Inflationary pressure seen from monetary policy

|

| Experts say that with the positive recovery of exports, the foreign exchange market will have many positive supporting factors. |

Exchange rates and interest rates under pressure of increase

Since April 2024 until now, the USD/VND exchange rate has had many unpredictable developments. In the session on July 11, the central exchange rate announced by the State Bank (SBV) was at VND24,253/USD, while the USD selling price at commercial banks was nearly VND 25,460/USD, exceeding the SBV's selling threshold of VND25,450/USD. Although the exchange rate in the domestic market has cooled down, it is clear that pressure is still present, especially in the context of many negative developments in the world economy.

Previously, by the end of May 2024, the exchange rate increased, according to Mr. Pham Chi Quang, Director of the Monetary Policy Department (SBV), the foreign exchange market and domestic exchange rates are under pressure from unpredictable fluctuations in the global financial market, combined with challenges and difficulties in the domestic market recently.

However, Mr. Pham Chi Quang affirmed that all difficulties and challenges in the domestic foreign currency market are only short-term, because in the time to come, with the positive recovery of exports, the market's foreign currency supply will be supported to increase... Furthermore, the State Bank has also implemented many solutions to regulate cash flow and limit factors that increase pressure on exchange rates.

However, according to Mr. Tran Ngoc Bau, CEO of WiGroup Data and Financial Technology Joint Stock Company, if we "struggle" to follow the USD to avoid VND devaluation too much, we will have to continue selling foreign exchange reserves. At the same time, domestic liquidity is also tense because when pumping USD out, the State Bank must absorb VND. If not, the second option is that the State Bank must increase interest rates, but currently market interest rates have risen while the operating interest rate remains the same.

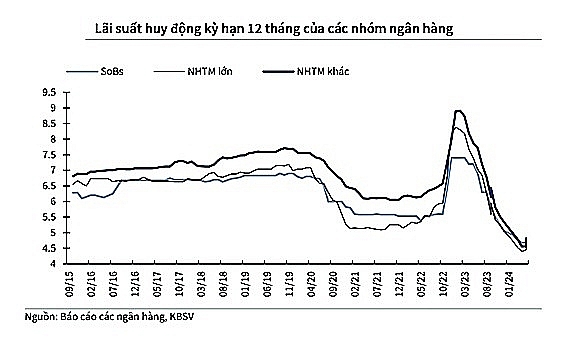

In fact, in July, many banks continued to increase deposit mobilization interest rates to the most attractive level compared to about a year ago, with the highest level of over 6 percent/year.

Previously, in May and June, the market also recorded a series of commercial banks adjusting to increase interest rates.

According to experts, short-term exchange rates are still the main pressure causing deposit interest rates to continue to increase. In the base scenario, the report of KB Securities Vietnam Company (KBSV) forecasts that the exchange rate will not cool down soon, and there will even be local tensions at some points, causing the State Bank to continue to intervene to sell foreign currency, along with the orientation of keeping interbank interest rates at a high enough level to limit exchange rate speculation activities.

These will directly impact system liquidity and increase deposit interest rates in market 1, especially in the group of small and medium-sized private commercial banks with less flexible mobilization sources and banks recording good credit growth.

Furthermore, the expected recovery in credit demand also leads to banks' need to mobilize capital, causing the increase in deposit interest rates to continue at the end of the year.

According to data from the State Bank, by the end of June 2024, credit growth reached 6 percent compared to the end of 2023, reaching the high target according to the Prime Minister's policy of reaching 5-6 percent by the end of the second quarter of 2024. Previously, credit growth by the end of May 2024 had only reached 2.4 percent, so in June alone, credit increased by 3.6 percent. Since the beginning of the year, the banking system has pumped more than VND800,000 billion into the economy.

|

Maintain low interest rates and controlled credit expansion

An increase in money supply will lead to inflationary pressure. According to economic expert Dr. Nguyen Tri Hieu, although increased interest rates demonstrate stronger economic activity, the management of interest rates needs to be carefully controlled in terms of inflation control, because if we want high economic growth, inflation can increase.

Regarding this issue, many experts have emphasized the coordination between monetary policy and other related policies to contribute to stabilizing the macroeconomy, controlling inflation, and ensuring major balances of the economy.

According to Associate Professor, PhD. Vu Duy Nguyen, Director of the Institute of Economics and Finance, Academy of Finance, a number of factors from the domestic socio-economic situation affect inflation and consumer price index in the last 2 quarters of the year. For example, macroeconomic policy continues to maintain a loose fiscal policy, combined with a loose monetary policy on the basis of foreign exchange reserves, budget revenue, and trade balance surplus, attracting and disbursing FDI capital continues to increase, people's deposit flow into commercial banks continues to increase...

However, the US Federal Reserve (FED) may lower interest rates at the beginning of the fourth quarter of 2024, which could also create significant pressure on Vietnam's exchange rate and interest rate policies towards increasing the amount of money in circulation.

Therefore, Associate Professor, PhD. Vu Duy Nguyen recommends continuing to maintain loose monetary policy with the State Bank maintaining low interest rates and expanding credit. But it is necessary to strictly control credit disbursement for the right purpose and effectively when using capital for production and consumption to ensure total supply output and business efficiency, increasing total demand through personal consumption. Along with that, it is necessary to stabilize the gold market, foreign exchange market and currency value, as well as prepare in advance scenarios to effectively respond to the possibility of central banks of major countries having policies to lower interest rates.

As for the State Bank, this agency also continuously informed that it will closely monitor developments and the world and domestic economic situation to proactively, flexibly and synchronously operate monetary policy tools, coordinate harmoniously and closely with other macroeconomic policies to support economic growth associated with inflation control, contributing to stabilizing the macroeconomy, money market, foreign exchange and banking system. The State Bank will also manage interest rates in accordance with market developments, encourage banks to reduce interest rates, and manage exchange rates flexibly...

At the regular Government meeting in June, the Prime Minister requested ministries, branches and localities to continue to prioritize promoting growth associated with maintaining macroeconomic stability, controlling inflation, and ensuring major balances of the economy. In particular, it is necessary to operate a reasonable, focused and focused fiscal expansion policy; coordinate synchronously, harmoniously and facilitate the implementation of proactive, flexible, timely and effective monetary policy; strengthen price management; control inflation according to set goals...

Related News

Ensuring national public debt safety in 2024

17:33 | 03/11/2024 Finance

How does the Fed's interest rate cut affect Vietnam?

11:56 | 05/10/2024 Headlines

Pressure on exchange rate plunges

18:02 | 01/09/2024 Finance

Determine tools, policy for inflation control

14:11 | 19/07/2024 Finance

Latest News

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

More News

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

PM urges stronger measures to manage interest rates

16:53 | 17/12/2024 Finance

Six SOEs to be transferred back to industry ministry

16:48 | 17/12/2024 Finance

Vietnamese products: Conquering foreign customers in supermarket systems

16:45 | 17/12/2024 Finance

Answering many questions from businesses at dialogue conference on tax and customs policies

10:01 | 17/12/2024 Finance

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Strengthen the management and use of electronic invoices for e-commerce

11:24 | 16/12/2024 Finance

Ministry of Finance proposes comprehensive amendments to the Personal Income Tax Law

11:23 | 16/12/2024 Finance

Expansionary fiscal policy halts decline, boosts aggregate demand

19:27 | 14/12/2024 Finance

Your care

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance