How will the Open Budget Portal be managed and operated?

| Launch ceremony of Open Budget Portal |

|

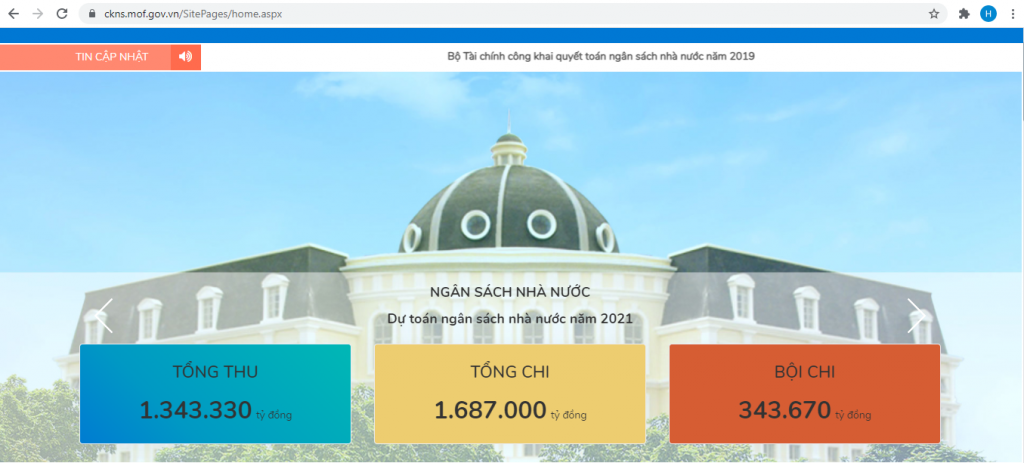

| The interface of the Open Budget Portal interface. Photo: Hoai Anh |

Ensuring stable and smooth operation

The Open Budget Portal is a website of the Ministry of Finance’s Portal (at https://ckns.mof.gov.vn), including data on the State budget and other socio-economic data arranged and organised for management, operation and exploitation via e-devices. The portal is developed and implemented in unified and centralised manner nationwide, performing the functions of publicising and receiving reports, and monitoring, checking and data storage and analysis.

The Department of Financial Informatics and Statistics (under the Ministry of Finance) is in charge of ensuring stable and smooth operation, meeting the needs of information access, use, update and exploitation of the application in a timely fashion.

The department is also responsible for the operation of the system; ensures unification of information between the portal and the data source systems; monitors data processing processes in the system or handling errors; perform daily backups of changed data in compliance with regulations on data backup and recovery of internal software and information systems under the Ministry of Finance.

The Department of State Budget is assigned to lead and work with relevant agencies to review and update formulas for calculating targets; report forms on publicising the State budget and the budgets of the provinces and centrally-run cities in accordance with current mechanisms and policies, meeting the requirements of each period. It is responsible for the management and use of administration accounts related to publicising these budgets.

The Department of Public Expenditure is assigned to lead and work with relevant agencies to regularly review and update formulas for calculating targets, report forms on publicising the budget of ministries and central Government agencies, meeting current regulations on information security of the Ministry of Finance.

Published data must be used

Regarding the publicity of the data and documents on the portal, Decision 1799 stipulates the Department of State Budget is in charge of notifying the State budget reports; publicising the State Budget data provided to international monetary and financial institutions and partner countries in accordance with Decision 749 dated March 7, 2005, of the Minister of Finance; publicising citisens’ budget reports; and articles/news related to the public revenue and expenditure.

The Department of Financial Planning is assigned to publicise documents, data and time limit for implementation of the Budget Estimate Unit.

Departments of Finance of provinces and centrally run cities are responsible for publicising documents, data and time limit for publicising local budgets and provincial budgets in accordance with Circular 343/2016/TT-BTC dated December 30, 2016 of the Minister of Finance.

Officers who are granted accounts on the portal are not allowed to use their accounts to sign in to the portal to implement other operations that are not within the scope of assigned tasks on the system, affecting the process, safety and security of the system and the accuracy of the data; are not allowed to grant system administration rights and develop software programmes to other objects.

The decision also states organisations and individuals accessing, using and exploiting data on the Portal must use published data, and not use or provide false information for others to use. When quoting information, they must clearly state the information source from the portal.

Related News

Deputy Prime Minister, Minister of Finance: Budget management to be more decentralized

09:22 | 10/11/2024 Finance

Businesses can choose a suitable electronic invoice model generated from the cash register

14:18 | 25/10/2024 Finance

Rush to finalize draft decree on public asset restructuring

09:28 | 29/10/2024 Finance

Ministry of Finance proposes to choose the option of reducing land rent by 30% in 2024

15:29 | 20/10/2024 Regulations

Latest News

Monetary policy forecast unlikely to loosen further

15:51 | 22/11/2024 Finance

World Bank outlines path for Vietnam to reach high income status

13:44 | 22/11/2024 Finance

Strictly control public debt and ensure national financial security 2025

09:26 | 22/11/2024 Finance

Revising the title of a draft of 1 Law amending seven finance-related laws

14:33 | 21/11/2024 Finance

More News

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance

State-owned securities company trails competitors

14:46 | 20/11/2024 Finance

Strengthening the financial “health” of state-owned enterprises

09:23 | 20/11/2024 Finance

U.S. Treasury continues to affirm Vietnam does not manipulate currency

13:46 | 19/11/2024 Finance

Exchange rate fluctuations bring huge profits to many banks

13:43 | 19/11/2024 Finance

A “picture” of bank profits in the first nine months of 2024

09:42 | 19/11/2024 Finance

Many challenges in restructuring public finance

10:02 | 18/11/2024 Finance

Tax declaration and payment by e-commerce platforms reduces declaration points and compliance costs

09:19 | 17/11/2024 Finance

Disbursement of public investment must be accelerated: Deputy PM

19:32 | 16/11/2024 Finance

Your care

Monetary policy forecast unlikely to loosen further

15:51 | 22/11/2024 Finance

World Bank outlines path for Vietnam to reach high income status

13:44 | 22/11/2024 Finance

Strictly control public debt and ensure national financial security 2025

09:26 | 22/11/2024 Finance

Revising the title of a draft of 1 Law amending seven finance-related laws

14:33 | 21/11/2024 Finance

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance