Great pressure on deposit interest rates, lending rates may increase

|

| Nguồn: SSI |

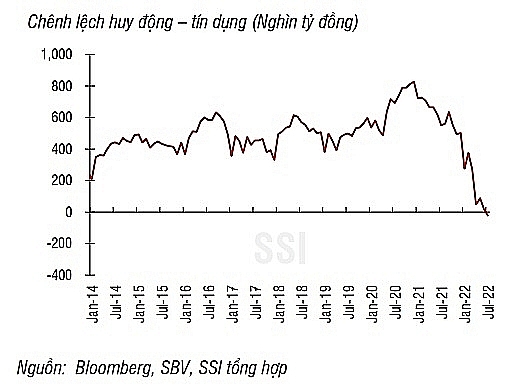

Data from the State Bank of Vietnam (SBV) showed that by the end of July, the credit balance increased by 9.42% compared to the beginning of the year, equivalent to an increase of 16.3% over the same period.

Thus, credit growth is tending to decrease after peaking at the end of May when increasing by nearly 17% over the same period, due to slow disbursement when many banks hit the annual credit growth ceiling.

Besides, capital mobilization growth also slowed down in July when it increased by 4.2% compared to the end of 2021 or 9.9% year-on-year, down from 10% in June.

According to the money the bond market report,of SSI Securities Company, it has made a difference in capital mobilization - credit continued to decline sharply and was negative in July - putting great pressure on deposit interest rates.

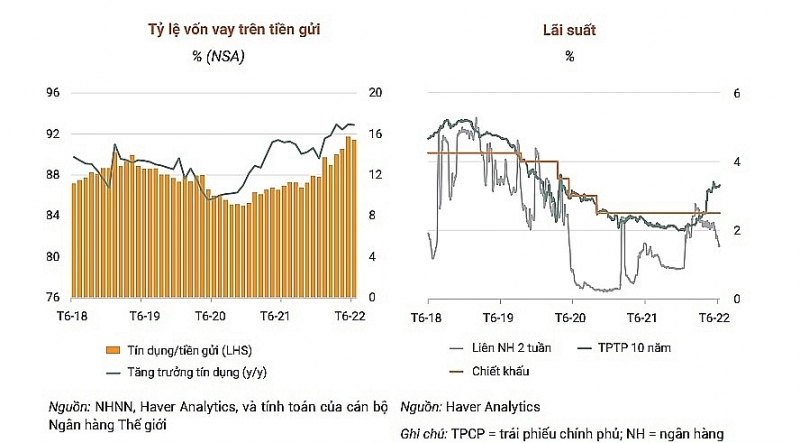

In fact, from the beginning of August, a number of banks have adjusted to increase deposit interest rates, including state-owned commercial banks such as Vietcombank or large private commercial banks such as MB, Techcombank, ACB, with a 20-40 basis point increase for the 12-month term.

Moreover, since June, interbank interest rates have shown signs of going up and started to increase sharply from mid-July when the State Bank continuously made withdrawals on the open market by issuing bills and performing other USD sales contracts. Currently, interbank interest rates are still anchored at a very high level. At the end of July, the overnight interest rate was up to 4.2%/year compared to 0.96%/year on July 18.

|

| Source: WB |

According to the August macro strategy report of Tien Phong Securities Company (TPS), the analysis team believes that deposit and lending interest rates may continue to increase due to the recovery of capital demand for business activities after the pandemic. The rate of increase of these two types of interest rates depends on the abundance of money circulating in the interbank market.

Also in the recent report of Vietnam Bank for Foreign Trade Securities (VCBS), experts forecast higher credit growth demand during the economic recovery period may be accompanied by an increase in deposit interest rates in the near future.

The volatility of deposit interest rates will continue to heavily depend on the abundance of capital flows in the interbank market. According to VCBS, deposit interest rates may increase by 1-1.5% in the whole of 2022. Lending rates will also increase, but there is a lag compared to the time of increase of deposit rates and there is a divergence in the increase.

VCBS also emphasized that the SBV's overall orientation is still to reduce lending interest rates to support businesses to recover after the pandemic. However, with credit growth possibly higher than the same period last year, deposit interest rates are under increasing pressure, and lending rates are hard to avoid certain pressures.

In the August 2022 review report that the World Bank has just released, this agency said that core inflation is still under control and the economy is still below potential, so monetary policy should be kept under control, but is still appropriate at present.

However, if inflation rises above the set target of 4%, Ms. Dorsati Madani, a senior economist at the World Bank, recommended that the SBV needs to be ready to switch to monetary tightening to control inflation pressure by increasing interest rates and tightening the money supply.

However, the SBV needs to communicate clearly and predictably about monetary policy decisions to help guide the market and ensure to keep inflation expectations.

Related News

Inflationary pressure seen from monetary policy

09:47 | 21/07/2024 Finance

Determine tools, policy for inflation control

14:11 | 19/07/2024 Finance

Prioritize resources and promptly supplement capital for policy credit

10:06 | 22/07/2024 Finance

Solutions to establish a green ecosystem in the logistics industry

10:04 | 04/07/2024 Import-Export

Latest News

Perfecting the legal framework to promote upgrading the stock market

08:18 | 26/07/2024 Finance

Margin loan continues hit new record

09:20 | 25/07/2024 Finance

Vietnam needs comprehensive regulatory framework to attract green financing

14:11 | 24/07/2024 Finance

2025 budget estimation must be practical, accurate and efficient

14:38 | 23/07/2024 Finance

More News

The corporate bond market will be more vibrant in the second half of the year

08:20 | 23/07/2024 Finance

Measures suggested to boost startups’ access to capital

19:38 | 21/07/2024 Finance

Banks with the problem of promoting credit growth

18:49 | 20/07/2024 Finance

Proposal to increase Special Consumption Tax on tobacco products

09:50 | 20/07/2024 Finance

Savings of individual customers at banks hit record high

14:30 | 19/07/2024 Finance

Managing fiscal policy has achieved many positive and comprehensive results

14:12 | 19/07/2024 Finance

The impact of wage increases on inflation will not be too significant

10:23 | 18/07/2024 Finance

Imposing and raising special consumption tax contributing to change consumption behavior

10:05 | 17/07/2024 Finance

The local Finance sector is flexible and strict in managing budget revenues and expenditures

10:05 | 17/07/2024 Finance

Your care

Perfecting the legal framework to promote upgrading the stock market

08:18 | 26/07/2024 Finance

Margin loan continues hit new record

09:20 | 25/07/2024 Finance

Vietnam needs comprehensive regulatory framework to attract green financing

14:11 | 24/07/2024 Finance

2025 budget estimation must be practical, accurate and efficient

14:38 | 23/07/2024 Finance

The corporate bond market will be more vibrant in the second half of the year

08:20 | 23/07/2024 Finance