The corporate bond market will be more vibrant in the second half of the year

| Corporate bond market is expected to prosper soon | |

| Public offerings key to promoting corporate bond market: experts | |

| The corporate bond market will enter new period of development |

|

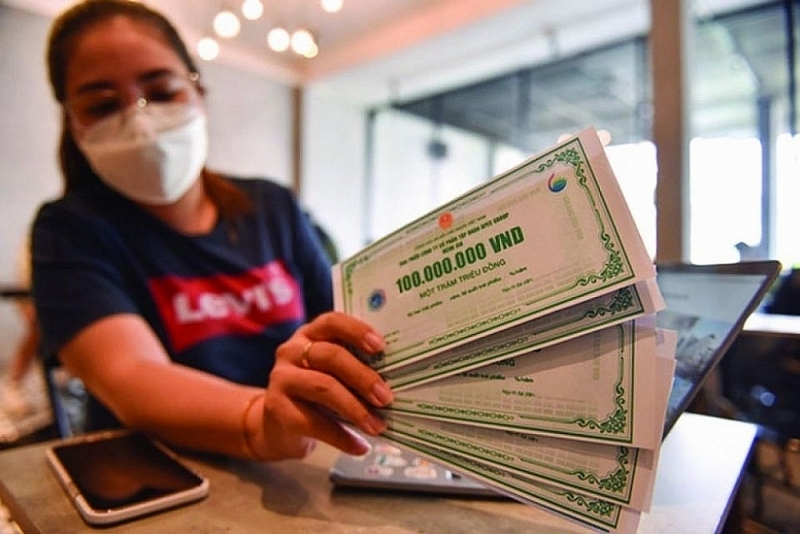

| According to forecasts, the second half of 2024 corporate bond issuance by businesses will accelerate. Photo: ST |

Circulation grew strongly

Regarding the situation of buying back bonds before maturity, according to the Vietnam Bond Market Association (VBMA) compiled from the Hanoi Stock Exchange (HNX) and the State Securities Commission (SSC), in June, businesses bought back 13,336 billion VND of bonds before maturity, down 68% compared to the same period in 2023. Data from the Ministry of Finance shows that in the first half of the year, the volume of pre-mature repurchases was 59.8 trillion VND, a decrease 39% over the same period in 2023.

According to data from the Ministry of Finance, from the beginning of the year to June 21, 2024, 41 enterprises have issued individual corporate bonds with a volume of 110.2 trillion VND. This number represents a remarkable growth in corporate bond issuance, increasing by 2.6 times compared to the same period in 2023.

In terms of structure, bonds of credit institutions still account for a significant proportion of 63.2% (equivalent to 69.6 trillion VND), real estate enterprises account for 28.6% (equivalent to 31.5 trillion VND). The investor structure shows that institutional investors buy corporate bonds on the primary market, accounting for 94.8% of the issuance volume, focusing on credit institutions (53.5%) and securities companies ( 21.9%), meanwhile, individual investors bought 5.2%. According to Fiin Ratings Joint Stock Company, taking advantage of low interest rates, credit institutions increase the issuance of medium and long-term bonds to ensure the safety ratios of the State Bank as well as to prepare capital sources when credit growth is more capable of recovery in the second half of the year.

In the second half of 2024, Fiin Ratings estimates that there will be about 139,765 billion VND of bonds maturing, of which the majority are real estate bonds with 58,782 billion VND, equivalent to 42%. Bond maturity pressure continues to be high in the third and fourth quarters of 2024, with the real estate industry accounting for 64% of total mature corporate bonds, in the context of many businesses having to request to defer debt payments and adjust acquisition plans. “Payment pressure exists for the real estate industry in the third quarter of 2024 when it reaches a value of 37 trillion VND, accounting for 64% of total corporate bonds due. In recent times, a large number of businesses have requested to defer principal payments and amend acquisition plans, which has relieved immediate payment pressure," said experts from Fiin Ratings.

Along with that, from the beginning of the year until now, the market has recorded an additional 20 trillion VND of delayed corporate bonds, including 72% of the value of bonds whose maturity was postponed from 1-2 years. The above plan helps businesses continue to have more time to focus on handling production and business difficulties and balancing cash flow to repay debt, especially for the real estate group when debt repayment ability is still low in the context of slow recovery of the housing market.

It will accelerate in the second half of the year

Facing the recovery of the macro economy, Fiin Ratings experts predict that businesses' demand for borrowing and issuing corporate bonds will accelerate in the second half of 2024, helping credit growth reach the target of 14-15% in whole year. According to analysis, Vietnam's exports grew again thanks to economic recovery in main markets, leading to improved capital needs of manufacturing enterprises. In addition, credit growth for the real estate business sector, including real estate corporate bond investment by commercial banks, recovered as legal obstacles were gradually resolved.

In addition, newly passed laws are expected to create conditions for the recovery of the real estate market, thereby promoting the issuance of real estate corporate bonds. Along with that, to meet increased credit demand in the second half of the year, credit institutions will need to consolidate medium and long-term capital sources, including the form of bond issuance to increase capital level 2. Therefore Corporate bond issuance activities of credit institutions will be busier in the near future. According to Fiin Ratings, as the largest group of corporate bond investors, the fact that credit institutions boost output through corporate bond investment channels is an important factor to help the corporate bond market become more vibrant in the second half of this year.

To continue to stabilize and develop the corporate bond market, the Ministry of Finance said it has reported to the Government leadership on overall operating solutions. The main solution groups include: synchronously implementing macro policy management solutions, controlling inflation, promoting disbursement of public investment capital; remove difficulties and stabilize the real estate market; Monitor due corporate bond payments and strengthen information and propaganda work; organize the market and improve the efficiency of management and supervision; Overall review to complete legal regulations related to corporate bond issuance in the Securities Law, Enterprise Law and related laws; Research policies to encourage credit ratings, promote the stock market upgrade roadmap, develop the institutional investor system, etc.

In the coming time, the Ministry of Finance will continue to monitor the situation of the corporate bond market, especially the coordinated implementation of macroeconomic management policies and real estate market recovery. Along with managing the appropriate credit growth rate, measures to ensure transparency and improve quality in the corporate bond market will support the market to develop more safely, healthily, and sustainably.

Related News

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance

Exchange rate risks need attention in near future

16:31 | 15/02/2025 Import-Export

Vietnam Customs kicks off campaign for innovation, breakthrough, and growth

14:15 | 21/01/2025 Customs

Outlook for lending rates in 2025?

15:20 | 31/12/2024 Finance

Latest News

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

More News

Fiscal, monetary policies support demand stimulation, price stabilisation

14:49 | 14/02/2025 Finance

Vietnam secures VND 157 billion from state enterprise divestment in 2024

09:16 | 14/02/2025 Finance

Vietnam gears up for potential inflation impact in 2025

14:26 | 11/02/2025 Finance

VN’s credit conditions in 2025 expected to be stable

14:24 | 11/02/2025 Finance

State revenue in first month of the year equal to 14% of the estimate

10:12 | 11/02/2025 Finance

Securities 2025 expects a breakthrough in scale and quality

14:37 | 10/02/2025 Finance

Cash reserves in stock accounts at six-quarter low amid margin rise

08:23 | 10/02/2025 Finance

Five solutions for developing stock market in 2025

10:01 | 07/02/2025 Finance

Minister of Finance Nguyen Van Thang works with GDVC at the first working day after the Tet holiday

14:43 | 04/02/2025 Finance

Your care

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance