How do project management units use State budget funds?

| Prime Minister direct to pilot settlement bad debts | |

| Adjustment of revenue targets for 23 Customs Departments | |

| Ha Noi publicizes 147 businesses with tax debts of over 63 billion VND |

|

| the State encouraged project management units to increase revenues, save expenses, streamline payroll and increase incomes. |

The Circular regulated the management and use of revenues from project management activities of investors and project management units funded by State budget capital (including projects funded with principal development of ODA and preferential loans of foreign donors which are balanced the State budget).

The use of funds saved by investors and management board of project group I has been specified in the Circular.

Accordingly, the cost of project management which is saved can provide the additional income, rewards; and expenditures on collective welfare activities. Within the limits of the source of savings, the project management units shall determine the coefficient of increase of the maximum salary fund 1.0 (one) times higher than the salary level. The rank and position of the State shall be determined to pay additional income to officials, public servants and employees who receive salary from the project management expenses.

In addition, they can provide collective welfare activities, such as lunch, tastings, visits, sickness, retirement, sick leave; support cadres, civil servants and employees on the payroll when reducing payrolls; support repairs of welfare works.

The amount of money saved at the end of the year, which has not yet been used up, shall be transferred to expenditures in subsequent years.

For project management units of group II, especially increased income, the Circular stated that the State encouraged project management units to increase revenues, save expenses, streamline payroll and increase incomes for workers on the basis of completion after fulfilling obligations to the state budget. Based on the financial performance of the year, the project management units shall decide on the total additional payment for the employees in the year to no more than three times of the salary level and allowances for officials, public servants and employees, which are defined by the State.

The additional income coefficient of the leadership position shall not exceed 2 times of the coefficient of income gained in the unit and also in line with the principle of quantity, quality and efficiency of the work. The Director of project management units shall pay income according to the unit's internal spending regulations.

As for the use of financial results of the project management units of group II in the year, annually after paying the expenses, paying taxes and other remittances according to regulations, the difference of revenues and the regular expenditures (if any), the project management units shall use them as the following orders: Deductions of at least 25% for establishment of non-business activity development fund; deductions for setting up the supplementary fund for income shall not exceed 3 times of the salary fund for grades, positions and wage allowances for officials, public servants and employees prescribed by the State.

Reward funds and welfare funds: The deduction levels applicable to these two funds shall not exceed three months' average salary or wage in the year.

This Circular shall come into effect from 15th September 2017 and replace Circular No. 05/2014 / TT-BTC of 6th January 2014 of the Ministry of Finance regulating the management and use of management expenses and investment projects using State budget capital.

| Changing the function of the Ministry of Finance in State asset management VCN- The Government has just issued Decree 87/2017/ND-CP regulating the functions, tasks, powers and organizational structure of ... |

| Group I: The investors are assigned by the investment deciders (except for cases where the investment decider assigns the specialized project management units for investment in specialized construction, the project management units for investment in the construction of the investment area), the project management units are established by the owner under Article 19 of the Government's Decree No. 59/2015 / ND-CP of 18th June 2015 on the management of construction investment projects. Group II: Specialized project management units are established by ministers, heads of central agencies and heads of provincial and district level People's Committees in accordance with clause 7 of Article 1 of Government’s Decree No. 42/2017 / ND-CP of 5th April 2017. The specialized project management units shall work out plans on financial autonomy, ensuring that they are self-financed according to their actual plans and conditions and report them to ones who have decided on the establishment thereof for approval according to the provisions of Decree No. 16/2015 / ND-CP of 14th February 2015 of the Government regulating the autonomy mechanism of public service delivery agencies; Decree No. 141/2016 / ND-CP of 10th October 2016 of the Government stipulating the autonomy mechanism of public non-business units in the field of economic and non-business. |

Related News

Vietnam is ready to welcome a new wave of investment in the semiconductor industry

16:08 | 15/05/2024 Headlines

Binh Dinh Customs: Set a goal to upgrade administrative reform

09:59 | 16/05/2024 Customs

Opportunities for Vietnam to participate in the global semiconductor industry value chain

11:34 | 15/05/2024 Import-Export

Ho Chi Minh City: Enterprises overcome difficulties, exports lead the country

14:58 | 10/05/2024 Import-Export

Latest News

E-commerce frauds require utmost in attention from regulators

20:07 | 18/05/2024 Regulations

Is animal feed containing Formic Acid precursors "helpless" in management?

16:09 | 15/05/2024 Regulations

Businesses and people expect VAT cut extension to be approved

17:06 | 13/05/2024 Regulations

Proposal to continue reducing VAT by 2% to support people and businesses

08:16 | 12/05/2024 Regulations

More News

Research and correct customs supervision processes at international airports

10:05 | 11/05/2024 Regulations

Small, low-value items imported on e-commerce platforms should be taxed

14:43 | 09/05/2024 Regulations

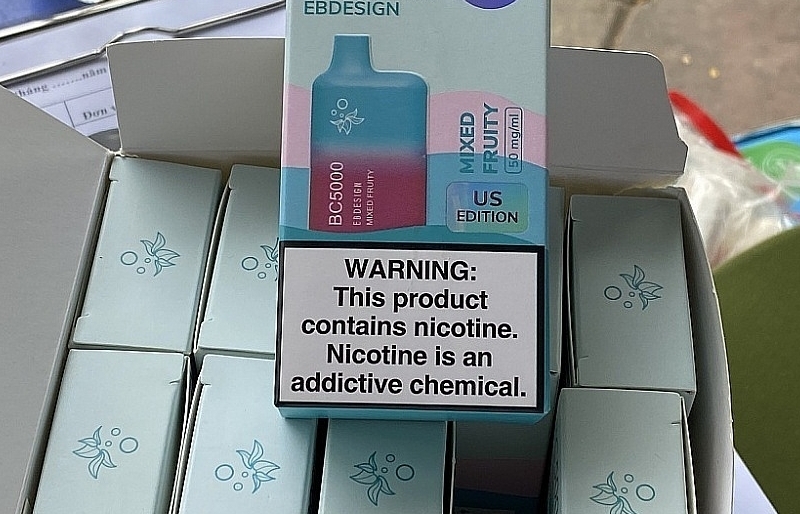

Customs finds difficulties because there is no e-cigarette management policy

09:56 | 09/05/2024 Regulations

Are goods imported on-spot for export production eligible for tax refund?

09:32 | 08/05/2024 Regulations

Risk prevention solutions for export processing and production enterprises

09:12 | 07/05/2024 Regulations

Conditions for price reduction of imported goods

15:38 | 06/05/2024 Regulations

Circular 83/2014/TT-BTC will be abolished from June 8

14:29 | 06/05/2024 Regulations

Proposal to continue reducing VAT by 2% in the last 6 months of 2024

10:35 | 05/05/2024 Regulations

Seafood exporters are worried about some inadequacies from the two new decrees

06:47 | 30/04/2024 Regulations

Your care

E-commerce frauds require utmost in attention from regulators

20:07 | 18/05/2024 Regulations

Is animal feed containing Formic Acid precursors "helpless" in management?

16:09 | 15/05/2024 Regulations

Businesses and people expect VAT cut extension to be approved

17:06 | 13/05/2024 Regulations

Proposal to continue reducing VAT by 2% to support people and businesses

08:16 | 12/05/2024 Regulations

Research and correct customs supervision processes at international airports

10:05 | 11/05/2024 Regulations