Managing balance between exchange rate and inflation

|

| Keeping the exchange rate stable contributes to controlling inflation according to the target. Photo: Internet |

Positive supply of foreign currency

According to the State Bank of Vietnam (SBV), in 2022, the domestic exchange rate and foreign currency market will be under great pressure from complicated, unpredictable and sudden developments in the international market; difficulties in domestic foreign currency supply and demand; the incident of SCB had a negative impact on market sentiment and liquidity.

However, the SBV still manages the monetary policy to create fiscal space for the exchange rate to fluctuate flexibly, thereby absorbing external shocks. Therefore, the foreign currency market is relatively stable again, legal foreign currency needs are fully met.

With the flexible management of open market operations, from the beginning of 2023 until now, the SBV has purchased a large amount of foreign currency to supplement foreign exchange reserves (over 6 billion USD). In addition, for transactions that credit institutions buy foreign currency forward with the SBV, the SBV and other credit institutions have extended these transactions with a total value of 3.99 billion USD, and organized credit cancellation of 1.74 billion USD from the SBV, thereby contributing to the introduction and circulation of a large amount of VND respectively.

For transactions that credit institutions buy foreign currency forward with the SBV, the SBV and other credit institutions have also extended these transactions, through which the SBV does not withdraw/delay the withdrawal of VND from circulation.

In a report on the bond market, experts of SSI Securities Company said that the exchange rate at commercial banks and on the free market was almost flat, fluctuating around 23,450 VND/USD, so the SBV has raised foreign exchange reserves to 91 billion USD. According to SSI, the supply of foreign currency has generally been quite positive in recent years, coming from disbursed FDI, trade balance surplus or indirect cash flow from capital sales or disbursement of foreign loans.

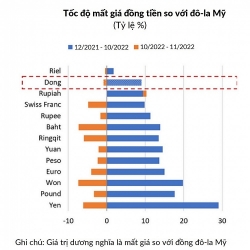

This development is quite contrary to the situation of some world market currencies. Therefore, commenting on this issue, economic expert Dr. Can Van Luc said that the exchange rate fluctuation between VND and USD above 3% is acceptable. The USD depreciates and the US economy is forecasted to have a lower growth rate and will only continue to raise interest rates from now at the end of the year so that other currencies will appreciate again, including VND. According to Mr. Luc, VND has appreciated by 0.7-0.8% against the USD since the beginning of the year, so it is forecasted that the whole year of 2023 may depreciate, only about 0.5-1%.

Not subjective to inflation pressure

According to experts, keeping the exchange rate stable will positively impact inflation, so it is necessary to find a balance between controlling the exchange rate and managing inflation. Because if we "sacrifice" the exchange rate, with an economy with a large openness like Vietnam, we will fall into the situation of importing inflation, pushing up inflation, and affecting the macro economy.

Currently, inflation is still under control, Dr. Nguyen Duc Do, Deputy Director of the Institute of Economics and Finance, Academy of Finance, commented that keeping the exchange rate stable will reduce the pressure to increase interest rates, keeping the prices of imported products stable.

Forecasting exchange rate movements in the coming period, UOB's analysis team assessed that the dong is still likely to remain stable even though the State Bank has cut operating interest rates twice thanks to the recovery of exports and industrial production in the coming months, combined with falling inflation.

But many experts said that although inflation pressure has decreased, it cannot be subjective, because inflation is still close to the target of 4.5% in January 2023, while global inflation is forecasted to continue to remain at a high level, central banks still anchored interest rates at high levels. Therefore, these will be barriers to efforts to keep the exchange rate stable and stabilize inflation.

Therefore, to keep the exchange rate stable, Prof. Dr. To Trung Thanh, Head of the Department of Scientific Management and Research teaching at the Faculty of Economics, National Economics University, considered it one of the "impossible trio", along with the free flow of capital and independence of monetary policy. This expert recommended that the SBV switch to a more flexible exchange rate management mechanism when pursuing inflation targeting policy in the long term. However, in the short term, when it is difficult to float the exchange rate, exchange rate management should be carefully considered to avoid shocks in the context of an unstable macroeconomic background.

| Exchange rate is no longer a concern VCN - The current context sets requirements for each group of enterprises in hedging against exchange rate ... |

From the perspective of the executive agency, during the regular Government meeting in April, Prime Minister Pham Minh Chinh requested harmonious, balanced, reasonable and effective management between interest rates and exchange rates, between growth and inflation, between supply and demand, between monetary and fiscal policy, between internal and external. The SBV also continuously emphasised on goals and solutions to manage the exchange rate in line with market conditions, intervene in the market when necessary, coordinate and synchronize monetary policy measures and tools to stabilize the foreign currency market, contributing to controlling inflation and stabilizing the macro-economy.

Related News

Managing price effectively, reducing pressure on inflation

12:09 | 04/10/2024 Finance

Pressure on exchange rate plunges

18:02 | 01/09/2024 Finance

Inflationary pressure seen from monetary policy

09:47 | 21/07/2024 Finance

Determine tools, policy for inflation control

14:11 | 19/07/2024 Finance

Latest News

Monetary policy forecast unlikely to loosen further

15:51 | 22/11/2024 Finance

World Bank outlines path for Vietnam to reach high income status

13:44 | 22/11/2024 Finance

Strictly control public debt and ensure national financial security 2025

09:26 | 22/11/2024 Finance

Revising the title of a draft of 1 Law amending seven finance-related laws

14:33 | 21/11/2024 Finance

More News

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance

State-owned securities company trails competitors

14:46 | 20/11/2024 Finance

Strengthening the financial “health” of state-owned enterprises

09:23 | 20/11/2024 Finance

U.S. Treasury continues to affirm Vietnam does not manipulate currency

13:46 | 19/11/2024 Finance

Exchange rate fluctuations bring huge profits to many banks

13:43 | 19/11/2024 Finance

A “picture” of bank profits in the first nine months of 2024

09:42 | 19/11/2024 Finance

Many challenges in restructuring public finance

10:02 | 18/11/2024 Finance

Tax declaration and payment by e-commerce platforms reduces declaration points and compliance costs

09:19 | 17/11/2024 Finance

Disbursement of public investment must be accelerated: Deputy PM

19:32 | 16/11/2024 Finance

Your care

Monetary policy forecast unlikely to loosen further

15:51 | 22/11/2024 Finance

World Bank outlines path for Vietnam to reach high income status

13:44 | 22/11/2024 Finance

Strictly control public debt and ensure national financial security 2025

09:26 | 22/11/2024 Finance

Revising the title of a draft of 1 Law amending seven finance-related laws

14:33 | 21/11/2024 Finance

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance