The corporate bond market enters a new phase of development

|

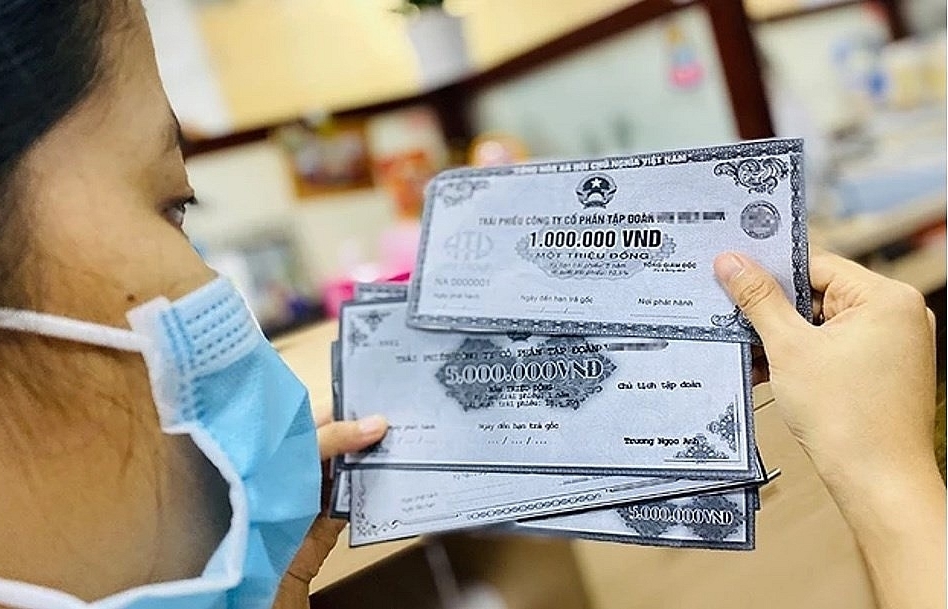

| The new legal framework is expected to remove the current shortcomings of the corporate bond market. Photo: Internet |

In the context that the corporate bond market shows slow development and has not seen positive changes, to help the market return to a growth trajectory, experts say that it requires the efforts of all participants in the market.

According to the Vietnam Bond Market Association (VBMA), as of January 31, no corporate bond issuance have been held in 2023. The issuances announced in January were mostly issued in December 2022. Meanwhile, enterprises bought back VND8,06 billion in January, up 56% compared with 2022. About VND285,178 billion of bonds are expected to mature in 2023.

Analysts said that the debt repayment pressure of enterprises will peak in 2023. This will be a great challenge for businesses in the context of declining debt repayment capacity and capital absorption. Therefore, it will be difficult for businesses to get support from creditors and investors.

Manager, Credit Risk Analytics, FiinRatings Le Hong Khang said that in the next 12 months, the overall picture of the market will still be gray, meaning that corporate bond issuance will remain quiet.

Khang said that in recent years, most investors have invested in corporate bonds because of the attractive interest rate compared to the savings channel. However, investors’ confidence has been seriously affected in 2022, so now, even if businesses issue bonds with very high interest rates, they may not attract investors because they still voice concerns about risks.

However, the degree of differentiation in the credit capacity of enterprises in 2023 will become very clear. For enterprises with bad credit capacity, the market may witness illiquidity, and businesses may be forced to work with bondholders and creditors to restructure debt repayment terms.

Meanwhile, the group of businesses with good credit capacity may narrow their production and business activities or conduct early redemption and wait for more positive signals. Some businesses can even be proactive in mergers and acquisitions (M&A).

Mr. Dao Phuc Tuong, a securities expert, said that deposit interest rates peaked and are falling, and the business environment faces difficulties, so even businesses with good credit capacity have to push up bond interest rates to raise capital for their business needs.

In the period of 2020-2021, most corporate bonds issued on the market, investors have a yield of about 8-9%, while the deposit interest rate of banks was at 6-7%. The risk premium of corporate bonds was at 1-3%.

Tuong said that many corporate bonds have a very low probability of default, but the yield is twice the interest rate on bank deposits for equivalent terms. Thus, bonds are an attractive investment channel for passive investors.

Mr. Khang also said that although the issuance of corporate bonds is quite quiet, this is still an effective capital mobilization channel for businesses. FiinRatings still supports investors in working with issuers to conduct credit rating assessments. "The market is entering a new development phase, focusing on depth when institutional investors are the main entity in the market," said Khang.

In the long term, Khang said that Vietnam is on the right track in creating tools to support the market's sustainable development, such as bond investment funds, credit risk analytics, etc. These tools will help bring more multi-dimensional views, and avoid information asymmetry, risk assessment asymmetry and unfortunate matters. "The market develops slowly, but makes certain steps," said Khang.

Expectations for the new legal framework

The issuer needs to proactively disclose information; management agencies should provide effective solutions to revive the corporate bond market, and investors should improve their knowledge and update information for investment.

The Ministry of Finance has submitted to the Government a draft Decree amending and supplementing a number of articles of Decree 65/2022/ND-CP. Specifically, the Ministry has proposed regulations on the payment of bond principals and interests by other assets such as real estate products or corporate shares.

Accordingly, the Ministry proposes the Government provide regulations saying that if an enterprise cannot pay bond principal and interest in cash, it may negotiate with investors for payment by other assets on the following principles: complying with the law; being approved by the bondholder; announcing information and taking responsibility for the legal status of the assets used to pay the principal and interest.

The new draft also allows to change the term of the issued bonds outstanding up to 2 years; supplements the provisions that if the investor does not agree to change bond terms and conditions, the enterprise must fully pay interest and principal of bonds to this investor.

These new regulations are expected to remove difficulties for the corporate bond market by flexible measures in accordance with legal regulations, such as restructuring of terms, interest rates, diversifying payment instruments, and early payment.

Meanwhile, green bonds are considered as a trend that may bring new changes to the market. Vietnam may soon issue regulations on environmental criteria and certification for green credit and green bond issuance projects. This criteria framework is being consulted and will be issued in 2023. This will be the premise for the issuance of the first green bonds, helping the market develop in a stronger manner.

In particular, the capital mobilization channel of many industries such as energy, construction, green real estate will be expanded. Therefore, Vietnamese enterprises should prepare for this trend of attracting green bond mobilization in 2023 and in the coming years.

Related News

Vietnam has 4 enterprises providing credit rating services

09:28 | 03/09/2024 Finance

Many positive signals in the corporate bond market

10:20 | 25/08/2024 Finance

The corporate bond market will be more vibrant in the second half of the year

08:20 | 23/07/2024 Finance

The corporate bond market will enter new period of development

08:44 | 03/03/2024 Finance

Latest News

Monetary policy forecast unlikely to loosen further

18:18 | 24/11/2024 Finance

Green credit proportion remains low due to lack of specific evaluation criteria

09:02 | 24/11/2024 Finance

Launching virtual assistants to support taxpayers

17:50 | 23/11/2024 Finance

Banks increase non-interest revenue

10:51 | 23/11/2024 Finance

More News

Monetary policy forecast unlikely to loosen further

15:51 | 22/11/2024 Finance

World Bank outlines path for Vietnam to reach high income status

13:44 | 22/11/2024 Finance

Strictly control public debt and ensure national financial security 2025

09:26 | 22/11/2024 Finance

Revising the title of a draft of 1 Law amending seven finance-related laws

14:33 | 21/11/2024 Finance

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance

State-owned securities company trails competitors

14:46 | 20/11/2024 Finance

Strengthening the financial “health” of state-owned enterprises

09:23 | 20/11/2024 Finance

U.S. Treasury continues to affirm Vietnam does not manipulate currency

13:46 | 19/11/2024 Finance

Exchange rate fluctuations bring huge profits to many banks

13:43 | 19/11/2024 Finance

Your care

Monetary policy forecast unlikely to loosen further

18:18 | 24/11/2024 Finance

Green credit proportion remains low due to lack of specific evaluation criteria

09:02 | 24/11/2024 Finance

Launching virtual assistants to support taxpayers

17:50 | 23/11/2024 Finance

Banks increase non-interest revenue

10:51 | 23/11/2024 Finance

Monetary policy forecast unlikely to loosen further

15:51 | 22/11/2024 Finance