Pressure on exchange rate plunges

| Determine tools, policy for inflation control | |

| Inflationary pressure seen from monetary policy |

|

| Source: Bloomberg, MBS Research |

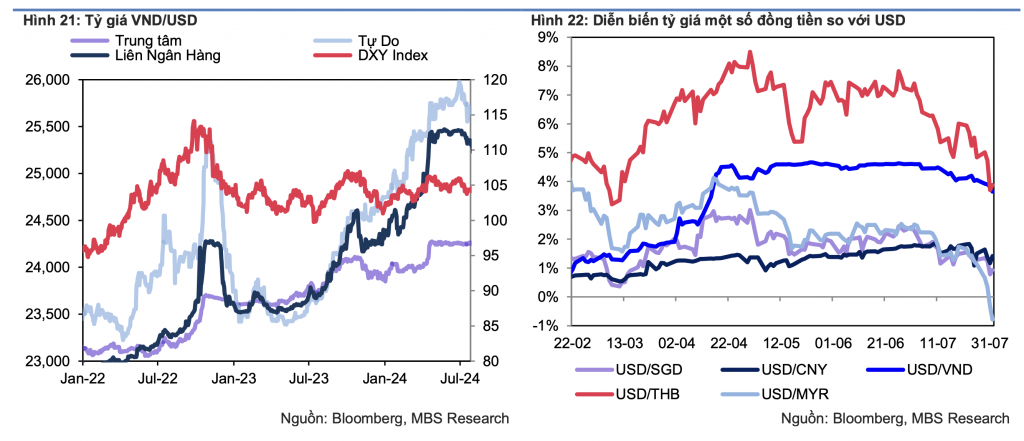

Currently, the sharp decrease in pressure on the exchange rate in August thanks to the weakening of the USD, and the maintained and improved stability of Vietnam's macro environment will be a basis for stabilizing the exchange rate in 2024.

Accordingly, the USD/VND exchange rate has dropped compared to the beginning of August 2024. The selling rate by the end of August fluctuated around VND/USD 25,000. In the free market, the USD exchange rate in Hanoi market is traded at VND/USD25,170 - 25,240 (buy - sell). From July 29, 2024 to current date, the USD in the free market has continuously decreased from VND25,720, down VND 500 per USD.

The weakening of the USD in the world market is the main reason for the sharp decrease in the domestic exchange rate. Currently, the US Dollar Index (DXY) has fluctuated around 100.9 points, but some time it has dropped to 100.45 points - the lowest level in more than a year.

According to the World Bank’s Macroeconomic Review, the SBV has implemented measures including intervention in the foreign exchange market and tightening liquidity to reduce pressure on the Vietnamese dong exchange rate.

The foreign exchange reserves decreased from US$90 billion in December 2023 to about US$83-84 billion by the end of June 2024 (equivalent to 2.7 months of import value). The SBV has begun to absorb liquidity in the interbank market and increased interbank interest rates to reduce pressure on the Vietnamese Dong.

KBSC Securities Company reported that the first half of 2024 is still a difficult period for the SBV in managing the exchange rate, but the depreciation rate of the Dong is still at a low average level compared to currencies in the region. Motivated by the new developments of the US economy as well as the plunge of DXY, KBSC believes that the most pressured period of the exchange rate has passed.

Experts from VNDirect Securities Company forecast that the exchange rate will continue to decline by the end of the year, with expectations that the US Federal Reserve (FED) will cut interest rates from September 2024, causing the USD to weaken, along with a positive trade surplus, and strong recovery of FDI capital flows and tourism.

On August 2024 report of Dragon Capital Securities (VDSC) also forecasts that the pressure on USD demand in the end of Q3 and first Q4/2024 will not greatly affect the exchange rate outlook, with the possibility of the USD/VND exchange rate at the end of 2024 fluctuating around VND/USD25,000, an increase of about 3% compared to the end of last year. Previously, in the July 2024 report, VDSC was concerned that the SBV may face exchange rate pressure and have to increase operating interest rates.

Related News

Difficulty in finding banks eligible to receive compulsory transfers

15:49 | 25/10/2024 Finance

Inflationary pressure seen from monetary policy

09:47 | 21/07/2024 Finance

Determine tools, policy for inflation control

14:11 | 19/07/2024 Finance

Businesses flexibly navigate exchange rate fluctuations

11:00 | 09/06/2024 Import-Export

Latest News

Tax declaration and payment by e-commerce platforms reduces declaration points and compliance costs

09:19 | 17/11/2024 Finance

Disbursement of public investment must be accelerated: Deputy PM

19:32 | 16/11/2024 Finance

HCMC: Domestic revenue rises, revenue from import-export activities begins to increase

09:36 | 16/11/2024 Finance

Effectively control fiscal and monetary policy : Deputy Prime Minister and Minister Ho Duc Phoc

09:33 | 16/11/2024 Finance

More News

Seaport stocks surge amid positive sector outlook

13:52 | 15/11/2024 Finance

Striving for revenue to rise by over 15% compared to assigned estimate

10:01 | 14/11/2024 Finance

Budget revenue is about to be completed for the whole year estimate

08:34 | 13/11/2024 Finance

Tax authorities and Police join forces to crack down on e-invoice fraud

14:14 | 12/11/2024 Finance

State revenue collection poised to surpass annual target

10:11 | 12/11/2024 Finance

Amending regulations for proactive, responsible tax officials

08:55 | 11/11/2024 Finance

Drastic actions taken to complete 95% public investment disbursement goal: Gov’t press conference

20:07 | 10/11/2024 Finance

Revising policies to adapt to two-way impact of FTAs

09:24 | 10/11/2024 Finance

Deputy Prime Minister, Minister of Finance: Budget management to be more decentralized

09:22 | 10/11/2024 Finance

Your care

Tax declaration and payment by e-commerce platforms reduces declaration points and compliance costs

09:19 | 17/11/2024 Finance

Disbursement of public investment must be accelerated: Deputy PM

19:32 | 16/11/2024 Finance

HCMC: Domestic revenue rises, revenue from import-export activities begins to increase

09:36 | 16/11/2024 Finance

Effectively control fiscal and monetary policy : Deputy Prime Minister and Minister Ho Duc Phoc

09:33 | 16/11/2024 Finance

Seaport stocks surge amid positive sector outlook

13:52 | 15/11/2024 Finance