Imposing taxes on imported fertilizers: Only defend the "dying" state-owned enterprises?

|

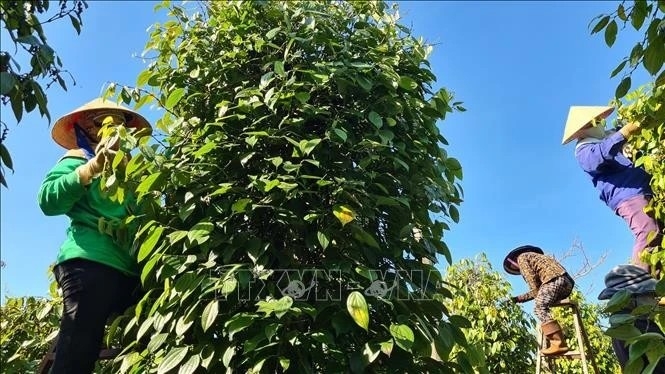

| The imposition of safeguard duties on imported fertilizers is not a long-term solution to help Vietnam's fertilizer industry increase its competitiveness. Source: Internet. |

Temporary solution

According to the Ministry of Industry and Trade, the investigation on the application of global safeguard measures for DAP and MAP imported into Vietnam concluded that the amount of imported DAP and MAP fertilizer has increased dramatically and relatively in the investigation period. Imports have caused price hikes on home-made goods in the period 2013-2016. The price pressures continue to occur in 2017 so the price of fertilizer produced in the country is still lower than the cost of production at 1,128,531 VND/ton.

"After thoroughly considering all aspects and consulting with relevant ministries and sectors, to ensure the harmonization of benefits between domestic producers and farmers, the Ministry of Industry and Trade decides to apply the main tax rate equal to the difference between the actual selling price and the selling price at the breakeven point of the domestic industry of 1,128,531 VND per ton, equivalent to only 60% of the tax rate applicable to Vietnam of the World Trade Organization (WTO) and Vietnamese law. This tax may increase the cost of cultivation, but according to calculations by MARD, the maximum will not exceed 0.72%", the Ministry of Industry and Trade said.

Obviously, in this story, the argument for imposing self-defense tax on fertilizer imports is to protect the fertilizer industry in the country. However, talk with reporters of the Customs Newspaper, longtime expert in the fertilizer industry, Dr. Nguyen Dang Nghia stated that this move is mainly aimed at protecting some state fertilizer enterprises, even the group profit factors, causing great harm to farmers. "The imposition of self-protection tariffs on DAP and MAP imports stemmed from the need to create technical barriers to protect the two large state-owned enterprises, DAP Dinh Vu Joint Stock Company (DAP - VINACHEM and DAP Lao Cai (DAP No. 2 Joint Stock Company - Vinachem). When applying taxes, fertilizer prices are high. For the production companies, fertilizer trade in the country will push up the price, the biggest losers to suffer are the farmers themselves", expert Nguyen Dang Nghia emphasized.

Around this issue, Mr. Nguyen Hac Thuy, Secretary General of Vietnam Fertilizer Association said: Currently, production of DAP fertilizer is difficult, so the State imposed a self-defense tax to "save" the business. However, this is only a temporary solution, not long term.

Respect the market mechanism

It is easy to see that imported fertilizers, despite their taxation, are still harsh competition, even "stifling" fertilizer production in the country. In depth analysis of this factor, expert Nguyen Dang Nghia said: In addition to high prices, the quality is not equal to imported goods is the key point that makes domestic fertilizer weak. "The products of DAP Dinh Vu or DAP Lao Cai are difficult to dissolve so farmers do not like them. DAP and MAP are the raw materials used to produce NPK fertilizer. Previously, even fertilizer companies in the Vietnam Chemical Group had to squeeze new fertilizer from DAP Dinh Vu and DAP Lao Cai to produce NPK fertilizer. Domestic products are boycotted by peasants, loss of customers makes enterprises lose market share", said Mr. Nghia.

At the present time, representatives of many fertilizer manufacturers also said that: DAP and self-protection tariffs are not what the company wants. These cause the NK fertilizer prices to rise, enterprises may have to choose domestic products due to price pressures, while the quality of fertilizer in the country is worse than imports. According to Mr. Nghia: In terms of nature, domestic products are less competitive with DAP and MAP products. They are derived from poor production technology by especially bulky enterprises with unreasonable management, not able to reduce the maximum cost.

