000 endangered wildlife

09:15 | 14/02/2025 Anti-Smuggling

An Giang Customs strictly controls goods moving across the border

08:45 | 09/02/2025 Anti-Smuggling

Remodel cars to hide drugs

20:47 | 30/01/2025 Anti-Smuggling