Efforts to bring the corporate bond market to the "rails"

| Synchronous solutions to regain stability for the corporate bond market | |

| How to regain investors' confidence in corporate bond market: experts | |

| Boosting the corporate bond market |

|

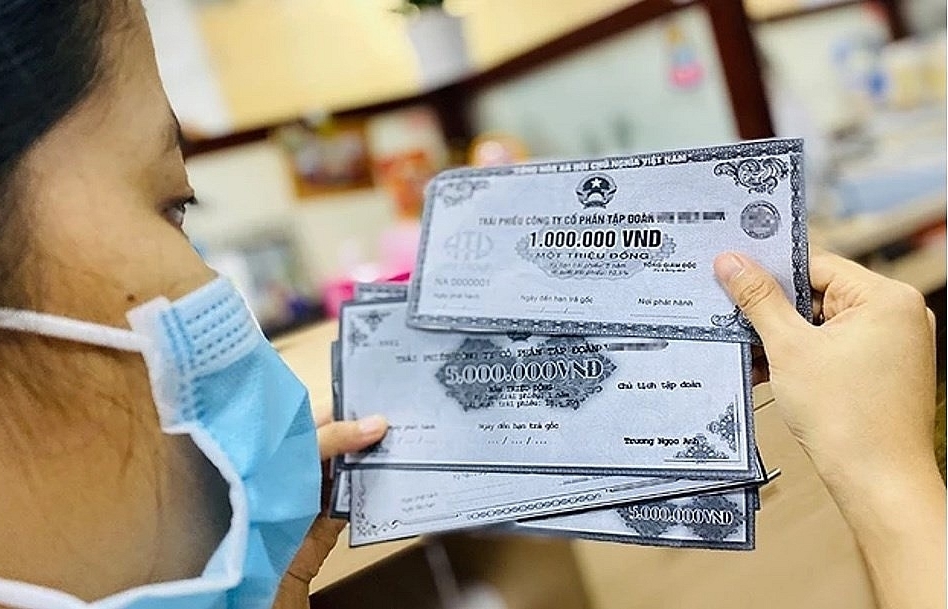

| Decree 65 promotes positive changes in enterprises in terms of transparency, limiting investors' risks. |

Enhance the openness and transparency of the market

The mistakes of some businesses in the corporate bond market over the past time have caused this market to decline. Part of the reason is the management loopholes of Decree 153/2020/ND-CP on the private placement of corporate bonds. Therefore, the Government issued Decree No. 65 amending and supplementing several articles of Decree No. 153/2020/ND-CP in the direction of supplementing regulations according to the Government's authority further to develop a transparent and sustainable corporate bond market, protect the interests of both issuers and investors, and overcome inadequacies in the market recently. Decree 65 also strengthens management and supervision, including inter-connected supervision between the financial market sector, the banking credit sector, and other sectors of the economy. These regulations are considered to contribute to market transparency and stability.

After issuing Decree 65, economic experts said that on the side of the issuer, Decree 65 has a legal nature of the opening, helping businesses meet the conditions under the new regulations to issue new bonds. For regulatory agencies, the State Securities Commission has a legal basis to review and approve new issuance documents. For the corporate bond market, Decree 65 has a positive and huge impact on solving capital problems and promoting positive changes in businesses regarding information transparency and limiting investors' risks.

According to the Ministry of Finance, from after Decree 65 was issued and took effect (September 16, 2022) to November 30, 2022, enterprises have issued nearly VND7 trillion, of which the issuance volume of construction enterprises accounted for 15.63%, production and service enterprises accounted for 19.52%, credit institutions accounted for 9.69%, real estate enterprises accounted for 9.07%, and other sectors accounted for 46.1% of the issuance volume. However, from September 2022, the corporate bond market was strongly affected by the difficulties of the money market when interest rates increased sharply, and the exchange rate of VND against USD rose dramatically. In addition, especially from October 6, 2022, the corporate bond market became more difficult after the incident involving Van Thinh Phat and SCB.

Deputy Minister of Finance Nguyen Duc Chi assessed that Decree 65 has promptly enhanced the market's publicity and transparency, dealing with inadequacies and protecting investors' interests. However, the market situation has changed extremely rapidly in recent months, so the Prime Minister has directed to immediately review regulations related to the corporate bond market, including Decree 65, to amend and supplement to help the market recover immediately. Currently, the Ministry of Finance is urgently submitting to the Government and the Prime Minister legal issues related to Decree 65 and involved regulations within the authority of the Government for consideration and settlement.