Regarding the time of application of safeguard measures, the Ministry of Industry and Trade has stated that the WTO allowed the application of safeguard measures for a period of four years, but the Ministry of Industry and Trade decided to apply only for two years. After 2 years, the Ministry of Industry and Trade will review and re-evaluate socio-economic impacts to decide whether to extend the safeguard measures. In that way, it can be understood that if after two years, domestically produced DAP and MAP fertilizers are weak, flickering and not competing with imported goods, the extension of safeguard measures can completely continue.

Disagreeing with this view, expert Nguyen Dang Nghia said: To solve the problem, we should accelerate the equitization of state fertilizer enterprises as DAP Dinh Vu, Lao Cai DAP. "While state fertilizer companies are quite weak, private fertilizer companies are growing quite fast, even better compared to other companies in the same sector. Let everything operate under the market mechanism, build a healthy competitive environment for businesses", said Mr. Nghia.

Around the story of improving the competitiveness of domestic fertilizer with imported goods, according to Mr. Thuy, it is important to amend the Law on Value Added Tax (VAT), which put the fertilizer products as subject to VAT at 0% in order to deduct input VAT. Previously, the Law amending and supplementing some articles of the tax law (Law 71/2014/QH13), it regulates fertilizer not subject to VAT, instead of 5% as in 2014. This makes fertilizer companies no longer deduct input VAT, resulting in significant increase in production costs.

Related News

Risk prevention solutions for export processing and production enterprises

09:12 | 07/05/2024 Regulations

Binh Duong Customs and Korean businesses solve difficulties and obstacles

15:03 | 28/04/2024 Customs

The supporting industrial enterprises transform for sustainable development

08:20 | 01/05/2024 Import-Export

Proposal to exclude criminal liability for tax officials when businesses provide false information to refund VAT

10:35 | 24/04/2024 Finance

Latest News

Vietnam remains attractive destinations for Japanese IT firms

15:42 | 08/05/2024 Import-Export

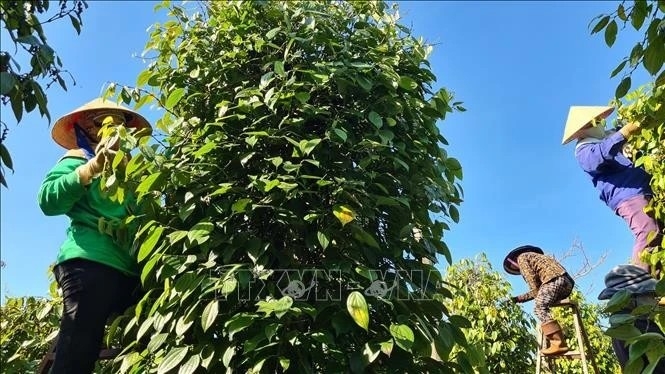

Pepper exports decrease in volume, increase in value

15:38 | 08/05/2024 Import-Export

Open credit flow to support import and export

09:30 | 08/05/2024 Import-Export

Import turnover increases by US$13.5 billion

09:30 | 08/05/2024 Import-Export

More News

Green production, trade will help wood industry increase export: Viforest

14:30 | 07/05/2024 Import-Export

Hanoi attracts over 1.1 billion USD in FDI in four months

14:28 | 07/05/2024 Import-Export

FDI flows strongly into manufacturing, real estate

14:26 | 07/05/2024 Import-Export

Maintaining recovery momentum amid uncertainties

09:09 | 07/05/2024 Import-Export

Make use of the most of favorable factors for economic growth

15:38 | 06/05/2024 Import-Export

Textile and garment businesses face difficulties due to lack of domestic supply

15:36 | 06/05/2024 Import-Export

Vietnam leads in export rice prices globally

15:34 | 06/05/2024 Import-Export

Production ensures export of 7.4 million tons of rice this year

14:30 | 06/05/2024 Import-Export

More businesses to join Vietnam E-Pavilion

16:34 | 05/05/2024 Import-Export

Your care

Vietnam remains attractive destinations for Japanese IT firms

15:42 | 08/05/2024 Import-Export

Pepper exports decrease in volume, increase in value

15:38 | 08/05/2024 Import-Export

Open credit flow to support import and export

09:30 | 08/05/2024 Import-Export

Import turnover increases by US$13.5 billion

09:30 | 08/05/2024 Import-Export

Green production, trade will help wood industry increase export: Viforest

14:30 | 07/05/2024 Import-Export