Solving problems with declarations about on-spot import for export production

|

| Customs officers of Hai Phong Customs Department perform their duties. Photo: N.Linh |

Accordingly, the local customs units asked the General Department of Customs to guide the customs regime for on-spot imports in cases where an enterprise imports goods for export production from non-tariff zones, they will apply the customs regime E31 or A12 and tax policy applicable to imported goods for export production from non-tariff zones.

Responding to this question, the General Department of Customs said, based on the current regulations in Clause 7, Article 16 of the Law on Import Tax and Export Tax; Clause 20, Article 5 of the Law on Value Added Tax; Clause 5, Article 30 of Decree 82/2018/ND-CP of the Government; Point h, Clause 2, Article 12 of Decree 134/2016/ND-CP as amended and supplemented in Clause 6, Article 1 of Decree 18/2021/ND-CP, if an export processing enterprise sells goods to a foreign individual or organization but the foreign individual or organization asks the export processing enterprise to deliver the goods to a domestic enterprise through a sale contract between the domestic enterprise and the foreign enterprise, the goods imported on the spot by the domestic enterprise from the export processing enterprise will be exempt from import tax if they meet provisions in Clause 2, Article 12 of Decree 134/2016/ND-CP as amended and supplemented in Clause 6, Article 1 of Decree 18/2021/ND-CP.

| Fear of raw material shortage for export production VCN - Currently, the average production capacity of seafood processing factories in the Mekong Delta has decreased ... |

The declaration using customs regime E31 - import of materials for export production, which is exempt from import tax and not subject to VAT.

Related News

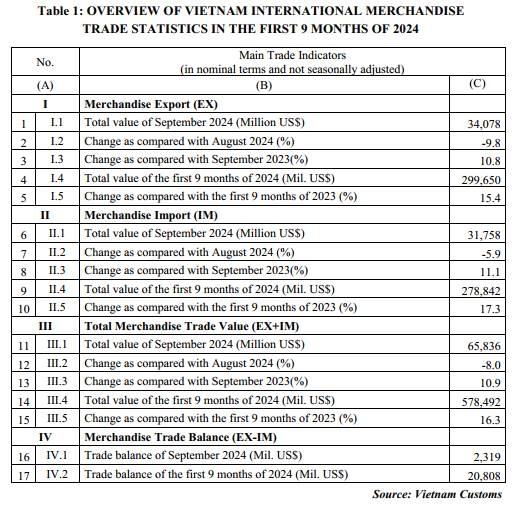

Preliminary assessment of Vietnam international merchandise trade performance in the first 9 months of 2024

09:22 | 20/11/2024 Customs Statistics

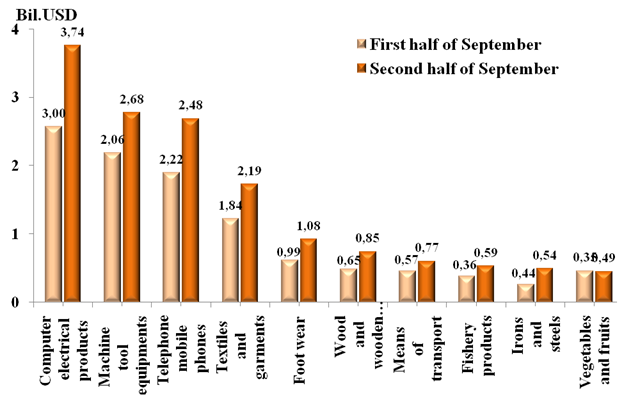

Preliminary assessment of Vietnam international merchandise trade performance in the second half of September, 2024

09:21 | 20/11/2024 Customs Statistics

Latest News

Hanoi Customs resolves tax policy queries for enterprises

09:26 | 22/11/2024 Regulations

Regularly check tax obligations to avoid temporary exit suspension

09:47 | 21/11/2024 Regulations

Implementing the SAFE framework in Vietnam: Assessment through the lens of international standards

09:14 | 20/11/2024 Regulations

Proposing the Tax Authority be flexible in applying tax debt enforcement measures simultaneously

09:40 | 19/11/2024 Regulations

More News

Many shortcomings in process and manual book on handling administrative violations

15:53 | 18/11/2024 Regulations

Implementing the SAFE Framework in Vietnam: Lessons from practice

10:03 | 18/11/2024 Regulations

Implementing the SAFE Framework in Vietnam: Solutions and Recommendations

09:18 | 17/11/2024 Regulations

Abolishing regulations on tax exemption for small-value imported goods must comply with international practices

13:54 | 15/11/2024 Regulations

Policy adaptation and acceleration of digital transformation in tax and customs management

10:03 | 14/11/2024 Regulations

Implement regulations on special preferential import tariffs under VIFTA

08:32 | 13/11/2024 Regulations

Perfecting tax policy for goods traded via e-commerce

09:24 | 10/11/2024 Regulations

Are belongings of foreigners on business trip to Vietnam exempt from tax?

14:23 | 09/11/2024 Regulations

Amending regulations on enforcement measures in tax administration

10:05 | 08/11/2024 Regulations

Your care

Hanoi Customs resolves tax policy queries for enterprises

09:26 | 22/11/2024 Regulations

Regularly check tax obligations to avoid temporary exit suspension

09:47 | 21/11/2024 Regulations

Implementing the SAFE framework in Vietnam: Assessment through the lens of international standards

09:14 | 20/11/2024 Regulations

Proposing the Tax Authority be flexible in applying tax debt enforcement measures simultaneously

09:40 | 19/11/2024 Regulations

Many shortcomings in process and manual book on handling administrative violations

15:53 | 18/11/2024 Regulations