A roadmap is needed to implement Decree 65 continuously

Issuers, market members, and experts assessed the direction of the Decree as good in the medium and long term. However, due to the economy's liquidity difficulties and market confidence being affected, enterprises have difficulty balancing cash sources for production and business and paying due debt obligations in 2022-2023. Therefore, the Government and the Prime Minister have directed the Ministry of Finance to study, evaluate, and propose ideas to adjust the roadmap for applying the provisions of Decree 65 in the current context. In the immediate future, the Decree amending Decree No. 65 was issued so that the market can adjust and businesses can balance their cash sources in the short term, overcoming the period when the economy is facing liquidity difficulties. However, in the medium and long term, to develop a transparent and sustainable corporate bond market, it is necessary to have a roadmap to implement the provisions of Decree No. 65 continuously and to thoroughly review and amend the regulations on professional securities investors and the conditions for a private placement of corporate bonds in the Law on Enterprises and the Law on Securities.

According to economist Can Van Luc, Decree 65 has stricter regulations on private bond issuance. This Decree is expected to help the market become safer and more sustainable, but it also needs a more appropriate roadmap. "Revising some contents of the decree needs to ensure the right balance and roadmap between risk control and healthy development," said Luc.

Recently, at the online conference to summarize the financial and state budget work in 2022 and implement the 2023 tasks of the Ministry of Finance, Minister Ho Duc Phoc said that the Ministry of Finance was finalizing the policy on the corporate bond market. Currently, the Ministry of Finance is proposing to amend and supplement Decree No. 65/2022/ND-CP of the Government on private placement of corporate bonds, in which it is proposed to postpone the implementation of regulations on mandatory credit rating requirements for one year; postpone the implementation of regulations on bond distribution time of each offering not exceeding 30 days; supplement regulations allowing previously issued bonds with the outstanding balance to be extended; and supplement regulations that enterprises can convert bonds into loans or other assets to pay bond principals and interests to assist enterprises in balancing capital sources as well as removing difficulties in liquidity for the market. "The Ministry of Finance actively cooperates with ministries, branches, and localities to put corporate bonds on the "rails", becoming an effective medium and long-term capital mobilization channel for the developing economy, and solving difficulties for businesses," said Phoc.

Related News

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance

Industrial real estate - "Magnet" attracting foreign capital

09:01 | 07/09/2024 Import-Export

Many positive signals in the corporate bond market

10:20 | 25/08/2024 Finance

Transparent and stable legislation is needed to develop renewable energy

13:45 | 01/08/2024 Import-Export

Latest News

Monetary policy forecast unlikely to loosen further

15:51 | 22/11/2024 Finance

World Bank outlines path for Vietnam to reach high income status

13:44 | 22/11/2024 Finance

Strictly control public debt and ensure national financial security 2025

09:26 | 22/11/2024 Finance

Revising the title of a draft of 1 Law amending seven finance-related laws

14:33 | 21/11/2024 Finance

More News

State-owned securities company trails competitors

14:46 | 20/11/2024 Finance

Strengthening the financial “health” of state-owned enterprises

09:23 | 20/11/2024 Finance

U.S. Treasury continues to affirm Vietnam does not manipulate currency

13:46 | 19/11/2024 Finance

Exchange rate fluctuations bring huge profits to many banks

13:43 | 19/11/2024 Finance

A “picture” of bank profits in the first nine months of 2024

09:42 | 19/11/2024 Finance

Many challenges in restructuring public finance

10:02 | 18/11/2024 Finance

Tax declaration and payment by e-commerce platforms reduces declaration points and compliance costs

09:19 | 17/11/2024 Finance

Disbursement of public investment must be accelerated: Deputy PM

19:32 | 16/11/2024 Finance

HCMC: Domestic revenue rises, revenue from import-export activities begins to increase

09:36 | 16/11/2024 Finance

Your care

Monetary policy forecast unlikely to loosen further

15:51 | 22/11/2024 Finance

World Bank outlines path for Vietnam to reach high income status

13:44 | 22/11/2024 Finance

Strictly control public debt and ensure national financial security 2025

09:26 | 22/11/2024 Finance

Revising the title of a draft of 1 Law amending seven finance-related laws

14:33 | 21/11/2024 Finance

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance